GR 1040X Instructions 03 01 City of Grand Rapids Grcity Form

What is the GR 1040X Instructions 03 01 City Of Grand Rapids Grcity

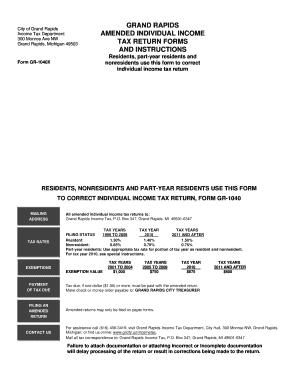

The GR 1040X Instructions 03 01 City Of Grand Rapids Grcity is a specific form used for amending tax returns within the City of Grand Rapids. This form allows taxpayers to correct errors or make changes to previously filed tax documents. It is essential for ensuring that the information reported to the tax authorities is accurate and up to date, which can affect tax liability and compliance with local regulations.

Steps to complete the GR 1040X Instructions 03 01 City Of Grand Rapids Grcity

Completing the GR 1040X form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents related to your original tax return. Next, carefully review the instructions provided with the form, as they outline the specific changes you need to make. Fill out the form by clearly indicating the corrections, ensuring that all information is legible. Finally, double-check your entries for accuracy before submitting the amended form to the appropriate tax authority.

Legal use of the GR 1040X Instructions 03 01 City Of Grand Rapids Grcity

The legal use of the GR 1040X form is crucial for maintaining compliance with tax laws in Grand Rapids. This form is legally binding when completed correctly and submitted within the designated time frames. It is important to follow all guidelines and requirements outlined in the instructions to avoid potential penalties or legal issues. Utilizing a reliable electronic signature platform can further ensure that the form is executed legally and securely.

Filing Deadlines / Important Dates

Filing deadlines for the GR 1040X form are critical to avoid penalties. Typically, amended returns must be filed within a specific period after the original return was submitted. It is advisable to check the latest guidelines from the City of Grand Rapids for any updates on deadlines. Marking these dates on your calendar can help ensure timely submission and compliance with local tax laws.

Required Documents

To complete the GR 1040X Instructions 03 01 City Of Grand Rapids Grcity, certain documents are essential. These typically include your original tax return, any supporting documentation for the changes being made, and identification information as required by the city’s tax regulations. Having these documents ready will facilitate a smoother completion process and help ensure accuracy in your amendments.

Form Submission Methods (Online / Mail / In-Person)

The GR 1040X form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person, depending on local guidelines. Each method has its own advantages, and it is important to select the one that best suits your needs while ensuring compliance with submission requirements.

Examples of using the GR 1040X Instructions 03 01 City Of Grand Rapids Grcity

Examples of using the GR 1040X form include situations where a taxpayer needs to correct income amounts, claim additional deductions, or adjust credits. For instance, if a taxpayer discovers that they missed reporting a source of income or need to amend their filing status, the GR 1040X allows them to make these corrections officially. Such amendments can lead to changes in tax liability, potentially resulting in refunds or additional payments owed.

Quick guide on how to complete gr 1040x instructions 03 01 city of grand rapids grcity

Effortlessly Prepare GR 1040X Instructions 03 01 City Of Grand Rapids Grcity on Any Device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal environmentally friendly option to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage GR 1040X Instructions 03 01 City Of Grand Rapids Grcity on any device through the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

Efficiently Modify and eSign GR 1040X Instructions 03 01 City Of Grand Rapids Grcity with Ease

- Obtain GR 1040X Instructions 03 01 City Of Grand Rapids Grcity and click on Get Form to initiate.

- Utilize the features we provide to complete your document.

- Select pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specially offers for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to record your changes.

- Choose your method for sending your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and eSign GR 1040X Instructions 03 01 City Of Grand Rapids Grcity and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gr 1040x instructions 03 01 city of grand rapids grcity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are GR 1040X Instructions 03 01 City Of Grand Rapids Grcity?

GR 1040X Instructions 03 01 City Of Grand Rapids Grcity provide detailed guidelines on how to complete the amended income tax return for residents of Grand Rapids. These instructions help ensure accurate filing and compliance with local regulations. Familiarizing yourself with these guidelines can signNowly reduce errors in your tax submissions.

-

How can airSlate SignNow assist with GR 1040X Instructions 03 01 City Of Grand Rapids Grcity?

airSlate SignNow simplifies the process of preparing and eSigning your documents related to the GR 1040X Instructions 03 01 City Of Grand Rapids Grcity. Our platform allows you to easily upload, modify, and send your tax forms securely. This ensures that you can manage your tax documents efficiently from anywhere.

-

Are there any costs associated with using airSlate SignNow for GR 1040X Instructions 03 01 City Of Grand Rapids Grcity?

airSlate SignNow offers a cost-effective solution for managing your GR 1040X Instructions 03 01 City Of Grand Rapids Grcity. We provide various pricing plans designed to fit different business needs and budgets. You can choose a plan that suits your frequency of use and the number of documents you need to handle.

-

What features does airSlate SignNow offer for handling GR 1040X Instructions 03 01 City Of Grand Rapids Grcity?

Our platform includes a range of features tailored for handling GR 1040X Instructions 03 01 City Of Grand Rapids Grcity, such as customizable templates, eSignature capabilities, and advanced document tracking. These features ensure you have full control over your documents throughout the signing process. Streamlining these tasks can lead to increased efficiency and productivity.

-

Can I integrate airSlate SignNow with other tools for GR 1040X Instructions 03 01 City Of Grand Rapids Grcity?

Yes, airSlate SignNow easily integrates with various tools and applications to streamline your document management related to GR 1040X Instructions 03 01 City Of Grand Rapids Grcity. Whether you need to connect with CRM systems, cloud storage services, or accounting software, our platform supports seamless integration. This flexibility enhances your workflow and reduces errors in the submission process.

-

How secure is airSlate SignNow for handling GR 1040X Instructions 03 01 City Of Grand Rapids Grcity?

Security is a top priority at airSlate SignNow. We implement robust encryption and security protocols to protect your documents associated with GR 1040X Instructions 03 01 City Of Grand Rapids Grcity. You can trust that your sensitive information is safe while you eSign and share your tax documents.

-

What are the benefits of using airSlate SignNow for GR 1040X Instructions 03 01 City Of Grand Rapids Grcity?

Using airSlate SignNow for your GR 1040X Instructions 03 01 City Of Grand Rapids Grcity can save you time, reduce paperwork, and enhance accuracy in your tax filings. The platform allows for easy document creation and collaboration, leading to a more efficient tax preparation process. Plus, the ability to eSign documents securely means you can finalize your submissions quickly and conveniently.

Get more for GR 1040X Instructions 03 01 City Of Grand Rapids Grcity

- 48647 mac vision account closure request form

- Afibercept 1 mg medicare part b coding for form

- Phone 1 866 752 7021 form

- Prenatal and pregnancy loss test request form

- Network panel change form blue cross blue shield of

- Sender clinic form

- Injectable medication precertification request injectable medication precertification form

- Credit limit inc req credit limit inc req form

Find out other GR 1040X Instructions 03 01 City Of Grand Rapids Grcity

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure