Lra Tax Clearance Certificate Online Application near Maseru Form

Understanding the LRA Tax Clearance Certificate Online Application

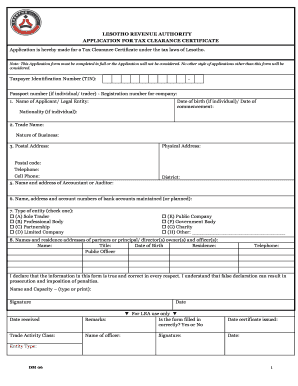

The LRA tax clearance certificate is an essential document for individuals and businesses in Lesotho, confirming that they have met their tax obligations. The online application process simplifies obtaining this certificate, making it accessible to users across the country. This digital approach allows applicants to complete the necessary forms and submit them without needing to visit a physical office.

Steps to Complete the LRA Tax Clearance Certificate Online Application

To successfully complete the online application for the LRA tax clearance certificate, follow these steps:

- Visit the official website of the Lesotho Revenue Authority.

- Navigate to the tax clearance certificate section.

- Fill out the required application form with accurate personal and financial information.

- Upload any necessary supporting documents, such as identification and proof of income.

- Review your application for completeness and accuracy.

- Submit the application and note any confirmation details provided.

Required Documents for the LRA Tax Clearance Certificate Application

When applying for the LRA tax clearance certificate online, certain documents are typically required to verify your identity and tax status. These may include:

- A valid form of identification, such as a national ID or passport.

- Proof of income, which could be recent pay stubs or tax returns.

- Any additional documentation requested by the Lesotho Revenue Authority.

Legal Use of the LRA Tax Clearance Certificate

The LRA tax clearance certificate serves multiple legal purposes. It is often required for various transactions, including:

- Applying for government contracts or tenders.

- Opening bank accounts for businesses.

- Securing loans or financing from financial institutions.

- Complying with regulatory requirements for operating a business.

Application Process & Approval Time for the LRA Tax Clearance Certificate

The application process for the LRA tax clearance certificate is designed to be efficient. Once the application is submitted, the Lesotho Revenue Authority typically reviews it within a specified timeframe. The approval time can vary based on the completeness of the application and the volume of requests being processed. Applicants should ensure all information is accurate and complete to avoid delays.

Eligibility Criteria for the LRA Tax Clearance Certificate

To be eligible for the LRA tax clearance certificate, applicants must meet specific criteria set by the Lesotho Revenue Authority. This often includes:

- Having a valid tax identification number.

- Being up-to-date with all tax payments and filings.

- Not having any outstanding tax liabilities or disputes with the tax authority.

Quick guide on how to complete lra tax clearance certificate online application near maseru

Complete Lra Tax Clearance Certificate Online Application Near Maseru effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Lra Tax Clearance Certificate Online Application Near Maseru on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest method to edit and electronically sign Lra Tax Clearance Certificate Online Application Near Maseru with ease

- Locate Lra Tax Clearance Certificate Online Application Near Maseru and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Identify relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivery for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Lra Tax Clearance Certificate Online Application Near Maseru and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lra tax clearance certificate online application near maseru

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is LRA tax clearance tracking?

LRA tax clearance tracking is the process of monitoring and managing the status of your tax clearance certificates issued by the LRA. With airSlate SignNow, you can easily track your LRA tax clearance statuses, ensuring compliance and timely renewals.

-

How does airSlate SignNow facilitate LRA tax clearance tracking?

airSlate SignNow simplifies LRA tax clearance tracking by providing a centralized platform where you can send, receive, and manage tax-related documents. Our user-friendly interface ensures that you can stay updated on your tax clearance status without any hassle.

-

Is there a cost associated with LRA tax clearance tracking using airSlate SignNow?

While airSlate SignNow offers various pricing plans, the cost of LRA tax clearance tracking features depends on your selected plan. We ensure competitive pricing that provides great value for businesses needing efficient document management solutions.

-

What are the key features of airSlate SignNow related to LRA tax clearance tracking?

Key features for LRA tax clearance tracking include automated reminders for certificate renewals, real-time status updates, and secure eSigning capabilities. These features help streamline your tax documentation process and reduce the risk of compliance issues.

-

Can airSlate SignNow integrate with other accounting software to assist with LRA tax clearance tracking?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, enhancing your LRA tax clearance tracking experience. This allows you to sync your tax data effortlessly and keep all your financial documents organized in one place.

-

What are the benefits of using airSlate SignNow for LRA tax clearance tracking?

Using airSlate SignNow for LRA tax clearance tracking provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced compliance. By digitizing your processes, you can focus on growing your business while ensuring your tax documentation is always up-to-date.

-

How secure is airSlate SignNow when handling LRA tax clearance documents?

Security is a priority at airSlate SignNow. Our platform uses advanced encryption and secure cloud storage to protect your LRA tax clearance documents from unauthorized access, ensuring that your sensitive information remains safe and confidential.

Get more for Lra Tax Clearance Certificate Online Application Near Maseru

Find out other Lra Tax Clearance Certificate Online Application Near Maseru

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy