Form 5701

What is the Form 5701

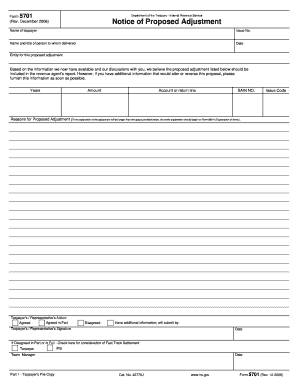

The Form 5701 is an official document used for specific tax-related purposes in the United States. This form is typically associated with the Internal Revenue Service (IRS) and is essential for individuals and businesses who need to report certain financial information. Understanding the purpose and requirements of the Form 5701 is crucial for ensuring compliance with U.S. tax regulations.

How to use the Form 5701

Using the Form 5701 involves several key steps to ensure accurate completion. First, gather all necessary financial documents and information relevant to the form. Next, carefully fill out each section of the form, paying close attention to detail to avoid errors. Once completed, review the form for accuracy before submission. It is important to follow any specific instructions provided by the IRS regarding the use of this form to ensure proper handling and processing.

Steps to complete the Form 5701

Completing the Form 5701 requires a systematic approach. Start by downloading the form from the IRS website or obtaining a physical copy. Then, follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide the necessary financial details as prompted by the form.

- Double-check all entries for accuracy.

- Sign and date the form where required.

After completing these steps, the form is ready for submission.

Legal use of the Form 5701

The legal use of the Form 5701 is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted according to the specified guidelines. Electronic signatures are acceptable if they comply with eSignature laws, which provide a framework for the validity of digital documents. Utilizing a reliable eSignature solution can enhance the legal standing of your completed Form 5701.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5701 can vary based on the specific circumstances of the taxpayer. It is essential to be aware of these deadlines to avoid potential penalties. Typically, the IRS sets annual deadlines for tax-related forms, and it is advisable to consult the IRS website or a tax professional for the most accurate and current information regarding submission dates.

Required Documents

When completing the Form 5701, certain documents may be required to support the information provided. Commonly needed documents include:

- Previous tax returns for reference.

- Financial statements or records relevant to the reporting period.

- Any additional forms that may be required by the IRS.

Having these documents ready can facilitate a smoother completion process and ensure compliance with IRS requirements.

Quick guide on how to complete form 5701

Accomplish Form 5701 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It presents an excellent eco-friendly substitute for conventional printed and signed materials, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 5701 on any device using the airSlate SignNow Android or iOS applications and ease any document-related process today.

The easiest way to alter and eSign Form 5701 effortlessly

- Find Form 5701 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Alter and eSign Form 5701 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5701

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5701 and how can airSlate SignNow help?

Form 5701 is a document often needed for compliance and accounting purposes. airSlate SignNow simplifies the process of sending and eSigning this form with an easy-to-use digital platform, ensuring you can collect signatures quickly and efficiently.

-

What features does airSlate SignNow offer for handling form 5701?

airSlate SignNow provides a range of features specifically designed for form 5701, including customizable templates, secure storage, and automatic reminders for signatures. These tools streamline your workflow and ensure that your documents are always in compliance.

-

How much does it cost to use airSlate SignNow for form 5701?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains an affordable solution for managing form 5701 and other documents. Consider starting with our free trial to evaluate how well our service meets your needs without any upfront cost.

-

Is airSlate SignNow compliant with regulations for form 5701 eSigning?

Yes, airSlate SignNow adheres to all necessary legal and regulatory requirements for eSigning form 5701. Our platform uses advanced encryption and secure authentication methods to ensure that your signed documents are legally valid.

-

What integrations does airSlate SignNow support for form 5701?

airSlate SignNow seamlessly integrates with a variety of applications, including CRM tools and cloud storage services, which can enhance your process for managing form 5701. Popular integrations include Salesforce, Google Drive, and Dropbox, enabling a more efficient workflow.

-

Can I customize form 5701 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for form 5701, making it easy to adapt the document to your specific needs. This feature saves you time and ensures that your forms are always formatted correctly.

-

How does airSlate SignNow enhance the security of form 5701?

airSlate SignNow prioritizes security by employing features like end-to-end encryption and two-factor authentication. These measures ensure that your form 5701 is protected throughout the signing process, giving you peace of mind.

Get more for Form 5701

Find out other Form 5701

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF