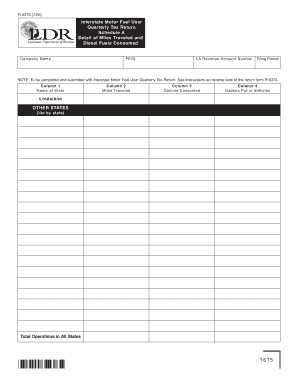

Interstate Motor Fuel User Quarterly Tax Return Schedule a Detail of Revenue Louisiana Form

What is the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana

The Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail of Revenue Louisiana is a specific tax form used by motor fuel users in Louisiana to report and remit taxes on fuel consumed in the state. This form is essential for ensuring compliance with state tax regulations and accurately tracking fuel usage for tax purposes. It collects detailed information about the fuel used, the type of fuel, and the total revenue generated from fuel sales. Users must complete this form quarterly to maintain compliance with Louisiana tax laws.

Steps to complete the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana

Completing the Interstate Motor Fuel User Quarterly Tax Return Schedule A requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including previous tax returns and fuel purchase records.

- Fill out the form with accurate information regarding fuel consumption and revenue.

- Calculate the total tax owed based on the fuel usage reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana

The legal use of the Interstate Motor Fuel User Quarterly Tax Return Schedule A is governed by state tax regulations. To be considered valid, the form must be completed accurately and submitted on time. Electronic signatures are accepted, provided they comply with the relevant eSignature laws. It is crucial for users to understand the legal implications of submitting this form, as inaccuracies or late submissions may lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Interstate Motor Fuel User Quarterly Tax Return Schedule A are critical for compliance. Typically, the form is due on the last day of the month following the end of each quarter. For example, the deadlines are usually as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

It is essential to mark these dates on your calendar to avoid late fees or penalties.

Required Documents

To complete the Interstate Motor Fuel User Quarterly Tax Return Schedule A, several documents are typically required. These may include:

- Previous tax returns for reference.

- Records of fuel purchases and consumption.

- Invoices or receipts related to fuel sales.

- Any relevant correspondence from the Louisiana Department of Revenue.

Having these documents on hand will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The Interstate Motor Fuel User Quarterly Tax Return Schedule A can be submitted through various methods:

- Online: Users can complete and submit the form electronically through the Louisiana Department of Revenue's online portal.

- Mail: The completed form can be printed and sent via postal mail to the appropriate tax office.

- In-Person: Users may also choose to deliver the form in person at designated tax offices.

Selecting the appropriate submission method can enhance the efficiency of the filing process.

Quick guide on how to complete interstate motor fuel user quarterly tax return schedule a detail of revenue louisiana

Complete Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana with ease

- Access Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the interstate motor fuel user quarterly tax return schedule a detail of revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana?

The Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana is a tax form required for reporting fuel taxes for interstate motor carriers. It provides detailed information about the revenue generated from motor fuel usage in Louisiana. Understanding this form is essential for compliance with state regulations.

-

How can airSlate SignNow assist with filing the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana?

airSlate SignNow simplifies the filing process for the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana by allowing you to electronically sign and send your documents. Our platform ensures that your submissions are secure and compliant with state requirements. You can track the document's status and receive acknowledgments promptly.

-

What pricing options are available for airSlate SignNow when filing the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs. You can choose a plan that fits your budget while gaining access to features specifically designed for filing tax returns, including the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana. Discounts may be available for annual subscriptions.

-

What features does airSlate SignNow offer for the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana?

airSlate SignNow provides key features such as secure eSigning, document templates, and automated workflows specifically for managing documents like the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana. These features enhance efficiency and reduce the time spent on administrative tasks, allowing businesses to focus on their core activities.

-

Are there any integrations with other tools available for airSlate SignNow when preparing the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana?

Yes, airSlate SignNow seamlessly integrates with various tools such as accounting software and document management systems. This allows you to easily import data needed for the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana. Such integrations streamline your workflow, reducing manual entry and the risk of errors.

-

What are the benefits of using airSlate SignNow for the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana?

Using airSlate SignNow for the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana offers numerous benefits, including time savings, enhanced document security, and improved compliance. Our platform ensures that your documents are signed and submitted efficiently, minimizing the chances of penalties for late filings.

-

Can I access airSlate SignNow from any device when filing the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana?

Absolutely! airSlate SignNow is cloud-based, allowing you to access it from any device with internet connectivity. This flexibility means you can prepare and file the Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana on-the-go, ensuring that you meet deadlines regardless of your location.

Get more for Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana

Find out other Interstate Motor Fuel User Quarterly Tax Return Schedule A Detail Of Revenue Louisiana

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document