MOTION for SHOW CAUSE SUMMONS or CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report Courts State Va

What is the motion for show cause summons or capias 05 163 Texas franchise tax annual no tax due information report courts state va

The motion for show cause summons or capias 05 163 Texas franchise tax annual no tax due information report courts state va is a legal document used in the context of Texas franchise tax compliance. This motion serves to compel a party to appear before the court to explain why they should not be held in contempt for failing to comply with a previous court order related to franchise tax obligations. It is particularly relevant for businesses that have reported no tax due and need to clarify their status with the state courts.

How to use the motion for show cause summons or capias 05 163 Texas franchise tax annual no tax due information report courts state va

Using the motion for show cause summons or capias requires careful attention to detail. First, ensure that all necessary information is accurately filled out, including the names of the parties involved and the specific court where the motion is being filed. It is crucial to include any relevant case numbers and dates. Once completed, the document must be filed with the appropriate court and served to the other party, ensuring that they receive proper notice of the motion.

Steps to complete the motion for show cause summons or capias 05 163 Texas franchise tax annual no tax due information report courts state va

Completing the motion involves several key steps:

- Gather all necessary information, including the business name, address, and tax identification number.

- Fill out the motion form, ensuring all fields are completed accurately.

- Review the document for any errors or omissions.

- File the motion with the court, following local rules for submission.

- Serve the motion to the other party, providing them with a copy of the filed document.

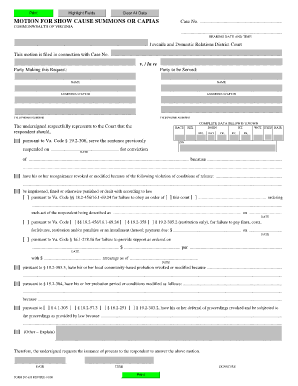

Key elements of the motion for show cause summons or capias 05 163 Texas franchise tax annual no tax due information report courts state va

Several key elements are essential to the motion for show cause summons or capias:

- The title of the motion, clearly indicating it is a show cause summons or capias.

- The names of the parties involved, including the petitioner and respondent.

- A clear statement of the facts that necessitate the motion.

- The specific legal basis for the motion, citing relevant statutes or case law.

- A request for the court to issue the summons or capias.

Legal use of the motion for show cause summons or capias 05 163 Texas franchise tax annual no tax due information report courts state va

The legal use of this motion is primarily to ensure compliance with court orders regarding franchise tax obligations. It is a formal request for the court to intervene when a party has failed to adhere to previous rulings or tax requirements. Properly executed, this motion can lead to enforcement actions, including potential penalties for non-compliance.

Filing deadlines and important dates related to the motion for show cause summons or capias 05 163 Texas franchise tax annual no tax due information report courts state va

Filing deadlines for the motion can vary based on the specific circumstances of the case. It is essential to be aware of any court-imposed deadlines for responding to motions or complying with previous orders. Typically, parties may have a limited time frame to file their motions after receiving notice of non-compliance or a court order. Keeping track of these dates is crucial to ensure that rights are preserved and compliance is maintained.

Quick guide on how to complete motion for show cause summons or capias 05 163 texas franchise tax annual no tax due information report courts state va

Complete MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report Courts State Va effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report Courts State Va on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report Courts State Va with ease

- Obtain MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report Courts State Va and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark relevant portions of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and then click on the Done button to save your updates.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report Courts State Va and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the motion for show cause summons or capias 05 163 texas franchise tax annual no tax due information report courts state va

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 in Texas?

A MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 is a legal document used in Texas courts to compel a party to appear and explain why they should not be held in contempt. This type of motion is particularly relevant for issues surrounding the Texas Franchise Tax Annual No Tax Due Information Report, ensuring compliance with state regulations.

-

How does the airSlate SignNow platform assist with MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 filings?

The airSlate SignNow platform streamlines the process of preparing and filing a MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report. Our easy-to-use tools facilitate document creation, signing, and secure storage, making compliance much simpler for businesses.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you require a single user license or an enterprise-level solution, our pricing is designed to be cost-effective, particularly for those needing support for legal documents like the MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163.

-

What features does airSlate SignNow include for legal document handling?

airSlate SignNow includes features such as electronic signatures, document templates, and advanced security options. These capabilities are essential for efficiently managing legal documents, like the MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report, ensuring you can execute and track all necessary filings easily.

-

Can airSlate SignNow help with multiple document signings?

Yes, airSlate SignNow supports batch signing, allowing multiple parties to sign different documents, including the MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163. This feature enhances efficiency, particularly for businesses handling numerous legal documents in compliance with Texas state regulations.

-

Is it possible to integrate airSlate SignNow with other software for managing legal documents?

Absolutely! airSlate SignNow seamlessly integrates with various applications commonly used in the legal industry, enhancing your workflow while managing documents like the MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report. This allows you to centralize your document management efforts.

-

What benefits does airSlate SignNow offer for law firms and businesses?

airSlate SignNow provides signNow advantages for law firms and businesses, including improved compliance, reduced turnaround times, and lower operational costs. With a focus on documents such as the MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163, our platform ensures that all necessary legal processes are handled efficiently.

Get more for MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report Courts State Va

Find out other MOTION FOR SHOW CAUSE SUMMONS OR CAPIAS 05 163 Texas Franchise Tax Annual No Tax Due Information Report Courts State Va

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed