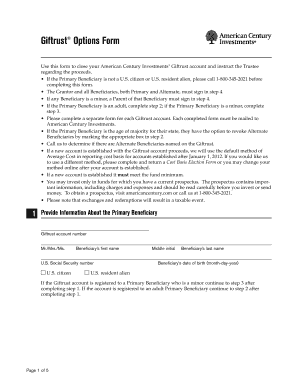

Giftrust Options Form 1 American Century

What is the Giftrust Options Form 1 American Century

The Giftrust Options Form 1 American Century is a specific document used by investors to manage their accounts with Twentieth Century Investors Inc. This form allows individuals to make various choices regarding their investments, including options for fund transfers, account updates, and beneficiary designations. Understanding this form is crucial for ensuring that your investment choices align with your financial goals.

How to use the Giftrust Options Form 1 American Century

Utilizing the Giftrust Options Form 1 American Century involves several steps. First, gather all necessary information, including your account details and any relevant investment preferences. Next, carefully read the instructions provided with the form to understand the options available. Complete the form by filling in the required fields accurately, ensuring that all selections reflect your intentions. Finally, review the completed form for any errors before submission.

Steps to complete the Giftrust Options Form 1 American Century

Completing the Giftrust Options Form 1 American Century requires attention to detail. Follow these steps:

- Obtain the latest version of the form from a reliable source.

- Fill in your personal information, including your name, address, and account number.

- Select the options that apply to your investment choices.

- Provide any required signatures to validate your selections.

- Double-check all entries for accuracy before submitting the form.

Legal use of the Giftrust Options Form 1 American Century

The legal use of the Giftrust Options Form 1 American Century is governed by various regulations that ensure the validity of electronic signatures and document submissions. To be legally binding, the form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This compliance guarantees that your electronic submission holds the same weight as a traditional paper document.

Key elements of the Giftrust Options Form 1 American Century

Several key elements are essential for the Giftrust Options Form 1 American Century. These include:

- Account Information: Details about your investment account.

- Options Selection: Choices regarding fund transfers and updates.

- Signature Section: Required for validation of your selections.

- Instructions: Guidance on how to complete and submit the form.

Who Issues the Form

The Giftrust Options Form 1 American Century is issued by Twentieth Century Investors Inc. This organization is responsible for managing investment accounts and providing investors with the necessary documentation to facilitate their investment decisions. Understanding the issuer can help you navigate the process more effectively.

Quick guide on how to complete giftrust options form 1 american century

Complete Giftrust Options Form 1 American Century effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without delays. Manage Giftrust Options Form 1 American Century on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to edit and eSign Giftrust Options Form 1 American Century seamlessly

- Obtain Giftrust Options Form 1 American Century and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Giftrust Options Form 1 American Century and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the giftrust options form 1 american century

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a twentieth century investors inc account certificate?

A twentieth century investors inc account certificate is a document that proves ownership of an investment account with Twentieth Century Investors Inc. It serves as a key component for verifying your holdings and provides essential details regarding your investments.

-

How can I obtain a twentieth century investors inc account certificate?

To obtain a twentieth century investors inc account certificate, you typically need to contact Twentieth Century Investors Inc directly through their customer service or online portal. They will guide you through the process, which may include verifying your identity and submitting specific documentation.

-

What are the benefits of using a twentieth century investors inc account certificate?

The benefits of a twentieth century investors inc account certificate include providing proof of investment ownership, facilitating easier transactions, and simplifying the process of estate management. It is a crucial document for both personal and professional financial activities.

-

Is there a fee for obtaining a twentieth century investors inc account certificate?

There may be a nominal fee associated with obtaining a twentieth century investors inc account certificate, depending on the policies of Twentieth Century Investors Inc. It's best to check directly with their customer service for detailed pricing information.

-

Can I integrate the twentieth century investors inc account certificate with other financial tools?

Yes, many users find it beneficial to integrate their twentieth century investors inc account certificate with financial management tools and software. This integration can enhance your investment tracking and reporting capabilities for better financial planning.

-

How does a twentieth century investors inc account certificate enhance my investment management?

A twentieth century investors inc account certificate enhances your investment management by providing a clear record of your holdings and simplifying the monitoring of your portfolio. It allows for more informed decision-making regarding buying, selling, or rebalancing investments.

-

What features should I look for in a twentieth century investors inc account certificate?

When looking for a twentieth century investors inc account certificate, ensure it provides detailed information about your investments, such as asset types and values. Security features, ease of access, and customer support are also essential attributes to consider.

Get more for Giftrust Options Form 1 American Century

- Form p11d revenue commissioners

- Early bird registration on or before 1 oct 2016 295 form

- First notice of claim for bunemploymentb benefits latitude financial bb form

- Medipac application form

- Hospital claim formexisting 20190404

- Full rate mailing statement form

- New zealand voc3 form

- Singapore general hospital form

Find out other Giftrust Options Form 1 American Century

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online