Form 760es

What is the Form 760es

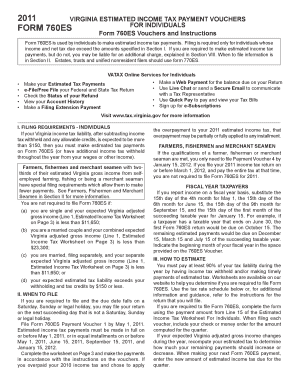

The Form 760es is a tax form used by individuals in the United States to make estimated tax payments to the state of Virginia. This form is essential for taxpayers who expect to owe at least one thousand dollars in state tax for the year and who do not have enough tax withheld from their income. By submitting this form, taxpayers can ensure that they meet their tax obligations and avoid potential penalties for underpayment.

How to use the Form 760es

Using the Form 760es involves several straightforward steps. Taxpayers must first determine their estimated tax liability for the year based on their income, deductions, and credits. Once this amount is calculated, they can fill out the form, indicating the amount they plan to pay for each quarter. It is important to submit the form along with the payment by the due dates to avoid interest and penalties.

Steps to complete the Form 760es

Completing the Form 760es requires careful attention to detail. Here are the steps to follow:

- Calculate your estimated tax liability based on your expected income for the year.

- Obtain the Form 760es from the Virginia Department of Taxation website or other authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the estimated tax payment amount for each quarter.

- Review the form for accuracy and completeness.

- Submit the form along with your payment by the specified due dates.

Legal use of the Form 760es

The legal use of the Form 760es is governed by Virginia tax laws. To be considered valid, the form must be completed accurately and submitted on time. Failure to comply with these regulations can result in penalties and interest charges. It is crucial for taxpayers to keep copies of their submitted forms and any correspondence with the Virginia Department of Taxation for their records.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 760es to avoid penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Keeping track of these dates ensures that payments are made timely and that taxpayers remain compliant with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Form 760es can be submitted through various methods, providing flexibility for taxpayers. It can be filed online through the Virginia Department of Taxation's website, which offers a secure platform for electronic submissions. Alternatively, taxpayers can mail their completed forms and payments to the appropriate address provided by the state. In-person submissions may also be possible at designated tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete form 760es

Effortlessly Prepare Form 760es on Any Device

The management of online documents has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed materials, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 760es on any device using airSlate SignNow's Android or iOS applications and enhance your document-based workflows today.

How to Modify and Electronically Sign Form 760es with Ease

- Obtain Form 760es and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight important sections of the documents or conceal sensitive data with the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or mistakes that require new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 760es and ensure exceptional communication throughout the preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 760es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 760es?

Form 760es is a payment voucher used for estimated tax payments in Virginia. It is essential for businesses and individuals who need to ensure they are meeting their tax obligations throughout the year. Understanding how to correctly fill out and submit Form 760es can help you avoid penalties and interest charges.

-

How can airSlate SignNow help with Form 760es?

With airSlate SignNow, you can easily prepare, send, and eSign Form 760es electronically. Our user-friendly platform streamlines the document signing process, making it faster and more efficient. Plus, you can track the status of your Form 760es submissions to ensure timely filing.

-

Is there a cost associated with using airSlate SignNow for Form 760es?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans provide you with the features necessary to manage documents like Form 760es effectively. You can choose the plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 760es?

AirSlate SignNow provides a variety of features for managing Form 760es, including customizable templates, eSigning capabilities, and document collaboration tools. These features ensure you can fill out and share your Form 760es efficiently. Additionally, the platform offers secure storage for your completed documents.

-

Can I integrate airSlate SignNow with other applications for Form 760es?

Yes, airSlate SignNow offers integrations with various applications, allowing you to seamlessly connect your workflow. You can integrate it with CRM systems, accounting software, and more, helping you streamline the process of managing Form 760es. These integrations enhance productivity and keep your financial data organized.

-

What are the benefits of using airSlate SignNow for Form 760es?

Using airSlate SignNow for Form 760es offers numerous benefits including increased efficiency, reduced paperwork, and faster turnaround times. The platform allows you to eSign documents from anywhere, ensuring you never miss deadlines. Additionally, it enhances compliance by maintaining a secure record of all transactions.

-

How does eSigning work with Form 760es on airSlate SignNow?

eSigning with airSlate SignNow is simple and intuitive. After you fill out Form 760es, you can electronically sign it using our platform, eliminating the need for printing and scanning. This process enhances security and reduces the time it takes to finalize your tax documents.

Get more for Form 760es

- Probate court of cuyahoga county ohio guardians complaint to form

- Order to terminate transferred guardianship form

- Uniform support declaration

- Civil comtempt form virginia

- Virginia court summons form

- Fictitious name certificate va form

- Declaration court form wa

- How to wisconsin order show cause form

Find out other Form 760es

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter