Fair Market Valuation Form Advanta IRA

What is the Fair Market Valuation Form Advanta IRA

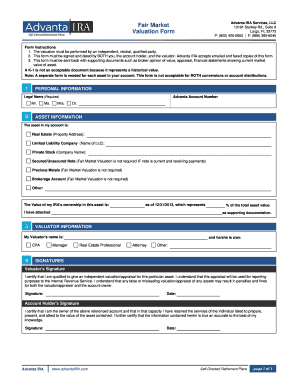

The Fair Market Valuation Form Advanta IRA is a crucial document used to determine the fair market value of assets held within an Individual Retirement Account (IRA). This form is essential for compliance with IRS regulations, particularly for reporting the value of non-traditional assets such as real estate or private equity. By accurately completing this form, account holders ensure that their IRA reflects the correct valuation of assets, which is vital for tax reporting and compliance purposes.

How to Use the Fair Market Valuation Form Advanta IRA

Using the Fair Market Valuation Form Advanta IRA involves several key steps. First, gather all necessary information regarding the assets held in the IRA, including purchase details and any relevant market data. Next, complete the form by accurately entering the asset descriptions and their corresponding values. It is important to ensure that the valuation reflects current market conditions. Once completed, the form should be submitted to Advanta IRA for processing, which may involve additional verification steps.

Steps to Complete the Fair Market Valuation Form Advanta IRA

Completing the Fair Market Valuation Form Advanta IRA requires careful attention to detail. Follow these steps for accurate completion:

- Gather documentation related to the assets, including purchase agreements and appraisals.

- Fill in the asset description fields with precise details about each item.

- Determine the fair market value using reliable sources, such as recent sales or appraisals.

- Enter the calculated values in the appropriate sections of the form.

- Review the form for accuracy and completeness before submission.

Legal Use of the Fair Market Valuation Form Advanta IRA

The Fair Market Valuation Form Advanta IRA serves a legal purpose in the context of IRS regulations. It is used to substantiate the value of assets within an IRA for tax reporting and compliance. Properly executed, this form can help prevent issues with the IRS, such as audits or penalties for underreporting asset values. It is essential to ensure that the form is filled out accurately and submitted on time to maintain compliance with all applicable laws.

Key Elements of the Fair Market Valuation Form Advanta IRA

Several key elements are essential to the Fair Market Valuation Form Advanta IRA. These include:

- Asset Description: A detailed description of each asset held in the IRA.

- Valuation Method: The method used to determine the fair market value, such as comparable sales or appraisals.

- Value Reporting: The accurate market value of each asset as of the reporting date.

- Signature: Required signatures to validate the form, ensuring that all information is correct.

Who Issues the Form

The Fair Market Valuation Form Advanta IRA is issued by Advanta IRA, a company specializing in self-directed retirement accounts. They provide the necessary forms and guidance for account holders to ensure compliance with IRS regulations. It is important for users to obtain the most current version of the form directly from Advanta IRA to ensure accuracy and compliance.

Quick guide on how to complete fair market valuation form advanta ira

Effortlessly Prepare Fair Market Valuation Form Advanta IRA on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Fair Market Valuation Form Advanta IRA on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Fair Market Valuation Form Advanta IRA with ease

- Find Fair Market Valuation Form Advanta IRA and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Verify all details and click the Done button to save your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Fair Market Valuation Form Advanta IRA and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fair market valuation form advanta ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Advanta IRA fair market valuation form?

The Advanta IRA fair market valuation form is an essential document used to determine the fair market value of assets held in an IRA. This form ensures accurate compliance with IRS regulations while providing a clear valuation for investment accounts. Utilizing this form can help streamline the valuation process for better financial planning.

-

How can I access the Advanta IRA fair market valuation form?

You can easily access the Advanta IRA fair market valuation form through the airSlate SignNow platform. Once you register, simply search for the form in our library of templates to download or fill it out online. This makes it convenient for you to complete your valuation tasks without hassle.

-

Are there any fees associated with using the Advanta IRA fair market valuation form?

Using the Advanta IRA fair market valuation form via airSlate SignNow does not incur additional fees above your regular subscription cost. We offer a cost-effective solution to manage your document workflows, including valuation forms, without extra expenses. It's important to review our pricing plans for comprehensive details.

-

What features does the airSlate SignNow platform offer for the Advanta IRA fair market valuation form?

airSlate SignNow provides intuitive features for the Advanta IRA fair market valuation form, including electronic signatures, document templates, and real-time collaboration tools. These features enable you to complete forms quickly and efficiently while ensuring compliance and accuracy. Enjoy a seamless document workflow designed for your convenience.

-

Can I integrate the Advanta IRA fair market valuation form with other software?

Yes, airSlate SignNow allows for smooth integrations with various software tools relevant to your operations, including accounting and financial management systems. This enables you to utilize the Advanta IRA fair market valuation form alongside your existing systems for a comprehensive management approach. Check our integration options for compatibility details.

-

What are the benefits of using the Advanta IRA fair market valuation form?

The primary benefits of using the Advanta IRA fair market valuation form include ensuring compliance with IRS regulations, maintaining accurate records, and facilitating informed investment decisions. By having a reliable valuation method, you enhance your financial oversight and planning capabilities. This form simplifies a critical aspect of IRA management.

-

Is there customer support available for using the Advanta IRA fair market valuation form?

Absolutely! airSlate SignNow provides comprehensive customer support for users of the Advanta IRA fair market valuation form. Our support team is available via various channels to assist you with any questions or challenges you may encounter. We prioritize your experience to ensure a smooth document signing journey.

Get more for Fair Market Valuation Form Advanta IRA

- Rev 072016 ksjc 1 329 in the district court of county kansasjudicialcouncil form

- 5113 185 in the district court of county kansas in the interest of name year of birth a male female case no form

- We care online kansas form

- Oath of court appointed special advocate kansasjudicialcouncil form

- Cdocuments and settingsnataliemy documentsksjc websitewebsite files 2008related linksstudies and reportsprevious judic form

- Cdocuments and settingsptulllocal settingstemporary internet filesolk2judicial performance reportwpd kansasjudicialcouncil

- 5113 1 186 in the district court of county kansas in kansasjudicialcouncil form

- 5113 163 in the district court of county kansas in kansasjudicialcouncil form

Find out other Fair Market Valuation Form Advanta IRA

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form