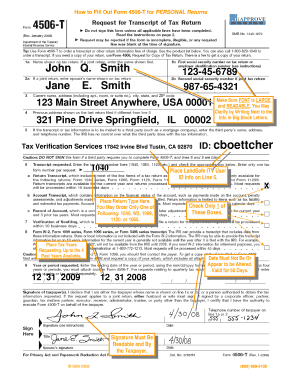

How to Fill Out Form 4506 T for PERSONAL Returns

Understanding the 4506 Form

The 4506 form, also known as the Request for Copy of Tax Return, is a document used by taxpayers to request copies of their previously filed tax returns from the Internal Revenue Service (IRS). This form is essential for individuals who need to provide proof of income for various purposes, such as applying for loans, mortgages, or financial aid. By submitting this form, taxpayers can obtain copies of their tax returns, including all attachments, for the specified tax years.

Steps to Complete the 4506 Form

Filling out the 4506 form involves several straightforward steps:

- Download the form: Access the 4506 form from the IRS website or obtain a physical copy from a local IRS office.

- Provide personal information: Fill in your name, Social Security number, and address. If you filed jointly, include your spouse's information.

- Select the tax years: Indicate the specific years for which you are requesting copies of your tax returns.

- Specify the purpose: Clearly state why you need the copies, such as for a loan application or personal records.

- Sign and date the form: Ensure that you sign and date the form to validate your request.

Legal Use of the 4506 Form

The 4506 form is legally recognized as a valid request for tax return copies. It must be completed accurately and submitted in accordance with IRS guidelines to ensure compliance. When using this form, it is crucial to understand that the information provided will be used by the IRS to verify your identity and the authenticity of the request. Therefore, ensuring that all details are correct and up-to-date is essential for legal purposes.

Obtaining the 4506 Form

To obtain the 4506 form, you can visit the IRS website, where the form is available for download. Alternatively, you can request a physical copy by contacting the IRS directly or visiting a local IRS office. It is important to ensure that you are using the most current version of the form to avoid any processing delays.

Examples of Using the 4506 Form

There are various scenarios in which individuals may need to use the 4506 form:

- Applying for a mortgage: Lenders often require copies of tax returns to assess your financial stability.

- Financial aid applications: Schools may request tax return copies to determine eligibility for aid.

- Loan applications: Financial institutions may ask for tax documentation to verify income.

Filing Deadlines and Important Dates

When submitting the 4506 form, it is essential to be aware of any relevant deadlines. Generally, the processing time for the IRS to fulfill requests can take several weeks. It is advisable to submit the form well in advance of any deadlines related to financial applications or tax obligations to ensure timely receipt of your tax return copies.

Quick guide on how to complete how to fill out form 4506 t for personal returns

Complete How To Fill Out Form 4506 T For PERSONAL Returns effortlessly on any device

Web-based document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage How To Fill Out Form 4506 T For PERSONAL Returns on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-centric process today.

The easiest way to alter and eSign How To Fill Out Form 4506 T For PERSONAL Returns without stress

- Find How To Fill Out Form 4506 T For PERSONAL Returns and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign How To Fill Out Form 4506 T For PERSONAL Returns and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill out form 4506 t for personal returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4506 form and why is it important?

The 4506 form is a request for a copy of your tax return from the IRS. It is essential for lenders, especially in mortgage applications, to verify a borrower’s income. By using the 4506 form, businesses can streamline their verification process and ensure compliance with regulations.

-

How can airSlate SignNow help me with the 4506 form?

airSlate SignNow allows you to easily create, send, and eSign the 4506 form digitally. This simplifies the process, enabling quick turnaround times and improved accuracy. Plus, the platform provides secure storage and tracking for all your critical documents.

-

Is there a fee to use airSlate SignNow for the 4506 form?

Yes, airSlate SignNow offers a cost-effective pricing model, suitable for businesses of all sizes. Subscription plans vary based on features needed, but all provide access to features like eSigning and document management, including for the 4506 form.

-

What features does airSlate SignNow offer for managing the 4506 form?

With airSlate SignNow, you can eSign the 4506 form, track its status, and store it securely. Additionally, the platform provides templates specifically for the 4506 form, making it easier to fill out and send. These features enhance efficiency and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other software for the 4506 form?

Absolutely! airSlate SignNow seamlessly integrates with many popular applications, including CRMs, document management systems, and accounting software. This means you can easily handle the 4506 form alongside your existing tools, streamlining your workflow.

-

How does airSlate SignNow ensure the security of the 4506 form?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and secure cloud storage to protect sensitive information in the 4506 form. Users can also control access and permissions to ensure that only authorized personnel can view or modify the document.

-

What are the benefits of using airSlate SignNow for the 4506 form?

Using airSlate SignNow for the 4506 form enhances efficiency and speeds up the documentation process. It allows for quick eSigning, reduces paper waste, and provides real-time tracking of document status. Customers appreciate the simplicity and effectiveness of managing the form through a digital platform.

Get more for How To Fill Out Form 4506 T For PERSONAL Returns

Find out other How To Fill Out Form 4506 T For PERSONAL Returns

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template