BPI LOAN APPLICATION FORMlegal Size PDF

Understanding the BPI Personal Loan Application Form PDF

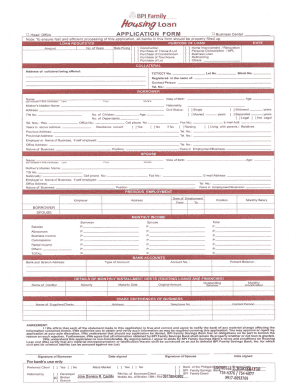

The BPI personal loan application form PDF is a crucial document for individuals seeking financial assistance from BPI. This form is designed to collect essential information about the applicant, including personal details, financial status, and the purpose of the loan. Understanding the structure and requirements of this form is vital for a successful application process. It typically includes sections for personal identification, income verification, and loan specifics, ensuring that BPI has all necessary information to assess the applicant's eligibility.

Steps to Complete the BPI Personal Loan Application Form PDF

Completing the BPI personal loan application form PDF involves several key steps:

- Download the Form: Obtain the latest version of the BPI personal loan application form PDF from the official BPI website or authorized sources.

- Fill in Personal Information: Provide accurate personal details, including your name, address, contact information, and social security number.

- Detail Financial Information: Include your income sources, employment details, and any existing debts. This information helps BPI evaluate your financial stability.

- Specify Loan Purpose: Clearly state the intended use of the loan, whether for personal expenses, home improvements, or other needs.

- Review and Sign: Carefully review the completed form for accuracy before signing it. Ensure that all required fields are filled out.

Legal Use of the BPI Personal Loan Application Form PDF

The BPI personal loan application form PDF holds legal significance as it serves as a formal request for credit. When filled out correctly and signed, it becomes a binding document that initiates the loan process. Compliance with legal requirements, such as providing truthful information and understanding the terms of the loan, is essential. Misrepresentation on the form can lead to legal consequences, including denial of the loan or future financial liabilities.

Required Documents for the BPI Personal Loan Application

To successfully submit the BPI personal loan application form PDF, applicants must include several supporting documents. These typically include:

- Proof of Identity: A government-issued ID, such as a driver's license or passport.

- Income Verification: Recent pay stubs, tax returns, or bank statements to demonstrate income stability.

- Employment Details: A letter from your employer or employment contract may be required to confirm your job status.

- Credit History: A credit report may be requested to assess your creditworthiness.

Application Process and Approval Time for BPI Personal Loans

The application process for a BPI personal loan begins with the submission of the completed application form and required documents. Once submitted, BPI typically reviews the application within a few business days. The approval time can vary based on factors such as the completeness of the application, verification of information, and the applicant's credit history. Applicants are usually notified of the decision via email or phone call, and if approved, further instructions regarding loan disbursement will be provided.

Digital vs. Paper Version of the BPI Personal Loan Application Form

Applicants have the option to complete the BPI personal loan application form PDF either digitally or in paper format. The digital version allows for easier editing and submission, often providing a more efficient process. However, some applicants may prefer the traditional paper format for personal comfort. Regardless of the format chosen, it is essential to ensure that all information is accurate and that the form is signed appropriately to maintain its validity.

Quick guide on how to complete bpi personal loan form

Effortlessly prepare bpi personal loan form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage bpi personal loan application form pdf on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign bpi loan application form pdf with ease

- Obtain bpi personal loan form pdf and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to finalize your changes.

- Choose how you wish to send your form – via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign bpi loan application and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to bpi housing loan form

Create this form in 5 minutes!

How to create an eSignature for the bpi form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask bpi downloadable forms pdf

-

What is the bpi personal loan application form pdf and how do I access it?

The bpi personal loan application form pdf is a downloadable document that allows you to apply for a personal loan through BPI. To access it, visit the BPI website or contact customer service for the latest version of the application form. Completing this form is a crucial step in securing your personal loan.

-

What are the key features of the bpi personal loan application form pdf?

The bpi personal loan application form pdf includes essential fields such as personal details, income information, and loan amount requested. These features ensure a streamlined application process. By filling out the pdf correctly, you can enhance your chances of approval.

-

Are there any fees associated with submitting the bpi personal loan application form pdf?

Typically, there are no fees for submitting the bpi personal loan application form pdf itself; however, there may be processing fees once your loan is approved. It's essential to review all potential costs with BPI before applying. Transparency in fees helps you understand the total cost of borrowing.

-

What benefits do I gain from using the bpi personal loan application form pdf?

Using the bpi personal loan application form pdf simplifies the loan application process, allowing for easy editing and submission. It also enables you to keep a copy of your application for your records. This convenience helps you track your borrowing journey effectively.

-

How long does it take to process the bpi personal loan application form pdf?

The processing time for the bpi personal loan application form pdf varies based on BPI's evaluation procedures. Generally, you can expect a response within a few business days. However, this timeline may be affected by the completeness of the submitted information.

-

Can the bpi personal loan application form pdf be submitted online?

Yes, you can submit the bpi personal loan application form pdf online, depending on BPI's current application process. Make sure to follow the instructions provided on their website for online submissions. This flexibility allows you to apply for a loan from the comfort of your home.

-

What documents do I need to attach with the bpi personal loan application form pdf?

When submitting the bpi personal loan application form pdf, you typically need to attach identification proof, income statements, and any other relevant financial documents. BPI may have specific requirements based on your personal circumstances. It's advisable to check the requirements before submitting your application.

Get more for bpi loan form

- Ks department of health and environment presumptive medical disability questionnaire ks department of health and environment form

- True colors word sort form

- Dmv 101 ps2 rev 215 division of motor vehicles transportation wv form

- Of special power form

- Dae fo 007 formulario de registro de empleadores

- Artist research worksheet form

- Numero de secteur proof of residence emploi quebec form

- Unpaid internship offer letter form

Find out other bpi authorization letter sample

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip