Employer's Quarterly Report Instructions 2016

What is the Employer's Quarterly Report Instructions

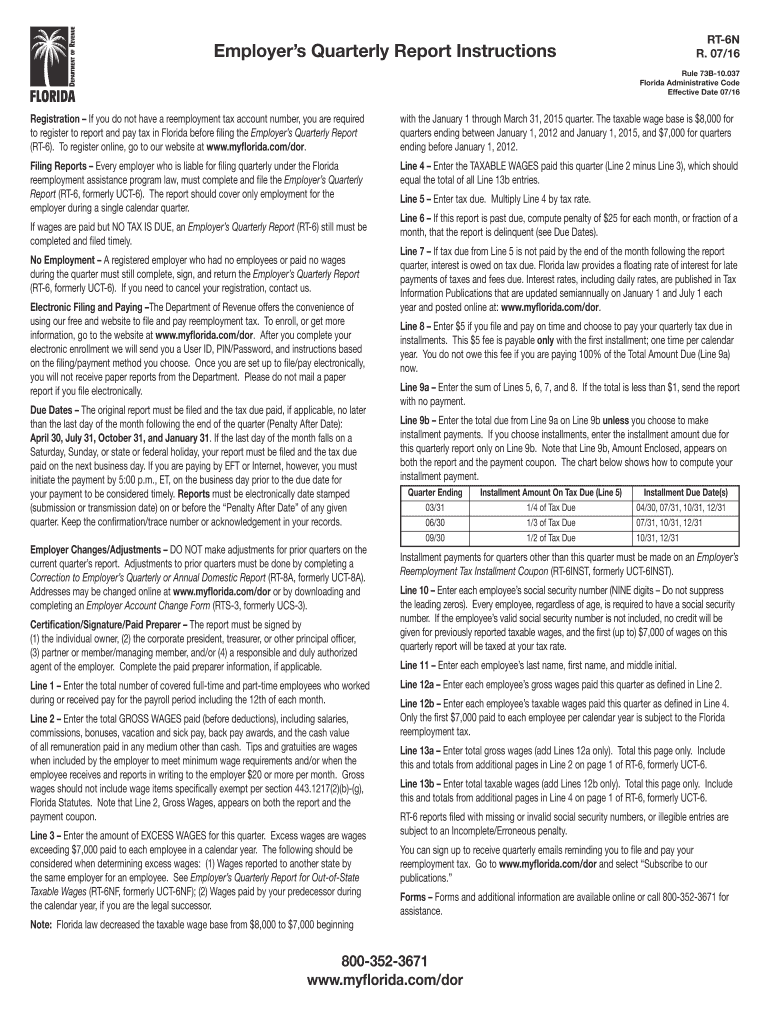

The Employer's Quarterly Report Instructions provide essential guidance for businesses in the United States to accurately report employee wages and tax withholdings. This form is crucial for compliance with federal and state tax regulations, ensuring that employers fulfill their obligations regarding payroll taxes. The instructions outline the necessary steps to complete the report, the information required, and the legal implications of submitting the form.

Steps to complete the Employer's Quarterly Report Instructions

Completing the Employer's Quarterly Report requires careful attention to detail. Here are the key steps to follow:

- Gather all relevant payroll records for the quarter, including employee wages and tax withholdings.

- Fill out the form accurately, ensuring that all employee information is correct and up to date.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, using the preferred method of submission.

Legal use of the Employer's Quarterly Report Instructions

The legal use of the Employer's Quarterly Report Instructions is paramount for businesses. This form must be completed in accordance with federal and state laws to avoid penalties. The report serves as a formal declaration of wages paid and taxes withheld, which can be audited by tax authorities. Accurate completion and timely submission are essential to maintain compliance and avoid legal repercussions.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Employer's Quarterly Report. Typically, these deadlines fall on the last day of the month following the end of each quarter. For example, reports for the first quarter, ending March 31, are due by April 30. It is crucial for businesses to mark these dates on their calendars to ensure timely submissions and avoid penalties.

Required Documents

To complete the Employer's Quarterly Report, several documents are necessary. Employers should have the following on hand:

- Employee payroll records for the reporting period.

- Tax identification numbers for the business and employees.

- Records of any tax payments made during the quarter.

Form Submission Methods (Online / Mail / In-Person)

The Employer's Quarterly Report can be submitted through various methods, providing flexibility for businesses. Employers may choose to file online through designated government portals, send the completed form via mail, or deliver it in person at local tax offices. Each method has its own processing times and requirements, so it's important to select the most suitable option for timely submission.

Penalties for Non-Compliance

Failure to comply with the Employer's Quarterly Report Instructions can result in significant penalties. These may include fines for late submissions, inaccuracies, or failure to file altogether. Additionally, non-compliance can lead to increased scrutiny from tax authorities, which may result in audits or further legal action. Employers should prioritize adherence to these instructions to mitigate risks associated with penalties.

Quick guide on how to complete employeramp39s quarterly report instructions

Complete Employer's Quarterly Report Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the right form and securely keep it online. airSlate SignNow furnishes you with all the resources necessary to craft, edit, and eSign your documents promptly without obstacles. Manage Employer's Quarterly Report Instructions on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to edit and eSign Employer's Quarterly Report Instructions effortlessly

- Find Employer's Quarterly Report Instructions and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Edit and eSign Employer's Quarterly Report Instructions and facilitate exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employeramp39s quarterly report instructions

Create this form in 5 minutes!

How to create an eSignature for the employeramp39s quarterly report instructions

How to create an eSignature for the Employeramp39s Quarterly Report Instructions online

How to create an eSignature for your Employeramp39s Quarterly Report Instructions in Chrome

How to make an electronic signature for signing the Employeramp39s Quarterly Report Instructions in Gmail

How to make an electronic signature for the Employeramp39s Quarterly Report Instructions from your mobile device

How to create an electronic signature for the Employeramp39s Quarterly Report Instructions on iOS

How to make an eSignature for the Employeramp39s Quarterly Report Instructions on Android OS

People also ask

-

What are the Employer's Quarterly Report Instructions?

The Employer's Quarterly Report Instructions provide detailed guidance on how to accurately complete and submit your quarterly payroll reports. These instructions ensure that employers comply with state and federal requirements while avoiding penalties. Understanding these guidelines is essential for maintaining accurate payroll records.

-

How can airSlate SignNow assist with the Employer's Quarterly Report Instructions?

airSlate SignNow simplifies the process of managing your Employer's Quarterly Report Instructions by allowing you to eSign and send documents securely. With our user-friendly platform, you can easily prepare your reports and ensure they are submitted on time, reducing the risk of errors and non-compliance.

-

Is there a cost associated with using airSlate SignNow for Employer's Quarterly Report Instructions?

Yes, airSlate SignNow offers various pricing plans that are designed to be cost-effective for businesses of all sizes. By using our platform for tasks like the Employer's Quarterly Report Instructions, you can save time and resources, making it a worthwhile investment for efficient document management.

-

What features does airSlate SignNow offer for handling Employer's Quarterly Report Instructions?

airSlate SignNow provides features such as document templates, secure eSigning, and cloud storage to streamline the process of completing Employer's Quarterly Report Instructions. Additionally, our platform offers tracking and notifications to keep you updated on the status of your documents.

-

Can airSlate SignNow integrate with payroll systems for Employer's Quarterly Report Instructions?

Absolutely! airSlate SignNow integrates seamlessly with various payroll systems, making it easy to access the necessary data for your Employer's Quarterly Report Instructions. This integration reduces manual entry and helps ensure your reports are accurate and timely.

-

What benefits does airSlate SignNow provide for businesses handling Employer's Quarterly Report Instructions?

By using airSlate SignNow for your Employer's Quarterly Report Instructions, businesses benefit from increased efficiency, reduced errors, and improved compliance. Our platform empowers you to manage documents effortlessly while maintaining accurate payroll records.

-

How secure is airSlate SignNow when handling sensitive Employer's Quarterly Report Instructions?

Security is a top priority at airSlate SignNow. Our platform uses bank-level encryption and secure servers to protect your sensitive data related to Employer's Quarterly Report Instructions, ensuring that your information remains confidential and safe from unauthorized access.

Get more for Employer's Quarterly Report Instructions

Find out other Employer's Quarterly Report Instructions

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template