Form 8916

What is the Form 8916

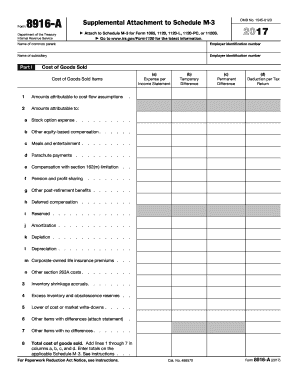

The Form 8916 is a tax document used by certain corporations to report their income and deductions for tax purposes. This form is specifically relevant for corporations that have made an election to be treated as an S corporation or have received a distribution from a corporation that has made such an election. Understanding the purpose of this form is crucial for compliance with IRS regulations and ensuring accurate tax reporting.

How to use the Form 8916

Using the Form 8916 involves filling out the required sections accurately to reflect the corporation's financial activities. Taxpayers must provide detailed information about their income, deductions, and any distributions received. It is essential to follow the IRS instructions carefully to ensure that all necessary information is included, which can help avoid delays or penalties. The completed form must be submitted along with the corporation's tax return.

Steps to complete the Form 8916

Completing the Form 8916 requires several steps:

- Gather all financial documents, including income statements and deduction records.

- Fill out the identification section with the corporation's name, address, and Employer Identification Number (EIN).

- Report all income and deductions accurately in the designated sections.

- Review the form for completeness and accuracy before submission.

- Submit the form along with the corporation's tax return by the specified deadline.

Legal use of the Form 8916

The legal use of the Form 8916 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted on time. Failure to comply with these requirements can result in penalties or additional scrutiny from the IRS. It is advisable for corporations to maintain thorough records supporting the information reported on the form to ensure legal compliance and facilitate any potential audits.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Form 8916 to avoid penalties. Typically, the form is due on the same date as the corporation's tax return. For most corporations, this is the fifteenth day of the third month following the end of their tax year. It is important to check the IRS guidelines for any specific deadlines that may apply to the corporation’s situation.

Required Documents

To complete the Form 8916, certain documents are necessary. These may include:

- Income statements detailing all sources of revenue.

- Records of deductions that the corporation intends to claim.

- Any prior year tax returns that may provide context for the current filing.

- Documentation for distributions received from S corporations, if applicable.

Penalties for Non-Compliance

Non-compliance with the requirements for the Form 8916 can lead to various penalties. These may include financial penalties for late filing, inaccuracies, or failure to file altogether. Additionally, the IRS may impose interest on any unpaid taxes associated with the form. It is crucial for corporations to understand these potential consequences and take steps to ensure timely and accurate submissions.

Quick guide on how to complete form 8916

Effortlessly Prepare Form 8916 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Handle Form 8916 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to alter and eSign Form 8916 without hassle

- Locate Form 8916 and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the risks of missing or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8916 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8916

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8916 and why is it important?

Form 8916 is used for reporting certain information about entities that have tax obligations. Understanding its requirements is essential for compliance and accurate tax filing. Using airSlate SignNow can help streamline the process of signing and submitting Form 8916 efficiently.

-

How can airSlate SignNow help me with Form 8916?

airSlate SignNow simplifies the eSigning process for Form 8916 by allowing you to send documents securely for electronic signatures. This not only saves time but also ensures the accuracy of signatures. The platform is designed to make handling tax forms like Form 8916 easy and efficient.

-

What are the pricing plans for airSlate SignNow for handling Form 8916?

airSlate SignNow offers various pricing plans that cater to different business needs, which can be especially helpful for those managing Form 8916 filings. These plans provide access to essential features that facilitate document signing and management. You can choose a plan that fits your budget while effectively managing Form 8916.

-

Is airSlate SignNow compliant with the regulations for Form 8916?

Yes, airSlate SignNow is designed to meet compliance standards, ensuring that your Form 8916 and other documents are handled according to legal requirements. The platform employs encryption and secure storage solutions to protect your sensitive data. This compliance gives users peace of mind when managing tax forms like Form 8916.

-

Can I integrate airSlate SignNow with other software for handling Form 8916?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for Form 8916 preparation and submission. By integrating your existing systems, you can streamline your document management process and improve efficiency in signing and submitting Form 8916.

-

What features does airSlate SignNow offer for managing Form 8916?

airSlate SignNow provides a range of features specifically designed to improve document management for Form 8916, including templates, bulk sending, and in-app notifications. These tools make it easier to organize and track your tax-related documents efficiently. The user-friendly interface ensures that managing Form 8916 is straightforward and effective.

-

Can I access airSlate SignNow on mobile for signing Form 8916?

Yes, airSlate SignNow is accessible via mobile devices, allowing you to manage and sign Form 8916 on the go. The mobile application replicates the desktop experience, ensuring you can efficiently handle your documents anywhere. This flexibility is perfect for busy professionals dealing with tax forms like Form 8916.

Get more for Form 8916

Find out other Form 8916

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF