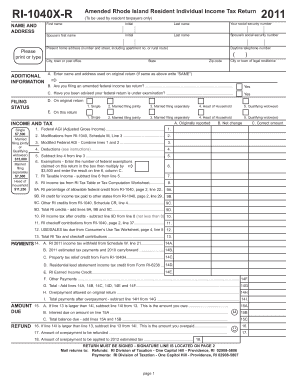

Ri 1040x Form

What is the 1040x Form?

The 1040x form is an amended U.S. federal tax return form used by taxpayers to correct errors on their original tax returns. This form allows individuals to make changes to their filing status, income, deductions, or credits after the initial submission has been processed. It is essential for ensuring that the tax records are accurate and reflect the correct financial situation of the taxpayer.

How to use the 1040x Form

To use the 1040x form effectively, taxpayers should first gather all relevant documents related to their original tax return. This includes W-2s, 1099s, and any other supporting documentation. Next, the taxpayer must fill out the form by providing the necessary corrections in the designated sections. It is important to clearly explain the reasons for the amendments in the explanation section of the form. Once completed, the form should be submitted to the IRS, following the specific filing instructions provided.

Steps to complete the 1040x Form

Completing the 1040x form involves several key steps:

- Obtain a copy of the original tax return that needs correction.

- Download the 1040x form from the IRS website or request a paper copy.

- Fill out the form, indicating the original amounts and the corrected amounts.

- Provide a clear explanation for each change made.

- Sign and date the form before submission.

Legal use of the 1040x Form

The 1040x form is legally recognized as a valid means for taxpayers to amend their tax returns. It is essential that the corrections made are accurate and supported by appropriate documentation. The IRS requires that any changes comply with tax laws and regulations. Failure to use the form correctly can lead to penalties or further scrutiny from the IRS.

Filing Deadlines / Important Dates

Taxpayers should be aware of the deadlines associated with filing the 1040x form. Generally, the form must be submitted within three years of the original tax return's due date, including extensions. Additionally, if the changes result in a refund, it is advisable to file as soon as possible to ensure timely processing of the refund.

Required Documents

When completing the 1040x form, certain documents are necessary to support the amendments. These may include:

- The original tax return.

- Any supporting documents related to the changes, such as W-2s or 1099s.

- Proof of payment for any additional taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The 1040x form can be submitted to the IRS via mail. Currently, there is no option for online submission of this form. Taxpayers should ensure that they send the form to the correct address based on their state of residence. It is advisable to use a trackable mailing method to confirm receipt by the IRS.

Quick guide on how to complete ri 1040x form 5817837

Prepare Ri 1040x Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed papers, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Ri 1040x Form on any device using airSlate SignNow's Android or iOS applications and simplify any documentation process today.

How to modify and eSign Ri 1040x Form with ease

- Find Ri 1040x Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to finalize your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Ri 1040x Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1040x form 5817837

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1040x form, and why do I need it?

The 1040x form is used to amend your federal tax return. If you've made an error or need to update your tax information, filing a 1040x is essential to ensure your tax records are accurate. Using airSlate SignNow, you can securely eSign your 1040x and submit it easily.

-

How does airSlate SignNow simplify the 1040x filing process?

AirSlate SignNow simplifies the 1040x filing process by allowing users to fill out forms electronically and eSign them without the need for printing. This not only saves time but also enhances accuracy, reducing the chances of further errors on your amendment. Moreover, it's accessible from any device, making it convenient for all users.

-

Are there any costs associated with using airSlate SignNow for my 1040x?

AirSlate SignNow offers a cost-effective pricing model with various plans suited to different needs. Depending on the features you choose, you can file your 1040x with minimal expenses while enjoying the convenience of an eSigning solution. There are also free trials available to explore before committing.

-

What features does airSlate SignNow offer for 1040x eSigning?

AirSlate SignNow provides a range of features that streamline the 1040x eSigning process. Users can access templates, easily upload and manage documents, and track the progress of their amendments. Additionally, advanced security protocols ensure that your personal information remains protected.

-

Can I integrate airSlate SignNow with other applications for 1040x management?

Yes, airSlate SignNow integrates seamlessly with a variety of applications to enhance your 1040x management. Popular tools like CRMs, cloud storage services, and financial software can be linked for easy access and document sharing. This integration ensures a smooth workflow and increases efficiency for your tax-related tasks.

-

Is airSlate SignNow compliant with tax regulations for 1040x submissions?

Absolutely! AirSlate SignNow is designed to comply with all relevant tax regulations regarding document security and eSigning. This ensures that your 1040x submissions are legally valid and accepted by tax authorities, giving you peace of mind when amending your returns.

-

What are the benefits of using airSlate SignNow for my 1040x?

Using airSlate SignNow for your 1040x offers numerous benefits, including time savings, reduced errors, and enhanced convenience. The platform allows for easy document management and eSigning, meaning you can focus more on your financial planning rather than the complexities of paperwork. Plus, you can access your documents from anywhere at any time.

Get more for Ri 1040x Form

- Profit participation agreement template innet form

- Equipment request form coleysolutionscom

- Coe dat participant application form 2018 nato

- Benevolence form new covenant ministries cogic ncmcogic

- Dte planning and design form

- Contrato de servicio movistar en casa tarifa plana zonal form

- 9v9 soccer formations pdf

- This is your medical insurance card form

Find out other Ri 1040x Form

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement