Form ST 14 Virginia Sales and BUse Tax Certificateb of Exemption PDF 1999-2026

What is the Virginia Sales and Use Tax Certificate of Exemption (Form ST-14)?

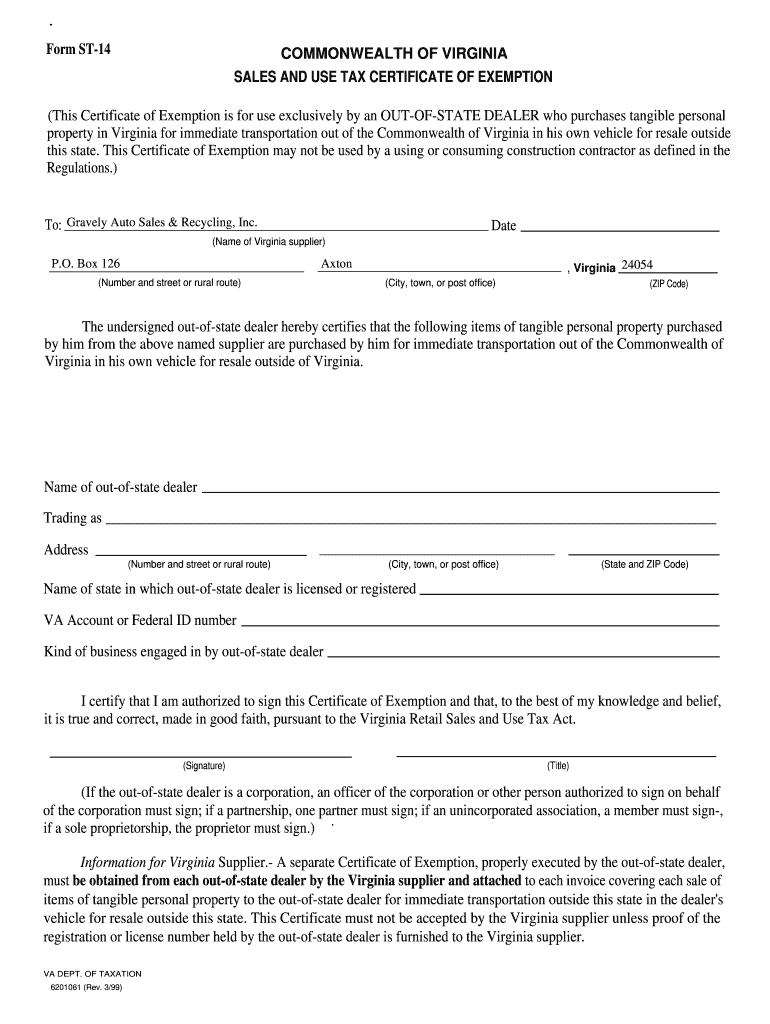

The Virginia Sales and Use Tax Certificate of Exemption, commonly referred to as Form ST-14, is a legal document that allows businesses and individuals to make tax-exempt purchases in the state of Virginia. This form is essential for entities that qualify for sales tax exemptions, such as non-profit organizations, government agencies, and certain businesses. By presenting this certificate to sellers, buyers can avoid paying sales tax on eligible purchases, thereby reducing their overall costs.

How to Use the Virginia Sales and Use Tax Certificate of Exemption (Form ST-14)

To effectively use Form ST-14, purchasers must complete the certificate accurately and present it to the seller at the time of purchase. The form requires specific information, including the buyer's name, address, and the reason for the exemption. Sellers are responsible for maintaining a copy of the completed form for their records to validate the tax-exempt status of the sale. It is important to ensure that the purchases made using this certificate align with the stated exemption purposes to avoid potential penalties.

Steps to Complete the Virginia Sales and Use Tax Certificate of Exemption (Form ST-14)

Completing the Form ST-14 involves several straightforward steps:

- Obtain a copy of the form, which can be downloaded from the Virginia Department of Taxation website.

- Fill in the required fields, including the purchaser's name, address, and the specific reason for the exemption.

- Ensure that the form is signed and dated by an authorized representative of the purchasing entity.

- Provide the completed form to the seller at the time of purchase.

Legal Use of the Virginia Sales and Use Tax Certificate of Exemption (Form ST-14)

The legal use of Form ST-14 is strictly defined by Virginia tax law. Only eligible entities can utilize this certificate to make tax-exempt purchases. Misuse of the form, such as using it for non-qualifying purchases or providing it to sellers without proper authorization, can lead to penalties, including back taxes and fines. It is crucial for users to understand their eligibility and the specific exemptions allowed under Virginia law to ensure compliance.

Key Elements of the Virginia Sales and Use Tax Certificate of Exemption (Form ST-14)

Form ST-14 includes several key elements that must be accurately filled out to ensure its validity:

- Purchaser Information: Name and address of the buyer.

- Exemption Reason: A clear statement of the reason for the tax exemption.

- Signature: Signature of an authorized representative of the purchasing entity.

- Date: The date the form is completed and signed.

Eligibility Criteria for the Virginia Sales and Use Tax Certificate of Exemption (Form ST-14)

To qualify for using Form ST-14, purchasers must meet specific eligibility criteria defined by Virginia tax regulations. Common qualifying entities include:

- Non-profit organizations recognized under IRS regulations.

- Government agencies at the federal, state, or local level.

- Certain educational institutions and charitable organizations.

It is essential for applicants to verify their eligibility before using the form to avoid any issues with compliance and taxation.

Quick guide on how to complete form st 14 virginia sales and buse tax certificateb of exemption pdf

Your assistance manual on how to prepare your Form ST 14 Virginia Sales And BUse Tax Certificateb Of Exemption PDF

If you're curious about how to create and dispatch your Form ST 14 Virginia Sales And BUse Tax Certificateb Of Exemption PDF, here are a few brief instructions on simplifying tax submission.

To start, you simply need to register your airSlate SignNow profile to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to modify, generate, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend information as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your Form ST 14 Virginia Sales And BUse Tax Certificateb Of Exemption PDF in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to access any IRS tax form; explore various versions and schedules.

- Click Get form to open your Form ST 14 Virginia Sales And BUse Tax Certificateb Of Exemption PDF in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Sign Tool to insert your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the form st 14 virginia sales and buse tax certificateb of exemption pdf

How to create an eSignature for the Form St 14 Virginia Sales And Buse Tax Certificateb Of Exemption Pdf online

How to generate an electronic signature for the Form St 14 Virginia Sales And Buse Tax Certificateb Of Exemption Pdf in Google Chrome

How to create an eSignature for putting it on the Form St 14 Virginia Sales And Buse Tax Certificateb Of Exemption Pdf in Gmail

How to generate an eSignature for the Form St 14 Virginia Sales And Buse Tax Certificateb Of Exemption Pdf right from your smartphone

How to create an electronic signature for the Form St 14 Virginia Sales And Buse Tax Certificateb Of Exemption Pdf on iOS devices

How to create an electronic signature for the Form St 14 Virginia Sales And Buse Tax Certificateb Of Exemption Pdf on Android

People also ask

-

What is a Virginia resale certificate ST 14?

A Virginia resale certificate ST 14 is a document that allows businesses to purchase goods tax-free, meant for resale. By providing this certificate to suppliers, businesses can avoid paying sales tax on items they intend to sell directly to customers.

-

How can airSlate SignNow help with the Virginia resale certificate ST 14?

airSlate SignNow streamlines the process of signing and sending a Virginia resale certificate ST 14 electronically. With our easy-to-use platform, businesses can quickly prepare, sign, and send documents, ensuring compliance and efficiency with minimal hassle.

-

Is there a cost associated with using airSlate SignNow for the Virginia resale certificate ST 14?

Yes, while airSlate SignNow offers competitive pricing, specific costs depend on the chosen subscription plan. We provide a range of options designed to cater to different business sizes and needs, making it a cost-effective choice for managing the Virginia resale certificate ST 14.

-

What features does airSlate SignNow offer for handling the Virginia resale certificate ST 14?

airSlate SignNow offers several features to manage the Virginia resale certificate ST 14, including e-signature capabilities, document templates, and storage options. These features ensure easy customization and secure handling of your certificate, enhancing overall efficiency.

-

Can I integrate airSlate SignNow with other applications while using the Virginia resale certificate ST 14?

Absolutely! airSlate SignNow supports integrations with numerous applications such as CRM and accounting software. This allows businesses to seamlessly utilize the Virginia resale certificate ST 14 within their existing workflow, streamlining operations.

-

What are the benefits of using airSlate SignNow for electronic signatures?

Utilizing airSlate SignNow for electronic signatures simplifies the process of obtaining necessary approvals for documents like the Virginia resale certificate ST 14. It speeds up transactions, reduces paperwork, and maintains a clear audit trail for compliance purposes.

-

How does airSlate SignNow ensure the security of the Virginia resale certificate ST 14?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect documents like the Virginia resale certificate ST 14. This commitment ensures that your sensitive information remains safe during the signing and storage process.

Get more for Form ST 14 Virginia Sales And BUse Tax Certificateb Of Exemption PDF

Find out other Form ST 14 Virginia Sales And BUse Tax Certificateb Of Exemption PDF

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF