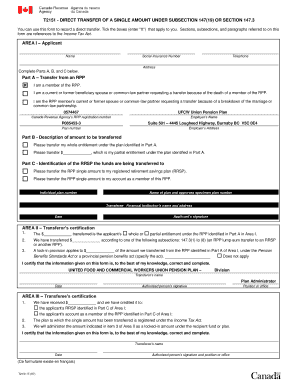

T2151 Form

What is the T2151

The T2151 form is a specific document used within various administrative and legal contexts in the United States. It serves to collect essential information that may be required for compliance with state or federal regulations. Understanding the T2151 form is crucial for individuals and businesses alike, as it plays a significant role in ensuring that necessary data is accurately reported and processed.

How to use the T2151

Using the T2151 form involves several key steps to ensure proper completion and submission. First, gather all required information, which may include personal identification details, financial data, or other relevant documentation. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the T2151, review the information for accuracy before submission to avoid delays or complications.

Steps to complete the T2151

Completing the T2151 form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents and information.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the information for any errors or omissions.

- Sign and date the form where required.

- Submit the completed form through the appropriate channels.

Legal use of the T2151

The T2151 form must be used in accordance with applicable laws and regulations. Its legal validity hinges on proper completion and adherence to submission guidelines. Utilizing a reliable electronic signature solution can enhance the form's legitimacy, ensuring compliance with legal standards such as the ESIGN Act and UETA. This makes the T2151 not just a form, but a critical document in legal and administrative processes.

Key elements of the T2151

Understanding the key elements of the T2151 form is vital for its effective use. Important components typically include:

- Identification fields for the individual or entity.

- Specific data points relevant to the purpose of the form.

- Signature lines for verification and legal acknowledgment.

- Instructions for completion and submission.

Examples of using the T2151

There are various scenarios where the T2151 form may be utilized. For instance, it can be required for tax reporting, compliance with regulatory agencies, or during legal proceedings. Understanding these examples can help users grasp the form's importance and ensure they are prepared to provide the necessary information when needed.

Quick guide on how to complete t2151 1621615

Complete T2151 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides all the tools you need to generate, modify, and electronically sign your documents swiftly without any hold-ups. Handle T2151 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and electronically sign T2151 with ease

- Obtain T2151 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and electronically sign T2151 and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t2151 1621615

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t2151 form example used for?

The t2151 form example is commonly used for documenting specific business transactions or agreements. This form ensures that all parties involved have clear, legally binding records of the terms discussed. By utilizing an eSigning solution like airSlate SignNow, businesses can streamline this process efficiently.

-

How can airSlate SignNow help me with a t2151 form example?

airSlate SignNow provides an easy-to-use platform that allows you to create, send, and eSign a t2151 form example effortlessly. With our intuitive interface, you can customize the form to meet your business needs and ensure that all signatures are collected digitally. This simplifies your document handling and enhances your workflow.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a range of pricing plans to accommodate different business sizes and needs. You can choose from monthly or annual subscriptions, providing flexibility based on your budget and document volume. Visit our pricing page to find the best plan that includes features for managing t2151 form examples and more.

-

Can I integrate airSlate SignNow with other applications for a t2151 form example?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Salesforce, and Microsoft Office. This ensures that you can efficiently manage your t2151 form example alongside your existing tools. Simply connect these applications to streamline your document workflow.

-

Is there a mobile app for managing t2151 form examples?

Absolutely! airSlate SignNow has a mobile app that allows you to manage your t2151 form examples on-the-go. Whether you need to send a document or collect signatures, our mobile app makes it easy to handle essential tasks directly from your smartphone or tablet.

-

What security measures does airSlate SignNow have for t2151 form examples?

Security is a priority at airSlate SignNow. We employ advanced encryption protocols to protect all documents, including your t2151 form examples. Additionally, our platform complies with industry standards, ensuring that your sensitive data and signatures remain secure and confidential.

-

How quick is the turnaround for signing a t2151 form example?

With airSlate SignNow, the turnaround for signing a t2151 form example is incredibly fast. Most documents can be sent and signed in a matter of minutes, which accelerates your business processes. You can track the signing process in real-time, ensuring that nothing slows you down.

Get more for T2151

- Florist worksheet form

- Community center rental contract cedarhurst on the bay cedarhurstonthebay form

- Permission slip to transport child form

- Attendant orientation supervisory visit form

- Senior minister job application template form

- Elizabeth d baier youth spirit award united way of posey county unitedwayposeycounty form

- Halloween dance flyer copy sunnytrails girl scout service unit form

- Ivy creek bulldogs form

Find out other T2151

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document