Insurance Premium Tax Minnesota Department of Revenue 2019

What is the Insurance Premium Tax Minnesota Department Of Revenue

The Insurance Premium Tax is a tax imposed on insurance premiums collected by insurance companies operating in Minnesota. This tax is administered by the Minnesota Department of Revenue and applies to various types of insurance, including life, health, and property insurance. The tax rate can vary depending on the type of insurance and the specific regulations set by the state. Understanding this tax is essential for insurance providers to ensure compliance and proper financial planning.

Steps to complete the Insurance Premium Tax Minnesota Department Of Revenue

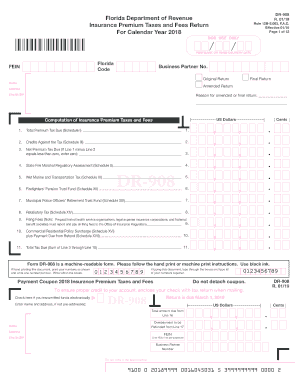

Completing the Insurance Premium Tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the insurance premiums collected during the tax period. This may include policyholder information, premium amounts, and any applicable deductions.

Next, accurately fill out the form by entering the required information, including total premiums and any adjustments. It is crucial to double-check all entries for accuracy to avoid penalties. Once the form is completed, it can be submitted electronically or via mail, depending on the preferred method of the Minnesota Department of Revenue.

Legal use of the Insurance Premium Tax Minnesota Department Of Revenue

The legal framework governing the Insurance Premium Tax is established by Minnesota state law. This tax is mandatory for all insurance companies operating within the state and is subject to specific compliance requirements. The Minnesota Department of Revenue outlines the legal obligations for insurers, including the need to file returns and remit payments by designated deadlines. Non-compliance can result in penalties, making it essential for businesses to adhere to these regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Insurance Premium Tax are critical for compliance. Typically, the tax must be filed annually, with specific due dates set by the Minnesota Department of Revenue. It is important for insurance companies to stay informed about these deadlines to avoid late fees and penalties. Marking these dates on a calendar can help ensure timely submission and payment.

Required Documents

To complete the Insurance Premium Tax form, several documents are required. These typically include:

- Records of premiums collected during the tax period

- Policyholder information

- Any applicable deductions or exemptions

- Previous tax returns for reference

Having these documents organized and readily available will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The Insurance Premium Tax form can be submitted through various methods. Insurance companies may choose to file online through the Minnesota Department of Revenue's official website, which often provides a more efficient and faster processing time. Alternatively, the form can be mailed to the appropriate address provided by the department. In-person submissions may also be possible, although this method is less common. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the company's needs.

Quick guide on how to complete insurance premium tax minnesota department of revenue

Easily Prepare Insurance Premium Tax Minnesota Department Of Revenue on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly and without hassle. Manage Insurance Premium Tax Minnesota Department Of Revenue seamlessly on any platform using the airSlate SignNow Android or iOS applications and simplify your document processes today.

Steps to Edit and Electronically Sign Insurance Premium Tax Minnesota Department Of Revenue Effortlessly

- Obtain Insurance Premium Tax Minnesota Department Of Revenue and click Get Form to initiate.

- Leverage the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details with the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate new document prints. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choosing. Edit and eSign Insurance Premium Tax Minnesota Department Of Revenue and ensure outstanding communication throughout every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct insurance premium tax minnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the insurance premium tax minnesota department of revenue

How to create an eSignature for your Insurance Premium Tax Minnesota Department Of Revenue in the online mode

How to generate an eSignature for your Insurance Premium Tax Minnesota Department Of Revenue in Chrome

How to make an eSignature for putting it on the Insurance Premium Tax Minnesota Department Of Revenue in Gmail

How to generate an electronic signature for the Insurance Premium Tax Minnesota Department Of Revenue from your smart phone

How to make an eSignature for the Insurance Premium Tax Minnesota Department Of Revenue on iOS devices

How to generate an eSignature for the Insurance Premium Tax Minnesota Department Of Revenue on Android devices

People also ask

-

What is the Insurance Premium Tax in Minnesota?

The Insurance Premium Tax in Minnesota is a tax levied on insurance premiums collected by insurance companies operating within the state. The Minnesota Department of Revenue oversees the administration of this tax, which is used to fund various state services and programs aimed at benefiting residents. It's important for businesses to understand this tax to ensure compliance and avoid potential penalties.

-

How is the Insurance Premium Tax calculated?

The Insurance Premium Tax is calculated based on the total premiums written by an insurance company during a specific period, typically reported quarterly or annually. The Minnesota Department of Revenue provides guidelines on the applicable tax rates and any exemptions that may apply. Businesses should consult these guidelines to ensure accurate tax calculations and submissions.

-

What are the benefits of understanding the Insurance Premium Tax in Minnesota?

Understanding the Insurance Premium Tax in Minnesota helps businesses stay compliant with state regulations, avoiding potential fines and legal issues. Additionally, it allows companies to better manage their financial planning and budgeting regarding insurance costs. By engaging with resources from the Minnesota Department of Revenue, businesses can navigate the tax landscape more effectively.

-

Are there any exemptions available for the Insurance Premium Tax?

Yes, certain exemptions might apply to the Insurance Premium Tax in Minnesota, as defined by the Minnesota Department of Revenue. There are specific categories of insurance or policy types that may qualify for tax exemption, saving businesses a signNow amount. It’s advisable for companies to review these exemptions to determine their eligibility.

-

How can airSlate SignNow assist with Insurance Premium Tax compliance?

airSlate SignNow offers an easy-to-use platform for businesses to manage document workflows, including those related to the Insurance Premium Tax in Minnesota. By streamlining eSigning and document sending, companies can quickly prepare necessary records for tax submissions to the Minnesota Department of Revenue. This not only saves time but also enhances compliance accuracy.

-

What features does airSlate SignNow offer for managing business tax documents?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and automated reminders that simplify the management of tax-related documents, including those for the Insurance Premium Tax in Minnesota. These functionalities help ensure that businesses stay organized and timely with their tax filings to the Minnesota Department of Revenue. These tools save time and reduce administrative burdens.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Each plan includes essential features for managing documents related to the Insurance Premium Tax in Minnesota, providing a cost-effective solution for eSigning and streamlined workflows. Potential customers can view detailed pricing information on the airSlate SignNow website.

Get more for Insurance Premium Tax Minnesota Department Of Revenue

- Commercial credit application ctlibrarians form

- St francis high school wheaton il guest request form at 8 sfhscollegeprep

- Walk on tryout certification lsu compliance dolan compliance lsu form

- University ecclesiastical endorsement form

- Title of form privacy act statement health statement sjms

- Providence guide to permitting city of providence form

- Dd form 1972 joint tactical air strike request april 2003 dtic

- Dss 5277 request for confidential information regarding child abuse neglect and dependency info dhhs state nc

Find out other Insurance Premium Tax Minnesota Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors