Hcc Emergency Loan Form

What is the Hcc Emergency Loan

The Hcc emergency loan is a financial assistance option designed to provide quick funding for individuals facing unexpected expenses or emergencies. This type of loan typically offers a streamlined application process and faster approval times compared to traditional loans. It is particularly beneficial for those who may not have access to other forms of credit or need immediate financial relief. The Hcc emergency loan can cover various expenses, including medical bills, car repairs, or other urgent financial needs.

How to Obtain the Hcc Emergency Loan

Obtaining the Hcc emergency loan involves a straightforward process. First, individuals must gather necessary documentation, such as proof of income, identification, and any relevant financial information. Next, applicants can complete the loan application form, which may be available online or through designated financial institutions. After submission, the lender will review the application and determine eligibility based on the provided information. Once approved, funds are typically disbursed quickly, allowing borrowers to address their financial needs promptly.

Steps to Complete the Hcc Emergency Loan

Completing the Hcc emergency loan application involves several key steps:

- Gather Documentation: Collect all necessary documents, including identification and proof of income.

- Fill Out the Application: Complete the application form accurately, ensuring all information is correct.

- Submit the Application: Send the completed form to the lender, either online or in-person.

- Await Approval: The lender will review the application and notify you of the decision.

- Receive Funds: If approved, funds will be disbursed, often within a short timeframe.

Legal Use of the Hcc Emergency Loan

The legal use of the Hcc emergency loan is governed by specific regulations and guidelines. Borrowers should ensure that the funds are used for legitimate purposes, such as covering unexpected expenses or emergencies. Misuse of the loan, such as using it for non-emergency expenses, may lead to legal repercussions or penalties. It is essential to understand the terms and conditions set forth by the lender to ensure compliance with all legal requirements.

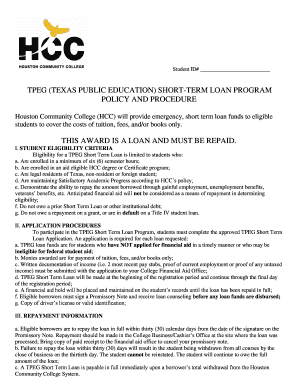

Eligibility Criteria

Eligibility for the Hcc emergency loan typically depends on several factors. Applicants must demonstrate a need for financial assistance, which may involve providing proof of income or employment. Additionally, lenders may assess credit history and financial stability to determine eligibility. Specific criteria can vary by lender, so it is advisable to review the requirements before applying to ensure that all conditions are met.

Required Documents

To successfully apply for the Hcc emergency loan, individuals must prepare certain documents. Commonly required documents include:

- Government-issued identification (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements to verify financial status

- Any additional documentation requested by the lender

Application Process & Approval Time

The application process for the Hcc emergency loan is designed to be efficient. After gathering the necessary documents and completing the application form, applicants can submit their information. Approval times can vary, but many lenders aim to provide a decision within one to three business days. Once approved, funds may be made available to the borrower almost immediately, allowing for quick access to financial support during emergencies.

Quick guide on how to complete hcc emergency loan

Prepare Hcc Emergency Loan effortlessly on any device

Web-based document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Hcc Emergency Loan on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign Hcc Emergency Loan with ease

- Find Hcc Emergency Loan and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential parts of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Hcc Emergency Loan to maintain excellent communication at any stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hcc emergency loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HCC emergency loan?

An HCC emergency loan is a financial product designed to help individuals cover unexpected costs related to their healthcare. This type of loan ensures that you have quick access to funds when faced with medical emergencies, allowing you to focus on recovery rather than financial stress.

-

How can airSlate SignNow assist with HCC emergency loans?

airSlate SignNow provides an efficient way to manage the documentation required for HCC emergency loans. Our eSigning features allow you to prepare, send, and sign loan applications quickly, ensuring a smooth process from start to finish.

-

What are the costs associated with HCC emergency loans?

The costs of HCC emergency loans can vary based on the lender and the loan terms. Generally, you might encounter interest rates and fees, but airSlate SignNow helps minimize related documentation costs through its user-friendly platform.

-

What features does airSlate SignNow offer for HCC emergency loan applications?

airSlate SignNow offers several features that streamline the HCC emergency loan application process, including customizable templates, automatic reminders for signers, and the ability to store documents securely. These features help ensure that your applications are completed accurately and promptly.

-

Are HCC emergency loans available for everyone?

HCC emergency loans are generally accessible to individuals who need urgent financial assistance for medical-related expenses. However, each lender has its own criteria, such as credit scores and income verification, which can affect eligibility.

-

What are the benefits of using airSlate SignNow for HCC emergency loans?

Using airSlate SignNow for HCC emergency loans offers numerous benefits, such as reduced processing time and enhanced security for sensitive documents. The ease of use and integration with other applications ensures a seamless experience throughout the loan process.

-

Can I integrate airSlate SignNow with other platforms for HCC emergency loans?

Yes, airSlate SignNow easily integrates with various platforms and applications that enhance your workflow for HCC emergency loans. This interoperability allows you to connect with your existing tools, making the loan documentation process more efficient.

Get more for Hcc Emergency Loan

- Please go over the information contained in this mailing so

- Jesus in haiti ministries mission trip application and form

- Iowa association medical staff services renewal namss form

- Masonic scholarship application 2020 grand lodge of iowa form

- Before completing this application read the informational back page which specifies the criteria for both

- Af am demitt form

- Masonic scholarship form

- Iowa association medical staff services renewal membership form

Find out other Hcc Emergency Loan

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe