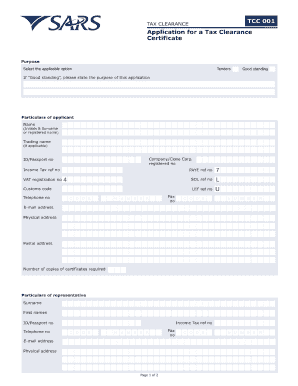

Income Tax Clearance Certificate PDF Form

What is the application tax clearance certificate?

The application tax clearance certificate serves as an official document issued by the relevant tax authority, confirming that an individual or business has met all tax obligations. This certificate is often required for various purposes, including loan applications, government contracts, and other financial transactions. It demonstrates compliance with tax laws and assures stakeholders that there are no outstanding tax liabilities.

How to obtain the application tax clearance certificate

To obtain the application tax clearance certificate, individuals or businesses typically need to follow a specific process. This process may vary by state but generally includes:

- Gathering necessary documentation, such as proof of identity, tax returns, and payment records.

- Completing the application form, which may be available online or in paper format.

- Submitting the application along with any required fees to the appropriate tax authority.

- Waiting for processing, which can take several days to weeks depending on the jurisdiction.

Steps to complete the application tax clearance certificate

Completing the application tax clearance certificate involves several key steps:

- Review the eligibility criteria to ensure you qualify for the certificate.

- Collect all required documentation, including your tax identification number and any relevant financial statements.

- Fill out the application form accurately, ensuring all information is current and correct.

- Submit the application through the designated method, whether online, by mail, or in person.

- Monitor the status of your application and respond promptly to any requests for additional information.

Legal use of the application tax clearance certificate

The application tax clearance certificate holds legal significance as it verifies an entity's compliance with tax obligations. It is often required in various legal and financial contexts, such as:

- Applying for business loans or grants.

- Participating in government contracts or tenders.

- Establishing credibility with potential business partners or clients.

Required documents for the application tax clearance certificate

When applying for the application tax clearance certificate, specific documents are typically required. These may include:

- A completed application form.

- Proof of identity, such as a driver's license or passport.

- Recent tax returns and payment records.

- Any additional documentation specified by the tax authority.

Eligibility criteria for the application tax clearance certificate

Eligibility for the application tax clearance certificate generally depends on meeting certain criteria, which may include:

- Having no outstanding tax liabilities or penalties.

- Filing all required tax returns on time.

- Being in good standing with the tax authority.

Quick guide on how to complete income tax clearance certificate pdf

Complete Income Tax Clearance Certificate Pdf effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing users to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Income Tax Clearance Certificate Pdf on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Income Tax Clearance Certificate Pdf with ease

- Obtain Income Tax Clearance Certificate Pdf and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Income Tax Clearance Certificate Pdf and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax clearance certificate pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an application tax clearance certificate?

An application tax clearance certificate is an official document that certifies a business has paid all its tax obligations, ensuring compliance with tax regulations. This certificate is often required for various business transactions, such as securing loans or winning contracts. Understanding this document is crucial for maintaining proper business operations and credibility.

-

How can I obtain an application tax clearance certificate?

To obtain an application tax clearance certificate, you typically need to submit an application to your local revenue office, providing necessary documentation related to your tax payments. The process may vary by jurisdiction, but using an efficient solution like airSlate SignNow can streamline the submission and approval process, making it easier to achieve compliance quickly.

-

What are the benefits of having an application tax clearance certificate?

Having an application tax clearance certificate provides essential benefits, including validating your business's tax compliance and enhancing your credibility with potential clients or partners. This certificate can also help secure financing and avoid penalties associated with tax obligations. Overall, it strengthens your standing in any business transaction.

-

How much does obtaining an application tax clearance certificate cost?

The cost of obtaining an application tax clearance certificate can vary depending on your location and the specific requirements of your jurisdiction. Some states may charge a nominal fee, while others may not. It is best to consult your local tax authority for accurate pricing and additional details.

-

Can airSlate SignNow help with the application process for a tax clearance certificate?

Yes, airSlate SignNow can signNowly streamline the application process for a tax clearance certificate by allowing you to create, sign, and send necessary documents electronically. This solution not only saves you time but also enhances the security and efficiency of your submissions. Additionally, it ensures that you remain compliant with all required regulations.

-

What features of airSlate SignNow assist with managing application tax clearance certificates?

airSlate SignNow offers features such as e-signature capabilities, secure document storage, and customizable templates that are highly beneficial for managing application tax clearance certificates. These features enable you to easily track submissions, keep records organized, and ensure that all documents are readily available and compliant with tax regulations.

-

Are there integrations available with airSlate SignNow for managing tax certificate applications?

Yes, airSlate SignNow integrates seamlessly with various applications that can assist in managing tax certificate applications. This includes accounting software, document management systems, and cloud storage solutions, which help enhance your workflow and ensure that all your tax clearance certificate documents are efficiently managed and accessible.

Get more for Income Tax Clearance Certificate Pdf

Find out other Income Tax Clearance Certificate Pdf

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy