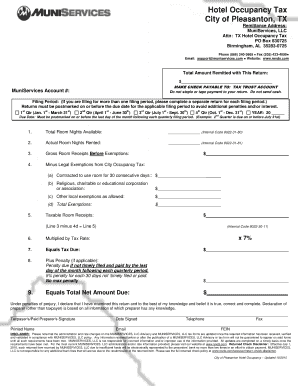

Hotel Occupancy Tax City of Pleasanton, TX Remittance Address MuniServices, LLC Attn TX Hotel Occupancy Tax PO Box 830725 Birmin Form

Understanding the Hotel Occupancy Tax in Pleasanton, TX

The Hotel Occupancy Tax in Pleasanton, Texas, is a tax levied on guests staying in hotels and similar accommodations. This tax is collected by the hotel operators and is then remitted to the city. The funds generated from this tax are typically used to promote tourism and enhance local infrastructure. Understanding the tax's purpose helps hotel operators and guests recognize its significance in supporting community services.

Steps to Complete the Hotel Occupancy Tax Remittance

Completing the Hotel Occupancy Tax remittance involves several key steps:

- Gather all necessary documentation, including receipts and records of occupancy.

- Calculate the total amount of tax collected based on the applicable rates.

- Fill out the remittance form accurately, ensuring all fields are completed.

- Submit the form along with the payment to the designated address.

Following these steps ensures compliance with local regulations and helps avoid potential penalties.

Legal Use of the Hotel Occupancy Tax Remittance Form

The Hotel Occupancy Tax remittance form is a legally binding document that must be filled out accurately and submitted in a timely manner. It is essential to adhere to the guidelines set forth by local authorities to ensure that the form is accepted. Failure to comply with these legal requirements can result in penalties, including fines or additional fees.

Required Documents for Submission

When submitting the Hotel Occupancy Tax remittance, certain documents are typically required:

- Completed remittance form.

- Records of occupancy for the reporting period.

- Payment for the tax due.

Having these documents ready will streamline the submission process and help ensure compliance with local tax regulations.

Filing Deadlines for the Hotel Occupancy Tax

It is crucial to be aware of the filing deadlines for the Hotel Occupancy Tax remittance. Typically, these deadlines are set by local authorities and may vary based on the reporting period. Missing a deadline can lead to penalties or interest charges. Staying informed about these dates helps ensure timely submissions and compliance with local laws.

Penalties for Non-Compliance

Non-compliance with the Hotel Occupancy Tax regulations can result in various penalties. These may include:

- Fines for late submissions.

- Interest on unpaid taxes.

- Legal action for persistent non-compliance.

Understanding these potential penalties emphasizes the importance of timely and accurate remittance submissions.

Quick guide on how to complete hotel occupancy tax city of pleasanton tx remittance address muniservices llc attn tx hotel occupancy tax po box 830725

Effortlessly prepare [SKS] on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Craft your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Hotel Occupancy Tax City Of Pleasanton, TX Remittance Address MuniServices, LLC Attn TX Hotel Occupancy Tax PO Box 830725 Birmin

Create this form in 5 minutes!

How to create an eSignature for the hotel occupancy tax city of pleasanton tx remittance address muniservices llc attn tx hotel occupancy tax po box 830725

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hotel Occupancy Tax in Pleasanton, TX?

The Hotel Occupancy Tax in Pleasanton, TX is a municipal tax collected from guests staying in local hotels. This tax helps fund local community projects and tourism initiatives. If you need more details, you can signNow out to MuniServices at the Hotel Occupancy Tax City Of Pleasanton, TX Remittance Address MuniServices, LLC Attn TX Hotel Occupancy Tax PO Box 830725 Birmingham, AL 352830725 Phone 866 2403665.

-

How can I remit my Hotel Occupancy Tax payments?

You can remit your Hotel Occupancy Tax payments via mail to the Hotel Occupancy Tax City Of Pleasanton, TX Remittance Address at MuniServices, LLC Attn TX Hotel Occupancy Tax PO Box 830725 Birmingham, AL 352830725. This ensures your payments are processed efficiently. For further inquiries, contact MuniServices by phone or email.

-

What are the consequences of not paying the Hotel Occupancy Tax?

Failure to pay the Hotel Occupancy Tax can lead to penalties, interest charges, and possible legal action. It's important for businesses to stay compliant to avoid these issues. For any questions regarding payment, you can signNow MuniServices at the Hotel Occupancy Tax City Of Pleasanton, TX Remittance Address MuniServices, LLC Attn TX Hotel Occupancy Tax PO Box 830725 Birmingham, AL 352830725.

-

How often do I need to file my Hotel Occupancy Tax returns?

Typically, hotel occupancy tax returns need to be filed monthly or quarterly, depending on local regulations in Pleasanton, TX. Make sure to check the specific filing deadlines to remain compliant. If you need assistance, you can contact MuniServices via phone at 866 2403665.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers an intuitive platform for sending, signing, and managing documents digitally. You can easily create templates, track document status, and ensure compliance with tax-related documents like the Hotel Occupancy Tax in Pleasanton, TX. For more information and support, you can signNow MuniServices at the Hotel Occupancy Tax City Of Pleasanton, TX Remittance Address.

-

Can airSlate SignNow help with compliance for the Hotel Occupancy Tax?

Yes, airSlate SignNow can streamline your document processes and support compliance with local regulations, including the Hotel Occupancy Tax. With features like secure eSignatures and audit trails, you’ll have peace of mind knowing your documents are in order. For any specific questions about compliance, please signNow out to MuniServices.

-

Are there any integration options with airSlate SignNow?

airSlate SignNow supports integrations with various business tools to enhance your workflow efficiency. This can be beneficial for managing tax documents and other compliance-related files. If you have further questions about integrations related to the Hotel Occupancy Tax, you can contact MuniServices at the provided number.

Get more for Hotel Occupancy Tax City Of Pleasanton, TX Remittance Address MuniServices, LLC Attn TX Hotel Occupancy Tax PO Box 830725 Birmin

- Les schwab tire centers and form

- Medical malpractice insurance for new york physicians and form

- Mason county ems amp trauma council form

- Managed care reinsurance claim form

- Hepatitis b vaccine documentation form

- Cosmetic dermatologic surgery fellowship program fellowship form

- Uces form

- United states tax court complaint relating to judicial form

Find out other Hotel Occupancy Tax City Of Pleasanton, TX Remittance Address MuniServices, LLC Attn TX Hotel Occupancy Tax PO Box 830725 Birmin

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself