Personal Tax Credit Return Bc Form

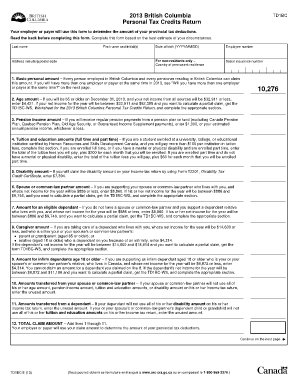

What is the Personal Tax Credit Return Bc

The Personal Tax Credit Return Bc is a specific form utilized by individuals to claim personal tax credits in British Columbia. This form allows taxpayers to report their eligibility for various tax credits, which can reduce their overall tax liability. Understanding this form is essential for ensuring that taxpayers maximize their benefits and comply with local tax regulations.

How to use the Personal Tax Credit Return Bc

Using the Personal Tax Credit Return Bc involves several straightforward steps. First, gather all necessary documentation, including proof of income and any relevant tax credit eligibility information. Next, complete the form accurately, ensuring that all required fields are filled out. Once completed, the form can be submitted electronically or via traditional mail, depending on the taxpayer's preference and local regulations.

Steps to complete the Personal Tax Credit Return Bc

Completing the Personal Tax Credit Return Bc requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as income statements and proof of residency.

- Fill out the personal information section, including name, address, and Social Security number.

- Indicate the specific tax credits you are claiming and provide any required supporting documentation.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, as per your preference.

Legal use of the Personal Tax Credit Return Bc

The legal use of the Personal Tax Credit Return Bc is governed by tax laws and regulations in British Columbia. To ensure compliance, it is crucial that taxpayers accurately report their information and adhere to submission guidelines. Electronic submissions are legally recognized, provided they meet specific criteria established by local authorities.

Eligibility Criteria

Eligibility for claiming credits on the Personal Tax Credit Return Bc typically includes factors such as income level, residency status, and specific life circumstances, such as being a student or a senior. Taxpayers should review the criteria carefully to determine their eligibility for various credits, ensuring they can maximize their tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the Personal Tax Credit Return Bc are crucial for taxpayers to observe. Generally, the deadline aligns with the overall tax filing deadline in British Columbia. It is important to stay informed about these dates to avoid penalties and ensure timely processing of the tax credits claimed.

Quick guide on how to complete personal tax credit return bc 100114392

Prepare Personal Tax Credit Return Bc effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Handle Personal Tax Credit Return Bc on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Personal Tax Credit Return Bc effortlessly

- Find Personal Tax Credit Return Bc and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Personal Tax Credit Return Bc and ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal tax credit return bc 100114392

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a personal tax credit return BC?

A personal tax credit return BC is a summary of taxable income, deductions, and credits that individuals in British Columbia file annually to calculate their tax obligations. It allows taxpayers to claim various credits to reduce their payable taxes. Understanding this process is crucial for maximizing your potential savings.

-

How can airSlate SignNow help with my personal tax credit return BC?

AirSlate SignNow offers a user-friendly platform to eSign documents related to your personal tax credit return BC. With our solution, you can quickly sign and send essential tax documents securely, ensuring that you meet deadlines without hassle. This enhances your overall efficiency during tax season.

-

What are the costs associated with using airSlate SignNow for my personal tax credit return BC?

AirSlate SignNow provides a cost-effective solution for managing documents, including personal tax credit returns BC. Our pricing plans are designed to accommodate individuals and businesses alike, with scalable options based on your usage. You can choose a plan that best fits your needs without overspending.

-

Are there any features specific to personal tax credit return BC in airSlate SignNow?

Yes, airSlate SignNow features dedicated templates and workflows specifically for personal tax credit returns BC. These tools streamline the process, allowing you to easily prepare and sign your tax documents. This way, you can ensure compliance while saving time and reducing stress during tax preparation.

-

Is airSlate SignNow secure for handling my personal tax credit return BC?

Absolutely! AirSlate SignNow prioritizes security, employing advanced encryption techniques to protect your personal tax credit return BC and sensitive information. We adhere to strict compliance standards to ensure that your data remains safe throughout the eSigning process.

-

Can I integrate airSlate SignNow with other tax software for my personal tax credit return BC?

Yes, airSlate SignNow easily integrates with popular tax software that helps in filing your personal tax credit return BC. This seamless integration allows you to manage your documents and signatures effortlessly within your preferred tax application, optimizing your workflow and enhancing productivity.

-

What are the benefits of using airSlate SignNow for my personal tax credit return BC?

Using airSlate SignNow for your personal tax credit return BC simplifies the document signing and submission process. It saves time, reduces errors, and enhances organization, ensuring that you can efficiently handle your tax responsibilities. Additionally, our platform allows you to keep track of all your submissions in one place.

Get more for Personal Tax Credit Return Bc

Find out other Personal Tax Credit Return Bc

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application