Form 8396

What is the Form 8396

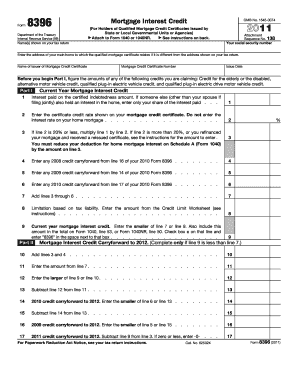

The Form 8396 is a tax form used by eligible homeowners to claim a credit for the interest paid on a qualified mortgage. This form is particularly relevant for individuals who qualify for the Mortgage Interest Credit, which is designed to assist low-income taxpayers in affording homeownership. The credit can be claimed on a federal tax return, providing significant financial relief to qualifying homeowners.

How to use the Form 8396

Using the Form 8396 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including your mortgage statement and any relevant tax information. Next, fill out the form by providing details such as your name, address, and the amount of mortgage interest paid. Once completed, the form should be attached to your federal tax return when filing. It is essential to retain a copy for your records.

Steps to complete the Form 8396

Completing the Form 8396 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form 8396 from the IRS website.

- Fill in your personal information, including your Social Security number.

- Calculate the amount of mortgage interest you paid during the tax year.

- Determine your credit rate based on IRS guidelines.

- Complete the calculations on the form to arrive at your total credit amount.

- Review the form for accuracy before submission.

Legal use of the Form 8396

The legal use of the Form 8396 is governed by IRS regulations. To ensure that the form is legally valid, it must be completed accurately and submitted within the designated filing period. Additionally, the information provided must be truthful and verifiable, as any discrepancies can lead to penalties or audits. The form must also comply with federal tax laws, making it crucial for taxpayers to understand their eligibility and the requirements associated with the credit.

Eligibility Criteria

To qualify for the Mortgage Interest Credit claimed on Form 8396, taxpayers must meet specific eligibility criteria. Generally, the applicant must be a homeowner who has a qualified mortgage and meets income limitations set by the IRS. The property must be the taxpayer's principal residence, and the mortgage must be secured by that residence. It is important to review the IRS guidelines to ensure compliance with all eligibility requirements before filing.

Form Submission Methods

The Form 8396 can be submitted through various methods, depending on how you choose to file your taxes. Taxpayers can file electronically using tax preparation software, which often includes options for e-filing the form. Alternatively, the form can be printed and mailed along with your federal tax return. If filing in person, you can bring the completed form to a local IRS office or a tax professional for assistance.

Quick guide on how to complete form 8396 100020273

Complete Form 8396 effortlessly on any device

Online document management has become trendy among businesses and individuals. It offers a suitable eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any hold-ups. Manage Form 8396 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form 8396 with ease

- Find Form 8396 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that aim.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8396 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8396 100020273

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8396 form and why is it important?

The 8396 form is a specific document used for various administrative purposes, particularly in business and tax applications. Understanding its significance can help streamline your processes and ensure compliance with federal regulations. By utilizing the 8396 form correctly, organizations can avoid unnecessary penalties and delays.

-

How can airSlate SignNow simplify the process of completing the 8396 form?

airSlate SignNow provides an intuitive platform to create, send, and eSign the 8396 form electronically. This reduces the time and effort associated with traditional paperwork while ensuring that all relevant information is collected accurately. Users can easily track the status of their forms, which enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for the 8396 form?

Yes, airSlate SignNow offers a cost-effective pricing structure that accommodates different business needs, including the processing of the 8396 form. Depending on your plan, you can access a range of features that facilitate document management and eSigning. Review our pricing page for detailed options and choose a plan that fits your budget.

-

What features does airSlate SignNow offer for managing the 8396 form?

With airSlate SignNow, you have access to features like document templates, customizable fields, and workflow automation which are essential for managing the 8396 form. Additionally, the platform allows for secure eSignature collection and real-time collaboration, making it easier for teams to manage important documents effectively.

-

Are there integrations available for the 8396 form with other software?

Yes, airSlate SignNow offers integrations with various applications, enabling seamless handling of the 8396 form alongside your existing tools. This includes popular services such as Google Drive, Dropbox, and CRM systems. These integrations enhance your workflow and ensure that all your document management needs are met efficiently.

-

Can I track the status of the 8396 form once it is sent?

Absolutely! airSlate SignNow provides comprehensive tracking features that allow you to monitor the status of your sent 8396 form. You receive notifications when the document is viewed, signed, or completed, thus keeping you informed throughout the process.

-

How secure is the airSlate SignNow platform when handling the 8396 form?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect your data while processing the 8396 form. Our platform is compliant with industry standards, ensuring that your sensitive documents are safe and confidentiality is maintained at all times.

Get more for Form 8396

Find out other Form 8396

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile