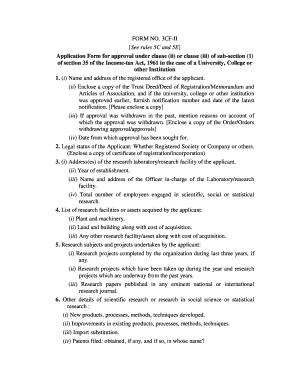

Form 3cf of Income Tax Act

What is the Form 3cf of Income Tax Act

The Form 3cf of Income Tax Act is a specific document utilized within the U.S. tax system. This form is designed for individuals and businesses to report certain types of income and deductions as specified by the Internal Revenue Service (IRS). It plays a crucial role in ensuring compliance with federal tax regulations and helps taxpayers accurately calculate their tax obligations. Understanding the purpose and requirements of this form is essential for effective tax management.

How to use the Form 3cf of Income Tax Act

Using the Form 3cf of Income Tax Act involves several straightforward steps. First, gather all necessary financial documents, including records of income, deductions, and any other relevant information. Next, fill out the form accurately, ensuring that all sections are completed according to IRS guidelines. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference and the specific requirements for your tax situation. Utilizing digital tools can streamline this process, making it easier to manage and submit your tax documents.

Steps to complete the Form 3cf of Income Tax Act

Completing the Form 3cf of Income Tax Act requires careful attention to detail. Follow these steps for a smooth completion:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Review the form's instructions to understand the requirements for each section.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check calculations to avoid errors that could lead to penalties.

- Sign and date the form, either electronically or physically, as required.

- Submit the form by the designated deadline to avoid late fees.

Legal use of the Form 3cf of Income Tax Act

The legal use of the Form 3cf of Income Tax Act is governed by specific regulations set forth by the IRS. To ensure that your submission is legally binding, it is essential to comply with the requirements for electronic signatures and document submission. Using a trusted digital platform can enhance the legality of your submission by providing features such as secure storage, audit trails, and compliance with eSignature laws. This ensures that your form is not only completed but also recognized as valid by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3cf of Income Tax Act are critical to avoid penalties and interest. Typically, the form must be submitted by April 15 for individual taxpayers, though extensions may be available under certain circumstances. It is important to stay informed about any changes to filing dates, especially in light of new tax laws or regulations. Keeping a calendar of important dates can help ensure timely submission of your tax documents.

Required Documents

To complete the Form 3cf of Income Tax Act accurately, several documents are required. These typically include:

- Income statements such as W-2s and 1099s.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any relevant schedules or additional forms that pertain to your tax situation.

Having these documents organized and readily available can facilitate a smoother filing process.

Quick guide on how to complete form 3cf of income tax act

Effortlessly Prepare Form 3cf Of Income Tax Act on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without interruptions. Manage Form 3cf Of Income Tax Act on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric workflows today.

How to Edit and Electronically Sign Form 3cf Of Income Tax Act with Ease

- Obtain Form 3cf Of Income Tax Act and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 3cf Of Income Tax Act to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3cf of income tax act

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3cf of income tax act?

The form 3cf of income tax act is a specific tax form used by individuals and businesses to report certain income and deductions for tax purposes. It is essential for accurately calculating tax liabilities and ensuring compliance with tax regulations.

-

How does airSlate SignNow assist with the form 3cf of income tax act?

airSlate SignNow streamlines the process of completing the form 3cf of income tax act by providing an easy-to-use eSigning platform. Users can fill out, send, and sign the necessary documents quickly, ensuring that all tax forms are prepared accurately and on time.

-

Is airSlate SignNow a cost-effective solution for managing the form 3cf of income tax act?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage the form 3cf of income tax act. The platform provides various pricing plans, allowing users to select the plan that suits their budget while gaining access to essential features for document management.

-

What features does airSlate SignNow offer for handling the form 3cf of income tax act?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure cloud storage to assist users with the form 3cf of income tax act. These tools make it easier to ensure that all necessary information is included and up-to-date.

-

Can I integrate airSlate SignNow with my accounting software for the form 3cf of income tax act?

Absolutely! airSlate SignNow can be easily integrated with various accounting software programs, enhancing the efficiency of managing the form 3cf of income tax act. This integration allows for seamless data transfer and improved accuracy in tax reporting.

-

What are the benefits of using airSlate SignNow for the form 3cf of income tax act?

Using airSlate SignNow for the form 3cf of income tax act provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. The platform's electronic signature capabilities also help expedite the signing process, making tax preparation faster and more convenient.

-

How secure is airSlate SignNow when handling the form 3cf of income tax act?

airSlate SignNow employs advanced security measures to protect sensitive information related to the form 3cf of income tax act. With features like encrypted data transfers and secure document storage, users can trust that their tax documents are safe and compliant with regulations.

Get more for Form 3cf Of Income Tax Act

Find out other Form 3cf Of Income Tax Act

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors