Clarendon County Delinquent Tax Sale Form

What is the Clarendon County Delinquent Tax Sale

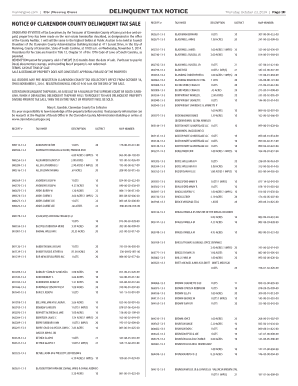

The Clarendon County delinquent tax sale is a legal process through which the county auctions properties that have unpaid property taxes. This process allows the county to recover lost revenue while providing opportunities for buyers to acquire properties at potentially lower prices. Properties included in the sale are typically those that have been delinquent for a specified period, and the sale is conducted in accordance with state laws and regulations.

How to use the Clarendon County Delinquent Tax Sale

Utilizing the Clarendon County delinquent tax sale involves several steps. First, interested buyers should review the delinquent tax list, which details properties available for auction. Next, potential bidders need to register for the auction, ensuring they meet any eligibility requirements. During the auction, participants can place bids on properties, and winning bidders must complete the necessary paperwork to finalize the purchase. Understanding the auction process and associated regulations is crucial for a successful transaction.

Steps to complete the Clarendon County Delinquent Tax Sale

Completing a transaction in the Clarendon County delinquent tax sale involves the following steps:

- Review the Clarendon County delinquent tax list to identify properties of interest.

- Register for the auction by providing required information and documentation.

- Participate in the auction, either in person or online, and place bids on desired properties.

- If successful, complete the necessary forms to finalize the purchase, including payment of any fees or taxes.

- Receive the deed and any relevant documentation confirming ownership.

Legal use of the Clarendon County Delinquent Tax Sale

The legal framework surrounding the Clarendon County delinquent tax sale ensures that the process is conducted fairly and transparently. Properties sold at the auction must adhere to state laws regarding notification, bidding procedures, and the rights of property owners. Buyers should familiarize themselves with these regulations to ensure compliance and protect their investment. Engaging with a legal professional can also provide valuable guidance throughout the process.

Filing Deadlines / Important Dates

Timely participation in the Clarendon County delinquent tax sale requires awareness of key deadlines and important dates. These may include:

- The deadline for property owners to pay delinquent taxes before the auction.

- The date of the auction itself, which is typically announced in advance.

- Any deadlines for submitting registration forms or required documentation for bidders.

Staying informed about these dates is essential for both property owners and potential buyers to navigate the process effectively.

Required Documents

To participate in the Clarendon County delinquent tax sale, certain documents are typically required. Bidders may need to provide:

- A valid form of identification, such as a driver's license or passport.

- Proof of registration for the auction, which may include a completed registration form.

- Financial documentation to demonstrate the ability to pay for purchased properties.

Ensuring that all necessary documents are prepared in advance can facilitate a smoother auction experience.

Quick guide on how to complete clarendon county delinquent tax sale

Complete Clarendon County Delinquent Tax Sale effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Clarendon County Delinquent Tax Sale on any device through airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Clarendon County Delinquent Tax Sale without difficulty

- Obtain Clarendon County Delinquent Tax Sale and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, be it via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Clarendon County Delinquent Tax Sale and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clarendon county delinquent tax sale

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Clarendon County delinquent tax sale 2024 schedule pdf?

The Clarendon County delinquent tax sale 2024 schedule pdf is a detailed document outlining the dates and procedures for the upcoming tax sale in Clarendon County. This PDF provides vital information for potential bidders, including property specifics, minimum bids, and sale locations.

-

How can I access the Clarendon County delinquent tax sale 2024 schedule pdf?

You can easily access the Clarendon County delinquent tax sale 2024 schedule pdf on the official Clarendon County website or local government offices. Once available, the document can usually be downloaded directly to your device for convenience.

-

Are there any fees associated with the Clarendon County delinquent tax sale 2024 schedule pdf?

While the Clarendon County delinquent tax sale 2024 schedule pdf itself is typically free to access, there may be fees associated with bidding on properties during the sale. It’s essential to review the schedule for any outlined costs related to bidding or property acquisition.

-

What properties are listed in the Clarendon County delinquent tax sale 2024 schedule pdf?

The properties listed in the Clarendon County delinquent tax sale 2024 schedule pdf include various residential and commercial real estate that have unpaid taxes. Each listing will provide details such as parcel numbers and assessed values, helping bidders make informed decisions.

-

How does the tax bidding process work in Clarendon County?

The bidding process for the Clarendon County delinquent tax sale, as outlined in the 2024 schedule pdf, involves public auctions where properties are sold to the highest bidder. Interested buyers must be aware of the bidding requirements, including registration and payment protocols.

-

Can I find information about previous tax sales in the Clarendon County delinquent tax sale 2024 schedule pdf?

The Clarendon County delinquent tax sale 2024 schedule pdf typically focuses on upcoming sales, but you may find links or references to past sales, including final sale amounts and unsold properties. These insights can be useful for understanding market trends and property values.

-

What should I know before participating in the Clarendon County delinquent tax sale?

Before participating in the Clarendon County delinquent tax sale, review the 2024 schedule pdf thoroughly for regulations and procedures. It's crucial to understand bidding strategies, potential risks, and any financial obligations to ensure a successful experience.

Get more for Clarendon County Delinquent Tax Sale

Find out other Clarendon County Delinquent Tax Sale

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History