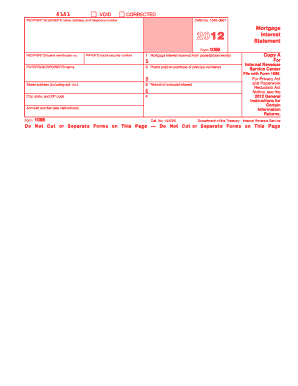

1098 Tax Form

What is the 1098 Tax Form

The 1098 Tax Form is an essential document used in the United States for reporting various types of payments made by individuals. Specifically, this form is primarily utilized to report mortgage interest, student loan interest, and tuition payments. It is issued by lenders or educational institutions to taxpayers who have made qualifying payments during the tax year. The information on the 1098 form helps taxpayers accurately report their deductions on their federal income tax returns, thereby potentially reducing their taxable income.

How to use the 1098 Tax Form

Using the 1098 Tax Form involves several steps to ensure that the information reported is accurate and beneficial for tax purposes. First, taxpayers should receive the form from the issuer, which could be a bank or educational institution. Once received, it is important to review the details for accuracy, including the amounts reported. Taxpayers will then use the information from the form to fill out their federal tax return, typically on Schedule A for itemized deductions. It is crucial to retain a copy of the 1098 form for personal records, as it may be needed for future reference or in case of an audit.

Steps to complete the 1098 Tax Form

Completing the 1098 Tax Form requires careful attention to detail. Here are the steps to follow:

- Gather relevant documentation, such as mortgage statements or tuition payment records.

- Review the 1098 form for accuracy, ensuring that all amounts match your records.

- Fill out your federal tax return, incorporating the amounts reported on the 1098 form.

- If applicable, consult a tax professional for guidance on maximizing deductions related to the 1098 form.

- Keep a copy of the completed form and your tax return for your records.

Legal use of the 1098 Tax Form

The legal use of the 1098 Tax Form is governed by IRS regulations. It serves as an official record of payments made, which can be used to claim deductions on your tax return. To ensure its legal validity, the form must be accurately completed and submitted in accordance with IRS guidelines. Additionally, maintaining proper documentation and records is essential to support the claims made on the form. Failure to comply with IRS requirements can result in penalties or disallowance of deductions.

Key elements of the 1098 Tax Form

Several key elements are included on the 1098 Tax Form, which are vital for accurate reporting. These elements include:

- Borrower's Information: Name, address, and taxpayer identification number of the borrower.

- Lender's Information: Name, address, and taxpayer identification number of the lender.

- Amount of Interest Paid: Total mortgage interest or tuition payments made during the tax year.

- Loan Information: Details regarding the loan, including the outstanding balance and type of loan.

Filing Deadlines / Important Dates

When dealing with the 1098 Tax Form, it is essential to be aware of important deadlines. The form is typically issued by January 31 of the year following the tax year in which payments were made. Taxpayers must include the information from the 1098 form when filing their federal tax returns, which are generally due by April 15. If additional time is needed, taxpayers can file for an extension, but they should still pay any taxes owed by the original deadline to avoid penalties.

Quick guide on how to complete 1098 tax form

Complete 1098 Tax Form effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely archive it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents rapidly without delays. Handle 1098 Tax Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest method to modify and eSign 1098 Tax Form without effort

- Obtain 1098 Tax Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this task.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate creating new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign 1098 Tax Form and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1098 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1098 Tax Form?

The 1098 Tax Form is a document used to report mortgage interest paid during the tax year. Homeowners are required to receive this form from their mortgage lender to file their taxes accurately. With airSlate SignNow, you can easily eSign and send your 1098 Tax Form securely.

-

How can airSlate SignNow help with the 1098 Tax Form?

airSlate SignNow allows you to electronically sign and store your 1098 Tax Form, making it easier to manage all your tax documents. Its intuitive platform streamlines the signing process, ensuring you meet important deadlines. This way, you can focus more on your taxes and less on logistics.

-

Is there a cost associated with using airSlate SignNow for the 1098 Tax Form?

Yes, airSlate SignNow offers competitive pricing plans to suit various needs for managing documents like the 1098 Tax Form. You can choose a plan that fits your budget and offers the features necessary for efficient document handling. The investment in our platform can save you time and enhance your document management process.

-

What features does airSlate SignNow offer for handling the 1098 Tax Form?

AirSlate SignNow provides features like document templates, advanced eSigning capabilities, and secure storage for your 1098 Tax Form. The user-friendly interface makes it easy to navigate, and you can customize templates for your specific needs. These features help streamline the process of managing tax documents.

-

Can I share my 1098 Tax Form with others using airSlate SignNow?

Yes, airSlate SignNow allows you to share your 1098 Tax Form with collaborators securely. You can invite others to review or sign your document, ensuring that everyone involved can complete their tasks without hassle. This feature helps facilitate quick and efficient communication on tax-related documents.

-

Does airSlate SignNow integrate with other software for tax documentation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, allowing you to handle your 1098 Tax Form more efficiently. These integrations help streamline your tax preparation process and ensure that all necessary documents are easily accessible.

-

How secure is my 1098 Tax Form using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your 1098 Tax Form and any other sensitive documents. With features like two-factor authentication and audit trails, you can be confident that your information is secure.

Get more for 1098 Tax Form

Find out other 1098 Tax Form

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online