Credit Limit Inc Req Credit Limit Inc Req Form

Understanding the Credit Limit Form

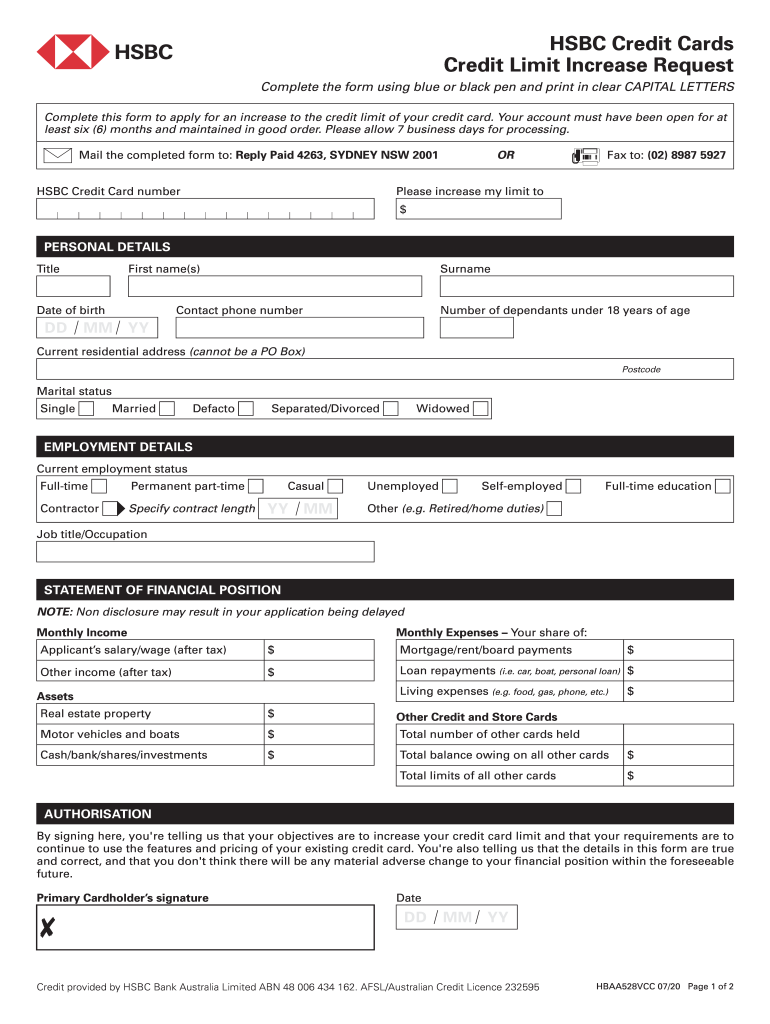

The credit limit form is a crucial document used by financial institutions to assess an individual's or business's request for an increase in their credit limit. This form typically requires personal and financial information, including income, existing debts, and credit history. Understanding the purpose of this form can help applicants prepare effectively and increase their chances of approval.

Steps to Complete the Credit Limit Form

Filling out the credit limit form involves several key steps to ensure accuracy and completeness:

- Gather necessary information: Collect personal identification, income details, and current credit information.

- Fill out personal details: Include your name, address, and contact information.

- Provide financial information: Disclose your income, employment status, and any existing debts.

- Review and verify: Double-check all entries for accuracy before submission.

Eligibility Criteria for Credit Limit Increase

Eligibility for a credit limit increase typically depends on several factors, including:

- Credit score: A higher credit score often improves your chances of approval.

- Payment history: Consistently making on-time payments can positively influence the decision.

- Current credit utilization: Lower utilization rates may indicate responsible credit management.

- Income stability: A steady income can support your request for a higher limit.

Legal Use of the Credit Limit Form

The credit limit form must be used in compliance with applicable laws and regulations. This includes adhering to federal and state guidelines regarding credit applications and consumer rights. Financial institutions are required to handle personal information securely and transparently, ensuring that applicants understand their rights during the process.

Required Documents for Submission

When submitting the credit limit form, certain documents may be required to support your application. These often include:

- Proof of income: Recent pay stubs or tax returns may be needed.

- Identification: A government-issued ID to verify your identity.

- Credit report: Some institutions may request a recent credit report to assess your creditworthiness.

Form Submission Methods

The credit limit form can typically be submitted through various methods, including:

- Online: Many financial institutions offer a secure online submission option for convenience.

- Mail: You may also send a physical copy of the completed form to the institution's address.

- In-person: Visiting a local branch can provide direct assistance with the application process.

Quick guide on how to complete credit limit inc req credit limit inc req

Complete Credit limit inc req Credit limit inc req seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Credit limit inc req Credit limit inc req on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Credit limit inc req Credit limit inc req with ease

- Obtain Credit limit inc req Credit limit inc req and then click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), inviitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Credit limit inc req Credit limit inc req to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit limit inc req credit limit inc req

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is a credit limit form?

A credit limit form is a document that allows businesses to request a specific credit limit from their financial institution. It typically includes details about the business's financial status and credit history. By using a credit limit form, companies can streamline the process of increasing their credit limits for better cash flow management.

-

How does airSlate SignNow facilitate the credit limit form process?

airSlate SignNow provides an intuitive platform that allows users to easily create, send, and eSign credit limit forms. With its user-friendly interface, you can customize your forms to fit your business needs. This efficiency helps businesses obtain credit approvals faster, without the hassle of traditional paperwork.

-

Is there a cost associated with using the credit limit form feature?

Yes, airSlate SignNow offers various pricing plans depending on the features required, including the credit limit form functionality. Each plan is designed to meet different organizational needs, making it a cost-effective solution for businesses of all sizes. You can choose a plan that best suits your budget while utilizing the credit limit form feature.

-

What features does airSlate SignNow offer for credit limit forms?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure electronic signatures for credit limit forms. These features simplify the process of managing and signing documents, ensuring a smooth experience for both businesses and their clients. Additionally, users can integrate the forms with other tools to enhance productivity.

-

Can I customize my credit limit form in airSlate SignNow?

Absolutely! You can fully customize your credit limit form in airSlate SignNow to include your branding, specific fields, and any required legal disclaimers. This customization not only ensures that the form aligns with your company’s policies but also enhances credibility with your clients.

-

What benefits does using airSlate SignNow's credit limit form provide?

Using airSlate SignNow's credit limit form enables businesses to save time and reduce errors associated with traditional paper forms. The electronic signature feature speeds up the approval process, allowing for quicker access to funds. Additionally, having a digital solution keeps your documents organized and easily accessible.

-

Does airSlate SignNow support integration with other software for credit limit forms?

Yes, airSlate SignNow supports integration with various third-party applications that enhance your workflow when dealing with credit limit forms. This includes accounting software, customer relationship management (CRM) systems, and more. Integrations improve efficiency, making it easier to manage finances and approvals within one ecosystem.

Get more for Credit limit inc req Credit limit inc req

- Demand for acknowledgment of satisfaction by corporation or llc tennessee form

- Tennessee acknowledgment form

- Quitclaim deed from individual to llc tennessee form

- Warranty deed from individual to llc tennessee form

- Tennessee acknowledgment form

- Notice completion 497326718 form

- Tennessee quitclaim deed 497326719 form

- Warranty deed from husband and wife to corporation tennessee form

Find out other Credit limit inc req Credit limit inc req

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter