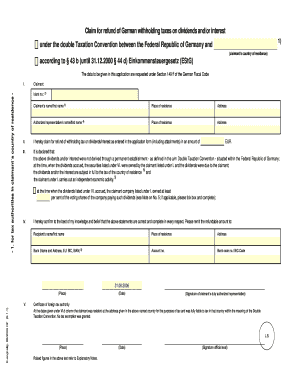

Claim for Refund of German Withholding Taxes on Dividends and or Interest Form

What is the claim for refund of German withholding taxes on dividends and or interest?

The claim for refund of German withholding taxes on dividends and or interest is a formal request made by individuals or entities to recover taxes that have been withheld on income earned from German sources. This process is particularly relevant for U.S. taxpayers who receive dividends or interest from German investments. The withholding tax is typically deducted at the source by the German tax authorities, and the claim allows taxpayers to seek a refund for any overpaid amounts or to reclaim taxes based on applicable tax treaties between Germany and the United States.

Steps to complete the claim for refund of German withholding taxes on dividends and or interest

Completing the claim for refund involves several key steps:

- Gather necessary documentation, including proof of income received, tax withheld, and any relevant tax treaty information.

- Fill out the appropriate claim form accurately, ensuring all required fields are completed.

- Attach supporting documents, such as withholding tax certificates and identification.

- Review the completed form for accuracy and completeness before submission.

- Submit the claim to the appropriate German tax authority, either electronically or by mail.

Required documents for the claim for refund of German withholding taxes on dividends and or interest

To successfully file a claim for refund, certain documents are essential:

- Tax withholding certificates from the German financial institution.

- Proof of identity, such as a passport or driver's license.

- Documentation of the income received, including statements or payment summaries.

- Any relevant forms that support the tax treaty claim, if applicable.

How to obtain the claim for refund of German withholding taxes on dividends and or interest

The claim form can typically be obtained from the official website of the German tax authority or through financial institutions that handle investments in Germany. It is important to ensure that the correct version of the form is used, as there may be updates or changes to the requirements. Additionally, some tax professionals may provide assistance in obtaining and completing the form.

Legal use of the claim for refund of German withholding taxes on dividends and or interest

The legal use of this claim is governed by international tax laws and treaties between the United States and Germany. Taxpayers must ensure compliance with both U.S. and German tax regulations when filing their claim. This includes adhering to deadlines and providing accurate information to avoid penalties or delays in processing the refund.

Eligibility criteria for the claim for refund of German withholding taxes on dividends and or interest

Eligibility for filing a claim for refund generally includes the following criteria:

- The claimant must be a U.S. taxpayer who has received dividends or interest from German sources.

- Taxes must have been withheld at the source by the German tax authorities.

- The claimant must provide documentation proving the amount of tax withheld and the income earned.

- Claims must be filed within the specified time frame set by German tax regulations.

Quick guide on how to complete claim for refund of german withholding taxes on dividends and or interest

Manage Claim For Refund Of German Withholding Taxes On Dividends And Or Interest effortlessly on any device

Online document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Handle Claim For Refund Of German Withholding Taxes On Dividends And Or Interest on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Claim For Refund Of German Withholding Taxes On Dividends And Or Interest without stress

- Find Claim For Refund Of German Withholding Taxes On Dividends And Or Interest and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Claim For Refund Of German Withholding Taxes On Dividends And Or Interest and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claim for refund of german withholding taxes on dividends and or interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to claim for refund of German withholding taxes on dividends and or interest?

To claim for refund of German withholding taxes on dividends and or interest, you need to submit a formal application to the German tax authorities. This application typically requires documentation such as proof of residence and statements showing the amount of taxes withheld. Utilizing airSlate SignNow can streamline this process by allowing you to eSign and send necessary documents securely.

-

Are there fees associated with submitting a claim for refund of German withholding taxes?

While airSlate SignNow offers a cost-effective solution for document management, there may be additional fees related to the processing of your claim for refund of German withholding taxes on dividends and or interest. It's advisable to review the specific requirements and consult with tax professionals for any potential costs related to this service.

-

What features does airSlate SignNow offer to assist in the claims process?

airSlate SignNow provides an intuitive platform for eSigning and sending documents securely, which is essential for claiming refunds on taxes. Features like templates, reminders, and tracking enhance your claim for refund of German withholding taxes on dividends and or interest, ensuring that your documents are processed efficiently and on time.

-

How can airSlate SignNow benefit businesses claiming for refunds?

Businesses can benefit from using airSlate SignNow by simplifying the claims process for refunds on taxes. The platform's ease of use allows for fast document preparation and eSigning, thereby minimizing delays in submitting your claim for refund of German withholding taxes on dividends and or interest and enhancing overall operational efficiency.

-

What integrations does airSlate SignNow support to aid in tax refund claims?

airSlate SignNow supports various integrations with popular business applications such as CRM systems and document management tools. This compatibility can help streamline your workflow when preparing and managing your claim for refund of German withholding taxes on dividends and or interest, making the process more efficient.

-

Is there a limit on the maximum amount that can be claimed for refund of German withholding taxes?

There is typically no upper limit to the total amount you can claim for refund of German withholding taxes on dividends and or interest; however, specific rules and regulations may apply based on your tax residency and investment status. It’s important to review the guidelines or consult with a tax advisor to understand your eligibility and limitations.

-

Can individuals also claim for refund of German withholding taxes on dividends and or interest?

Yes, individuals can claim for refund of German withholding taxes on dividends and or interest, provided they meet certain eligibility criteria. Using airSlate SignNow can simplify the application process for individuals and ensure that necessary documents are accurately submitted and securely signed.

Get more for Claim For Refund Of German Withholding Taxes On Dividends And Or Interest

- Aas 45 reportable event recordreport state of new jersey form

- Paad application 2011 form

- Aptp form nj

- Njfamilycare aged blind disabled 2016 form

- 11 09 deletion of forms isd 379 and mad 075 new mexico hsd state nm

- Dwssnvgov energy assistance 2012 form

- Nevada application radioactive license form

- Family amp medical leave act fmla medical release form

Find out other Claim For Refund Of German Withholding Taxes On Dividends And Or Interest

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later