Colorado Transfer Statement 2005-2026

What is the Colorado Transfer Statement

The Colorado Transfer Statement is a legal document used to facilitate the transfer of ownership of a vehicle in the state of Colorado. This form is essential when a vehicle is sold, gifted, or otherwise transferred from one individual or entity to another. It serves to establish a clear record of the transfer, ensuring that all parties involved understand the terms and conditions of the transaction. The statement includes vital information such as the vehicle's identification number (VIN), the names and addresses of the transferor and transferee, and the date of the transfer.

Steps to complete the Colorado Transfer Statement

Completing the Colorado Transfer Statement involves several key steps:

- Gather necessary information, including the vehicle's VIN, the names and addresses of both the seller and buyer, and the sale price or consideration.

- Obtain the official Colorado Transfer Statement form, which can be downloaded from the Colorado Department of Revenue website or acquired at a local DMV office.

- Fill out the form accurately, ensuring that all information is legible and complete.

- Both the seller and buyer should sign the document to validate the transfer.

- Submit the completed form to the Colorado Department of Revenue, along with any required fees and additional documentation, if applicable.

Legal use of the Colorado Transfer Statement

The Colorado Transfer Statement is legally binding and must be used in accordance with state laws governing vehicle ownership transfers. This document protects the rights of both the seller and buyer, providing legal evidence of the transaction. It is crucial to ensure that the form is filled out correctly and submitted within the appropriate timeframe to avoid any legal complications. Failure to properly execute the transfer can result in penalties or disputes regarding ownership.

Required Documents

When completing the Colorado Transfer Statement, several documents may be required to accompany the form:

- The original vehicle title, signed by the seller.

- Proof of identification for both the seller and buyer, such as a driver's license.

- Any applicable lien release documents if the vehicle was financed.

- Payment for any transfer fees, which may vary based on the vehicle's value and local regulations.

Who Issues the Form

The Colorado Transfer Statement is issued by the Colorado Department of Revenue, specifically through the Division of Motor Vehicles (DMV). This agency is responsible for overseeing vehicle registrations, titles, and transfers within the state. Individuals can obtain the form directly from the DMV's website or visit a local DMV office for assistance.

Examples of using the Colorado Transfer Statement

There are various scenarios in which the Colorado Transfer Statement is utilized:

- When a vehicle is sold from one private party to another, the statement documents the sale and transfer of ownership.

- If a vehicle is gifted to a family member or friend, the form is used to record the change in ownership without a sale price.

- In cases of inheritance, the statement helps transfer the vehicle from the deceased owner's name to the heir or executor of the estate.

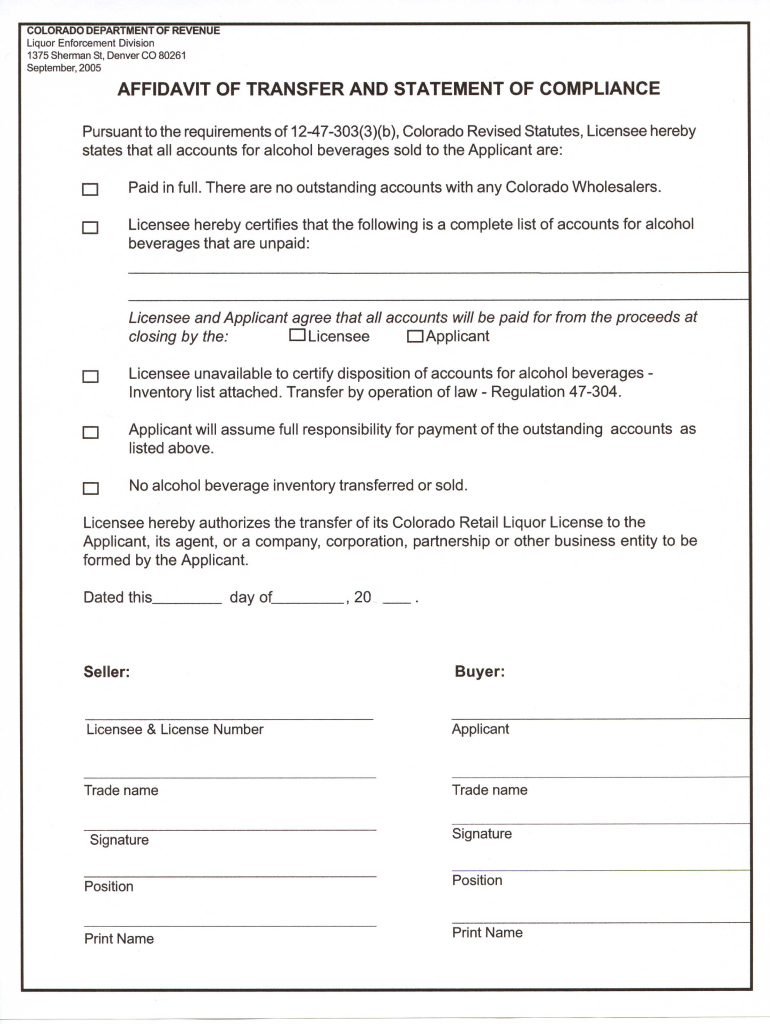

Quick guide on how to complete affidavit of transfer and statement of compliance colorado

Your assistance manual on preparing your Colorado Transfer Statement

If you’re uncertain about how to finalize and submit your Colorado Transfer Statement, here are some straightforward instructions to simplify tax filing.

To begin, you only need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that allows you to modify, draft, and finalize your income tax paperwork seamlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to amend any information as needed. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing options.

Complete the following steps to wrap up your Colorado Transfer Statement in just minutes:

- Establish your account and begin handling PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to launch your Colorado Transfer Statement in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it onto your device.

Refer to this guide to submit your taxes electronically with airSlate SignNow. Kindly remember that paper submissions may lead to errors in returns and delays in reimbursements. Naturally, before e-filing your taxes, review the IRS website for filing guidelines pertinent to your state.

Create this form in 5 minutes or less

FAQs

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the affidavit of transfer and statement of compliance colorado

How to create an electronic signature for your Affidavit Of Transfer And Statement Of Compliance Colorado online

How to create an eSignature for your Affidavit Of Transfer And Statement Of Compliance Colorado in Google Chrome

How to generate an eSignature for signing the Affidavit Of Transfer And Statement Of Compliance Colorado in Gmail

How to make an electronic signature for the Affidavit Of Transfer And Statement Of Compliance Colorado from your smartphone

How to create an eSignature for the Affidavit Of Transfer And Statement Of Compliance Colorado on iOS

How to generate an electronic signature for the Affidavit Of Transfer And Statement Of Compliance Colorado on Android

People also ask

-

What is a statement of transfer in Colorado?

A statement of transfer in Colorado is a legal document that facilitates the transfer of ownership of property. It outlines details such as the parties involved and the nature of the transfer. Understanding this document is crucial for both personal and business transactions in the state.

-

How can airSlate SignNow help with the statement of transfer Colorado?

AirSlate SignNow streamlines the process of managing and signing documents like the statement of transfer Colorado. Our platform allows users to eSign documents securely and quickly, ensuring a hassle-free transfer process. With easy access to templates and automated workflows, it simplifies document management.

-

What are the pricing options for airSlate SignNow when handling statement of transfer Colorado?

AirSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. For users dealing with the statement of transfer Colorado, our plans provide access to necessary features at an affordable rate. You can choose from monthly or annual subscriptions, ensuring flexibility according to your business needs.

-

Is airSlate SignNow compliant with Colorado regulations for statement of transfer?

Yes, airSlate SignNow complies with all relevant Colorado laws and regulations regarding document signing, including the statement of transfer Colorado. Our platform utilizes advanced encryption and security features, ensuring that your documents are legally binding and protected. Trust us to keep your transactions compliant.

-

What features does airSlate SignNow offer for managing a statement of transfer Colorado?

AirSlate SignNow includes various features such as eSigning, document templates, and real-time tracking, all tailored for the statement of transfer Colorado. Our user-friendly interface allows you to easily create, send, and monitor these important documents. Enhance your efficiency with automated reminders and notifications.

-

Can I integrate airSlate SignNow with other tools for managing statement of transfer Colorado?

Absolutely! AirSlate SignNow can be integrated with a variety of tools and applications to enhance your workflow for the statement of transfer Colorado. Compatible with popular CRMs, project management tools, and cloud storage services, these integrations help you manage documents seamlessly across platforms.

-

What benefits does airSlate SignNow offer for eSigning a statement of transfer Colorado?

Using airSlate SignNow for eSigning your statement of transfer Colorado saves time and enhances security. The solution allows you to sign documents from any device without the need for printing or faxing, hereby reducing environmental impact. Experience faster transactions and peace of mind knowing that every signature is legally recognized.

Get more for Colorado Transfer Statement

Find out other Colorado Transfer Statement

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer