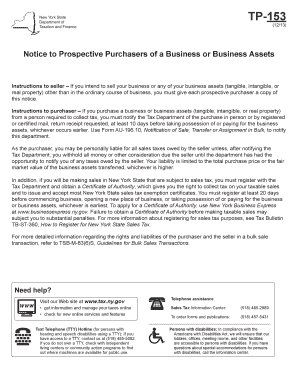

Tp 153 Form

What is the TP 153?

The TP 153 is a New York State form used primarily for tax purposes, specifically related to the allocation of income and expenses for tax reporting. This form is essential for individuals and businesses who need to report their income accurately while complying with state tax regulations. It serves as a declaration of income sources and deductions, ensuring that taxpayers fulfill their obligations under New York tax law.

How to use the TP 153

Using the TP 153 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form by entering relevant information about your income sources and applicable deductions. It is crucial to review the instructions provided with the form to ensure compliance with state requirements. Once completed, the form must be submitted to the appropriate tax authority by the designated deadline.

Steps to complete the TP 153

Completing the TP 153 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Fill out the form, ensuring that all income sources are reported accurately.

- Calculate total deductions and ensure they align with state regulations.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the TP 153

The TP 153 is legally binding when completed and submitted according to New York State tax laws. To ensure its legal standing, it must be filled out accurately and submitted by the required deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. Utilizing a reliable digital solution for e-signatures can enhance the legal validity of the form, ensuring that all signatures are authenticated and compliant with eSignature laws.

Key elements of the TP 153

Several key elements must be included when completing the TP 153. These include:

- Personal identification information, such as name and Social Security number.

- A detailed account of income sources, including wages, interest, and dividends.

- Documentation of allowable deductions, such as business expenses or educational costs.

- Signature and date to validate the form.

Form Submission Methods

The TP 153 can be submitted through various methods to accommodate different preferences. Taxpayers can choose to submit the form online through the New York State Department of Taxation and Finance website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own set of guidelines, so it is essential to follow the instructions provided for each submission option.

Quick guide on how to complete tp 153

Complete Tp 153 effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Handle Tp 153 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Tp 153 easily

- Locate Tp 153 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal weight as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invitation link, or download to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tp 153 while ensuring smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tp 153

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tp 153 and how can it benefit my business?

The tp 153 is a document integration tool within airSlate SignNow that enhances your ability to manage electronic signatures seamlessly. By using tp 153, businesses can streamline their document workflow, reduce processing time, and ensure compliance with legal standards for e-signatures.

-

How much does airSlate SignNow with tp 153 cost?

The pricing for airSlate SignNow varies depending on the plan you choose. However, the value of integrating tp 153 into your business operations is signNow, as it offers a cost-effective solution for managing document workflows and eSignatures efficiently.

-

Can I integrate tp 153 with other applications I use?

Yes, tp 153 provides versatile integration options with popular applications like Google Drive, Salesforce, and more. This feature allows you to enhance your existing workflows and improve productivity by centralizing document management and eSignatures in one place.

-

What features does tp 153 offer for document signing?

The tp 153 includes features like customizable templates, real-time tracking of document statuses, and multi-party signing capabilities. These features enable users to execute documents efficiently while maintaining compliance and security in the signing process.

-

How secure is the tp 153 electronic signature solution?

Security is a top priority with tp 153, which employs advanced encryption and compliance with various e-signature regulations. This ensures that all documents signed through airSlate SignNow are secure and legally binding, providing peace of mind for your business.

-

What type of support is available for tp 153 users?

airSlate SignNow offers comprehensive support for tp 153 users, including online resources, tutorials, and customer service representatives. This ensures that you have the assistance needed to maximize the effectiveness of your document signing processes.

-

Can tp 153 help improve my document workflow?

Absolutely! The tp 153 is designed to automate and simplify the document signing process, which can signNowly enhance your overall workflow. By reducing the time spent on manual signing processes, your team can focus on more critical tasks, improving overall efficiency.

Get more for Tp 153

- Name affidavit of buyer new hampshire form

- Name affidavit of seller new hampshire form

- Non foreign affidavit under irc 1445 new hampshire form

- Owners or sellers affidavit of no liens new hampshire form

- New hampshire affidavit form

- Complex will with credit shelter marital trust for large estates new hampshire form

- New hampshire dissolve form

- Nh limited form

Find out other Tp 153

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself