Form 720 Rev April Irs

What is the Form 720 Rev April IRS

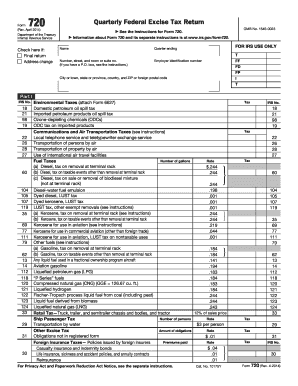

The Form 720 Rev April IRS is a tax form used by businesses to report and pay federal excise taxes. This form is essential for entities that engage in specific activities, such as manufacturing, selling, or importing certain products subject to excise tax. The form helps the IRS track and collect taxes on goods and services that may impact public health, safety, or the environment. Understanding its purpose is crucial for compliance and avoiding potential penalties.

How to use the Form 720 Rev April IRS

Using the Form 720 Rev April IRS involves several steps to ensure accurate reporting and payment of excise taxes. First, businesses must determine if they are liable for excise tax based on their activities. Next, they should gather necessary financial information related to taxable transactions. The form requires detailed reporting of the types of taxes owed, which can include environmental taxes, fuel taxes, and others. After completing the form, businesses can submit it electronically or via mail, ensuring they adhere to IRS guidelines for submission.

Steps to complete the Form 720 Rev April IRS

Completing the Form 720 Rev April IRS involves a systematic approach:

- Identify the applicable excise taxes based on your business activities.

- Gather all relevant financial records, including sales and purchase invoices.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total excise tax owed based on the information provided.

- Review the form for accuracy before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Form 720 Rev April IRS

The legal use of the Form 720 Rev April IRS is governed by federal tax laws. Businesses must ensure that the information provided is accurate and complete to avoid legal repercussions. Filing this form correctly is essential for compliance with the IRS regulations. Inaccuracies or omissions can lead to audits, fines, or other legal actions. Therefore, understanding the legal implications of this form is vital for any business subject to excise taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 Rev April IRS are critical for compliance. Generally, the form must be filed quarterly, with specific due dates for each quarter. For instance, the due date for the first quarter is usually April 30, while subsequent quarters follow on July 31, October 31, and January 31 of the following year. It is essential for businesses to mark these dates on their calendars to ensure timely submission and avoid penalties associated with late filings.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Form 720 Rev April IRS. The form can be submitted electronically through the IRS e-file system, which is often the most efficient method. Alternatively, businesses may choose to mail the completed form to the appropriate IRS address. In-person submissions are generally not available for this form, making electronic and mail submissions the primary methods. Choosing the right method can help streamline the filing process and ensure timely compliance.

Quick guide on how to complete form 720 rev april irs

Complete Form 720 Rev April Irs effortlessly on any device

Digital document management has become a favored choice for companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and electronically sign your documents promptly without any hold-ups. Manage Form 720 Rev April Irs on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 720 Rev April Irs without hassle

- Locate Form 720 Rev April Irs and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or dislocated files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Form 720 Rev April Irs and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 720 rev april irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 720 Rev April Irs used for?

Form 720 Rev April Irs is primarily used for reporting and paying certain federal excise taxes. It's important for businesses to complete this form accurately to remain compliant with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help with Form 720 Rev April Irs?

airSlate SignNow offers an efficient platform to electronically sign and submit Form 720 Rev April Irs. Our solution streamlines the signing process, ensuring more productive workflows and faster submission times.

-

What are the pricing plans for using airSlate SignNow to handle Form 720 Rev April Irs?

Our pricing plans for airSlate SignNow are competitive and designed to accommodate various business sizes. We offer monthly and annual subscriptions, providing features like document templates and secure signing specifically for forms like Form 720 Rev April Irs.

-

Can I integrate airSlate SignNow with my accounting software for Form 720 Rev April Irs?

Yes, airSlate SignNow supports integrations with a variety of accounting software platforms. This way, you can easily manage and access Form 720 Rev April Irs alongside your other financial documents for better workflow efficiency.

-

What features does airSlate SignNow offer for managing Form 720 Rev April Irs?

airSlate SignNow provides features such as customizable templates, real-time tracking, and automated reminders, all tailored for documents like Form 720 Rev April Irs. These tools enhance collaboration and ensure that forms are completed and submitted on time.

-

Is airSlate SignNow secure for handling sensitive information like Form 720 Rev April Irs?

Absolutely! airSlate SignNow employs advanced encryption protocols and robust security measures to protect your data. This ensures that sensitive documents, including Form 720 Rev April Irs, are safely handled throughout the signing and submission process.

-

What benefits do businesses gain from using airSlate SignNow for Form 720 Rev April Irs?

Using airSlate SignNow for Form 720 Rev April Irs simplifies the entire signing and submission process. Businesses benefit from increased efficiency, reduced paperwork, and the ability to quickly access and review documents anytime, anywhere.

Get more for Form 720 Rev April Irs

- Y otc t 1 professional services agreement between form

- Commercial lease extension legal form

- Listing agreement granting a broker or realtor the exclusive right form

- South carolina disclaimer of interest formsdeedscom

- Recruiting telemarketing ic agreement 050911 united american form

- District court rules of civil procedure courtsstatehius form

- Aapl la lease aapl form 820 oil gas and mineral lease

- Unjust dismissal complaint form

Find out other Form 720 Rev April Irs

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free