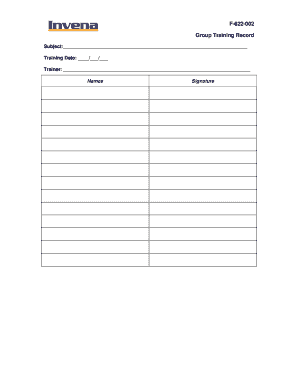

F622 002 Form

What is the F622 002

The F622 002 is a specific form used for various administrative and legal purposes within the United States. It serves as an essential document for individuals and businesses to comply with regulatory requirements. Understanding the F622 002 is crucial for ensuring proper documentation in various transactions and interactions with government entities.

How to use the F622 002

To effectively use the F622 002, individuals must first determine the specific context in which the form is required. This may involve identifying the relevant agency or organization that mandates its use. Once the context is established, users should accurately fill out the form, ensuring that all required fields are completed. It is important to review the information for accuracy before submission to avoid delays or complications.

Steps to complete the F622 002

Completing the F622 002 involves several key steps:

- Gather necessary information and documents that will be required to fill out the form.

- Carefully read the instructions provided with the form to understand all requirements.

- Fill out the form accurately, ensuring all fields are completed as needed.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission method, whether online, by mail, or in person.

Legal use of the F622 002

The F622 002 must be used in accordance with applicable laws and regulations. Legal compliance is essential when submitting this form, as improper use can lead to penalties or legal repercussions. It is advisable to consult with a legal professional if there are uncertainties regarding the form's usage or implications.

Filing Deadlines / Important Dates

Filing deadlines for the F622 002 can vary depending on the specific requirements associated with its use. It is important to be aware of any critical dates to ensure timely submission. Missing a deadline may result in penalties or complications in processing the form.

Required Documents

When preparing to complete the F622 002, certain documents may be required. These can include identification, proof of residency, or other relevant paperwork that supports the information provided in the form. Ensuring that all necessary documents are ready can facilitate a smoother completion process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f622 002

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f622 002 feature in airSlate SignNow?

The f622 002 feature in airSlate SignNow allows users to streamline their document signing process. This feature enhances efficiency by enabling users to send, sign, and manage documents electronically, reducing the need for paper-based workflows.

-

How does airSlate SignNow pricing work for the f622 002 plan?

The pricing for the f622 002 plan is designed to be cost-effective, catering to businesses of all sizes. Users can choose from various subscription tiers that provide access to essential features, ensuring that they only pay for what they need.

-

What are the key benefits of using the f622 002 solution?

Using the f622 002 solution from airSlate SignNow offers numerous benefits, including increased productivity and reduced turnaround times for document signing. Additionally, it enhances security and compliance, making it a reliable choice for businesses.

-

Can I integrate f622 002 with other software applications?

Yes, airSlate SignNow's f622 002 can be easily integrated with various software applications, including CRM and project management tools. This integration capability allows for a seamless workflow, enhancing overall efficiency.

-

Is the f622 002 feature user-friendly for new customers?

Absolutely! The f622 002 feature is designed with user-friendliness in mind, making it accessible for new customers. With an intuitive interface and straightforward navigation, users can quickly learn how to send and eSign documents.

-

What types of documents can I manage with f622 002?

With the f622 002 feature, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility makes it suitable for different industries and use cases, ensuring that all your document needs are met.

-

How secure is the f622 002 solution for document signing?

The f622 002 solution prioritizes security, employing advanced encryption and authentication measures to protect your documents. This ensures that all signed documents are secure and compliant with industry standards.

Get more for F622 002

- Free alabama power of attorney formspdf templates

- Alabama agents certification for power of attorney form

- Arkansas law a form

- Authorization for review of criminal history information acic

- Arkansas durable medical power attorney form

- Power of attorney delegating parental powers form

- Arizona mechanics waiver form

- Notice of levy california form

Find out other F622 002

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History