Kentucky Tax Withholding Form K 4 Hr Nku

What is the Kentucky Tax Withholding Form K-4?

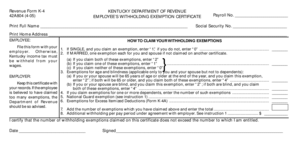

The Kentucky Tax Withholding Form K-4 is a crucial document used by employees in Kentucky to indicate their tax withholding preferences. This form allows employers to determine the appropriate amount of state income tax to withhold from an employee's paycheck. By completing the K-4, employees can specify the number of allowances they wish to claim, which directly influences their tax withholding amount. Understanding the K-4 form is essential for ensuring accurate tax deductions and compliance with state tax regulations.

Steps to Complete the Kentucky Tax Withholding Form K-4

Completing the Kentucky Tax Withholding Form K-4 involves several straightforward steps:

- Obtain the Form: Access the K-4 form through your employer or download it from the Kentucky Department of Revenue website.

- Fill in Personal Information: Provide your name, address, Social Security number, and filing status.

- Claim Allowances: Indicate the number of allowances you are claiming. This number can affect your tax withholding.

- Sign and Date: Ensure you sign and date the form to validate it.

- Submit the Form: Return the completed K-4 to your employer for processing.

Key Elements of the Kentucky Tax Withholding Form K-4

Several key elements are essential to understand when filling out the K-4 form:

- Personal Information: Accurate details such as your full name, address, and Social Security number are mandatory.

- Allowances: The number of allowances you claim can reduce your taxable income and affect your take-home pay.

- Filing Status: Indicate whether you are single, married, or head of household, as this impacts your tax rate.

- Signature: Your signature confirms that the information provided is accurate and complete.

Legal Use of the Kentucky Tax Withholding Form K-4

The Kentucky Tax Withholding Form K-4 is legally binding once completed and submitted to your employer. It is essential to provide accurate information to avoid issues with tax compliance. The form must be filled out in accordance with Kentucky state tax laws, and any changes in your personal circumstances, such as marital status or number of dependents, should prompt a review and potential update of your K-4 form.

How to Obtain the Kentucky Tax Withholding Form K-4

The K-4 form can be obtained through various means:

- Employer: Most employers provide the K-4 form during the onboarding process or upon request.

- Online: You can download the K-4 form directly from the Kentucky Department of Revenue's official website.

- Tax Preparation Services: Many tax professionals and services can provide you with the form and assist in its completion.

Form Submission Methods

Once the Kentucky Tax Withholding Form K-4 is completed, it can be submitted to your employer in several ways:

- In-Person: Hand the form directly to your HR or payroll department.

- Mail: Send the completed form via postal service, if your employer accepts mail submissions.

- Digital Submission: Some employers may allow electronic submission of the K-4 form through secure online portals.

Quick guide on how to complete kentucky tax withholding form k 4 hr nku

Complete Kentucky Tax Withholding Form K 4 Hr Nku effortlessly on every device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed files, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and without hesitation. Manage Kentucky Tax Withholding Form K 4 Hr Nku on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven task today.

How to edit and electronically sign Kentucky Tax Withholding Form K 4 Hr Nku with ease

- Find Kentucky Tax Withholding Form K 4 Hr Nku and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, text (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Kentucky Tax Withholding Form K 4 Hr Nku and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kentucky tax withholding form k 4 hr nku

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is K-4 Kentucky withholding form?

The K-4 Kentucky withholding form is used by employees to indicate their state tax withholding preferences. It helps employers calculate the appropriate amount of state income tax to withhold from an employee's paychecks based on their personal exemptions and filing status. Understanding what is K-4 Kentucky withholding form is crucial for both employers and employees to ensure compliance with state tax laws.

-

How can I obtain a K-4 Kentucky withholding form?

You can obtain a K-4 Kentucky withholding form from the Kentucky Department of Revenue's website or through your employer. It's often provided during the onboarding process. Ensuring you have the right form is essential to fully understand what is K-4 Kentucky withholding form and how to complete it correctly.

-

Why is the K-4 Kentucky withholding form important?

The K-4 Kentucky withholding form is important as it determines how much state tax will be withheld from your paycheck. Accurate filing of this form prevents underpayment or overpayment of taxes throughout the year. Knowing what is K-4 Kentucky withholding form helps you manage your finances and tax obligations effectively.

-

What if I don't submit a K-4 Kentucky withholding form?

If you don't submit a K-4 Kentucky withholding form, your employer will generally withhold taxes at the highest rate. This could lead to a larger tax refund or potential tax liability at the end of the year. It’s essential to understand what is K-4 Kentucky withholding form to ensure that you are not over or under-withheld.

-

Can I change my K-4 Kentucky withholding form later?

Yes, you can change your K-4 Kentucky withholding form at any time by completing a new form and submitting it to your employer. It's advisable to review your withholding if your financial situation changes or if you want to adjust your tax withholding amount. Understanding what is K-4 Kentucky withholding form allows for better financial planning.

-

Is the K-4 Kentucky withholding form the same for all employees?

No, the K-4 Kentucky withholding form can vary for different employees based on individual tax situations, exemptions, and filing status. Each employee should accurately complete their form to reflect their unique financial circumstances. Knowing what is K-4 Kentucky withholding form enables personalized tax withholding.

-

How do I accurately fill out the K-4 Kentucky withholding form?

To accurately fill out the K-4 Kentucky withholding form, provide your personal information, including your filing status and number of exemptions you're claiming. Make sure to consult the instructions included with the form to avoid errors. Understanding what is K-4 Kentucky withholding form is key to ensuring correct completion.

Get more for Kentucky Tax Withholding Form K 4 Hr Nku

Find out other Kentucky Tax Withholding Form K 4 Hr Nku

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe