Dr0104 Form

What is the DR0104?

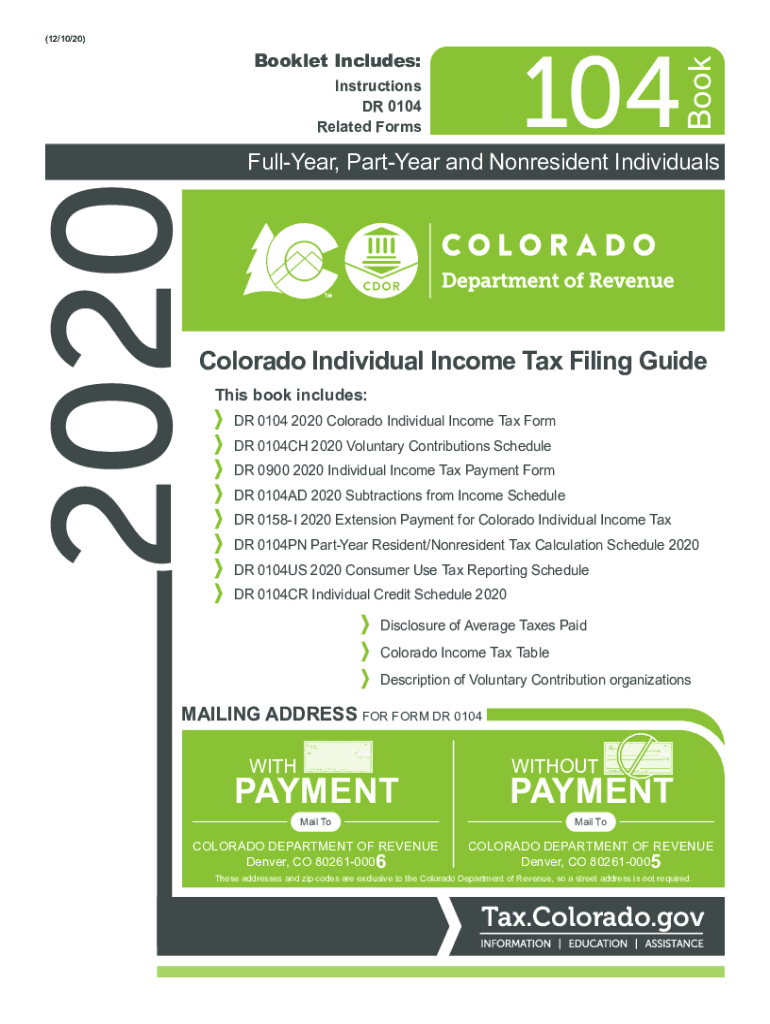

The DR0104 is a specific form used in Colorado, primarily for vehicle registration purposes. It is essential for individuals and businesses alike who need to register a vehicle or update their registration details. This form captures vital information about the vehicle, including its identification number, make, model, and owner details. Understanding the purpose and requirements of the DR0104 is crucial for ensuring compliance with state regulations.

How to Obtain the DR0104

To obtain the DR0104 form, individuals can visit the Colorado Department of Revenue's website or their local county clerk and recorder's office. The form is typically available for download online, allowing users to print it for completion. Additionally, physical copies can be requested at designated state offices. Ensuring that you have the correct version of the form is important, as updates may occur periodically.

Steps to Complete the DR0104

Completing the DR0104 involves several straightforward steps:

- Gather necessary information about the vehicle, including the Vehicle Identification Number (VIN), make, model, and year.

- Provide personal information, such as the owner's name, address, and contact details.

- Indicate any relevant changes, such as a change of ownership or address.

- Review the form for accuracy before submission to avoid delays.

Once completed, the form can be submitted online, by mail, or in person at a local office.

Legal Use of the DR0104

The DR0104 is legally recognized in Colorado for vehicle registration purposes. To ensure its legal validity, the form must be filled out accurately and submitted according to state guidelines. Compliance with local regulations is essential, as improper use of the form can lead to penalties or issues with vehicle registration. Understanding the legal implications of the DR0104 helps users navigate the registration process smoothly.

Key Elements of the DR0104

Several key elements are essential when filling out the DR0104:

- Vehicle Information: This includes the VIN, make, model, and year.

- Owner Details: Full name, address, and contact information of the vehicle owner.

- Registration Type: Indicate whether the registration is for a new vehicle, renewal, or change of ownership.

- Signature: The form must be signed by the owner or authorized representative to validate the submission.

Form Submission Methods

The DR0104 can be submitted through various methods, providing flexibility for users:

- Online: Users can complete and submit the form electronically through the Colorado Department of Revenue's online portal.

- Mail: Completed forms can be mailed to the appropriate county clerk and recorder's office.

- In-Person: Individuals can visit their local office to submit the form directly and receive assistance if needed.

Quick guide on how to complete dr0104

Effortlessly Prepare Dr0104 on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without holdups. Manage Dr0104 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Method to Modify and eSign Dr0104 with Ease

- Obtain Dr0104 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Dr0104 and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr0104

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr0104, and how does it relate to airSlate SignNow?

Dr0104 is a unique identifier for specific features and functionalities within airSlate SignNow. This powerful tool allows users to seamlessly create, send, and eSign documents, ensuring streamlined workflows and enhanced productivity for businesses.

-

How much does airSlate SignNow cost, and does dr0104 provide any discounts?

AirSlate SignNow offers flexible pricing plans tailored to different business needs. While dr0104 itself doesn’t directly indicate discounts, our pricing is competitive, and we occasionally offer promotional discounts that can enhance cost savings.

-

What features does airSlate SignNow include under the dr0104 designation?

Under the dr0104 designation, airSlate SignNow includes features like customizable templates, real-time collaboration, and advanced security measures. These features are designed to simplify the eSigning process and boost efficiency for users.

-

What are the benefits of using airSlate SignNow with reference to dr0104?

Using airSlate SignNow, identified by dr0104, allows businesses to enhance their document management processes. Benefits include reduced turnaround times, increased accuracy, and improved compliance, all contributing to a more efficient operation.

-

Can airSlate SignNow integrate with other software, and how does dr0104 facilitate this?

Yes, airSlate SignNow can integrate with various software applications such as CRM and project management tools. The dr0104 identification allows users to easily access integration options, ensuring a cohesive tech ecosystem tailored to their business needs.

-

Is airSlate SignNow suitable for small businesses, and how does dr0104 support this?

Absolutely! AirSlate SignNow, branded under dr0104, is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal solution for startups and smaller enterprises.

-

How secure are eSignatures on airSlate SignNow features related to dr0104?

E-Signatures on airSlate SignNow, particularly those highlighted by dr0104, comply with industry standards for security. We implement robust encryption methods and legal compliance measures to protect your documents and ensure a secure signing experience.

Get more for Dr0104

- Heirship affidavit descent minnesota form

- Warranty deed form mn

- Subcontractors notice to owner corporation or llc minnesota form

- Quitclaim deed from individual to two individuals in joint tenancy minnesota form

- Minnesota subcontractor form

- Quitclaim deed by two individuals to husband and wife minnesota form

- Warranty deed from two individuals to husband and wife minnesota form

- Minnesota corporation company form

Find out other Dr0104

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later