Ohio Universal Tax Form 2015

What is the Ohio Universal Tax Form

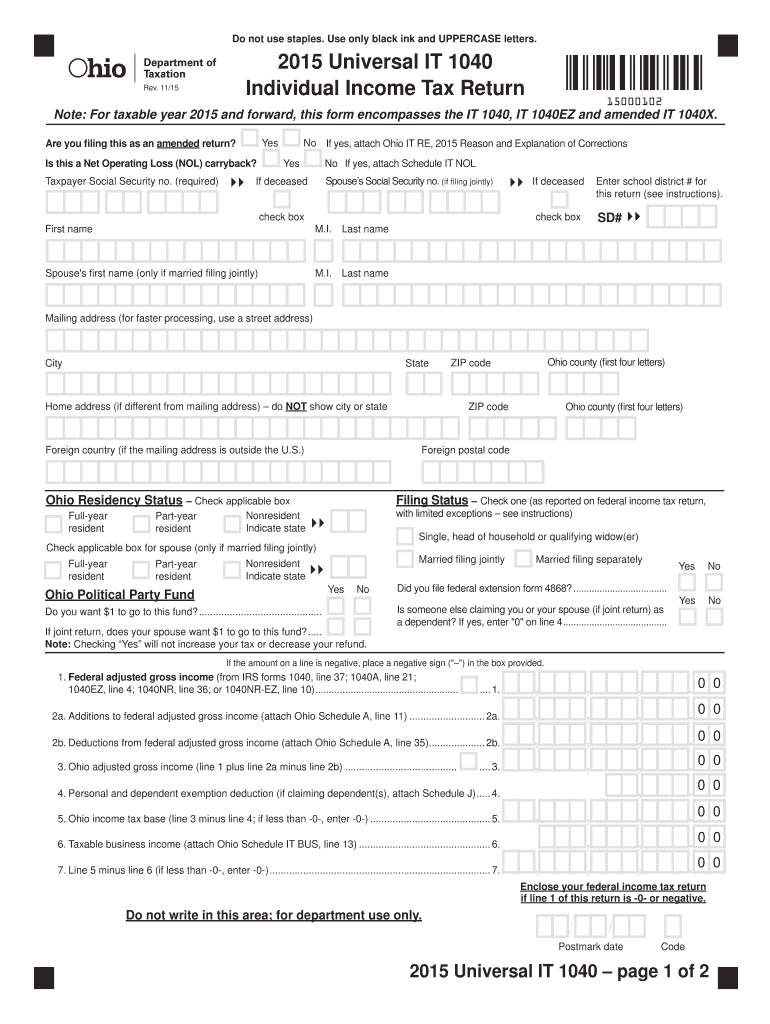

The Ohio Universal Tax Form is a standardized document used for reporting various tax liabilities in the state of Ohio. This form consolidates multiple tax types, making it easier for taxpayers to fulfill their obligations. It is primarily utilized by individuals and businesses to report income, sales, and other applicable taxes. The form serves as a comprehensive tool for ensuring compliance with state tax regulations and is essential for accurate tax reporting.

How to use the Ohio Universal Tax Form

To effectively use the Ohio Universal Tax Form, taxpayers should first ensure they have the correct version of the form. It is important to gather all necessary financial documents, including income statements and receipts for deductible expenses. Once the form is obtained, it should be filled out completely and accurately, following the provided instructions. After completing the form, taxpayers can submit it through various methods, including online, by mail, or in person, depending on their preference and the specific requirements of the Ohio Department of Taxation.

Steps to complete the Ohio Universal Tax Form

Completing the Ohio Universal Tax Form involves several key steps:

- Obtain the latest version of the form from the Ohio Department of Taxation website.

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Choose a submission method: online, by mail, or in person, and follow the specific instructions for that method.

Legal use of the Ohio Universal Tax Form

The legal use of the Ohio Universal Tax Form is governed by state tax laws. To ensure compliance, taxpayers must accurately report their income and any applicable deductions or credits. The form must be signed and dated to validate its submission. Additionally, electronic submissions must adhere to the eSignature regulations to be considered legally binding. Understanding these legal requirements is crucial for avoiding penalties and ensuring that tax filings are accepted by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Universal Tax Form typically align with the federal tax deadlines. Generally, individual taxpayers must file their returns by April 15 of each year. However, extensions may be available under certain circumstances. Businesses may have different deadlines based on their fiscal year and tax structure. It is essential to stay informed about these dates to avoid late fees and penalties.

Required Documents

When completing the Ohio Universal Tax Form, several documents are required to ensure accurate reporting. Taxpayers should have:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as medical costs or charitable contributions

- Records of any estimated tax payments made throughout the year

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state tax regulations.

Quick guide on how to complete ohio universal tax 2015 form

Complete Ohio Universal Tax Form effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Ohio Universal Tax Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ohio Universal Tax Form with ease

- Locate Ohio Universal Tax Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Ohio Universal Tax Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio universal tax 2015 form

Create this form in 5 minutes!

How to create an eSignature for the ohio universal tax 2015 form

How to make an eSignature for your Ohio Universal Tax 2015 Form online

How to make an eSignature for the Ohio Universal Tax 2015 Form in Google Chrome

How to generate an eSignature for putting it on the Ohio Universal Tax 2015 Form in Gmail

How to generate an eSignature for the Ohio Universal Tax 2015 Form straight from your mobile device

How to generate an eSignature for the Ohio Universal Tax 2015 Form on iOS

How to create an eSignature for the Ohio Universal Tax 2015 Form on Android OS

People also ask

-

What is the Ohio Universal Tax Form?

The Ohio Universal Tax Form is a standardized document used for filing various state taxes. With airSlate SignNow, you can easily fill, sign, and submit this form digitally, ensuring accuracy and compliance with Ohio tax regulations.

-

How does airSlate SignNow simplify the process of using the Ohio Universal Tax Form?

airSlate SignNow provides an intuitive platform that streamlines the completion and submission of the Ohio Universal Tax Form. Our service enables users to fill out forms electronically, add eSignatures, and store documents securely, making tax season much less stressful.

-

Is there a cost associated with using the Ohio Universal Tax Form through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to the Ohio Universal Tax Form along with other essential features, ensuring you pay only for what you need.

-

Can I integrate airSlate SignNow with other applications while using the Ohio Universal Tax Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to access and manage your Ohio Universal Tax Form alongside other business tools. This enhances workflow efficiency and saves time.

-

What benefits do I gain from using airSlate SignNow for the Ohio Universal Tax Form?

Using airSlate SignNow for the Ohio Universal Tax Form provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform helps you manage tax submissions effortlessly, ensuring that you meet deadlines without hassle.

-

Is airSlate SignNow suitable for individuals and businesses using the Ohio Universal Tax Form?

Yes, airSlate SignNow is suitable for both individuals and businesses. Regardless of your size or tax filing needs, our platform is flexible enough to accommodate the specific requirements for handling the Ohio Universal Tax Form.

-

How secure is my information when using the Ohio Universal Tax Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. When using the Ohio Universal Tax Form, your data is encrypted and stored securely, ensuring that your personal and financial information is protected throughout the process.

Get more for Ohio Universal Tax Form

Find out other Ohio Universal Tax Form

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online