Employee's Report of Work Related Injury Des Umd Form

What is the Employee's Report of Work Related Injury Des Umd

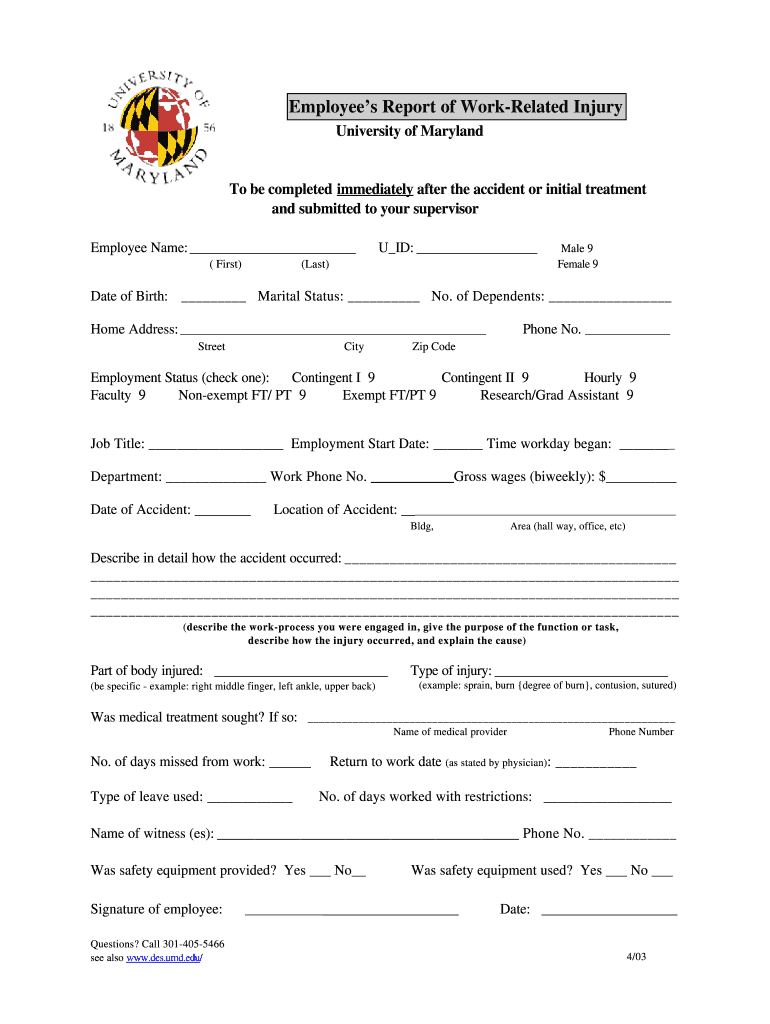

The Employee's Report of Work Related Injury, commonly referred to as the Des Umd, is a critical document used by employees to formally report any injuries sustained while on the job. This report serves as an official record that outlines the circumstances surrounding the injury, including the time, location, and nature of the incident. It is essential for initiating the workers' compensation process and ensuring that employees receive the necessary medical care and benefits.

How to Use the Employee's Report of Work Related Injury Des Umd

Using the Employee's Report of Work Related Injury Des Umd involves several straightforward steps. First, the employee must accurately fill out the form, providing detailed information about the injury and the events leading up to it. This includes the date and time of the incident, a description of what happened, and any witnesses present. Once completed, the report should be submitted to the appropriate personnel within the organization, typically a supervisor or human resources representative, to ensure timely processing of the claim.

Steps to Complete the Employee's Report of Work Related Injury Des Umd

Completing the Employee's Report of Work Related Injury Des Umd requires careful attention to detail. Follow these steps for accuracy:

- Begin by entering your personal information, including your name, job title, and department.

- Provide the date, time, and location of the incident.

- Describe the nature of the injury and how it occurred, including any equipment or materials involved.

- List any witnesses who can corroborate your account of the incident.

- Sign and date the form to verify that the information provided is accurate.

Key Elements of the Employee's Report of Work Related Injury Des Umd

Several key elements must be included in the Employee's Report of Work Related Injury Des Umd to ensure its validity. These include:

- Employee Information: Full name, job title, and contact details.

- Incident Details: Date, time, and specific location of the injury.

- Description of Injury: A detailed account of the injury, including symptoms and immediate actions taken.

- Witness Information: Names and contact information of any witnesses to the incident.

- Signature: The employee's signature confirming the accuracy of the report.

Legal Use of the Employee's Report of Work Related Injury Des Umd

The Employee's Report of Work Related Injury Des Umd holds significant legal weight. It serves as evidence in workers' compensation claims and can be used in legal proceedings if disputes arise regarding the injury. To ensure legal compliance, it is crucial that the report is filled out accurately and submitted promptly. Adhering to state-specific regulations regarding the reporting of workplace injuries is also essential to maintain the validity of the report.

Quick guide on how to complete employees report of work related injury des umd

Complete Employee's Report Of Work Related Injury Des Umd with ease on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow equips you with everything you need to create, edit, and electronically sign your documents promptly without delays. Manage Employee's Report Of Work Related Injury Des Umd on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and electronically sign Employee's Report Of Work Related Injury Des Umd effortlessly

- Find Employee's Report Of Work Related Injury Des Umd and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Employee's Report Of Work Related Injury Des Umd while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Can I be fired from my work (In British Columbia Canada) for the amount of work safe bc first aid reports I have filled out due to on the job injuries?

There's a couple of ways to look at it.If the injuries are a result of you not following established safety procedures then I, as an employer, would be very much inclined to dismiss such a person.Similarly, an employee who is repeatedly injured due to an Inability to focus on the task at hand is a tremendous liability to the employer and should either be directed to seek counseling or dismissed.On the other hand, there could be a fault within management and the safety program (or lack of). Proper training for a new employee is required and a new hire, especially a “green”, youthful person needs to be mentored and supervised initially.Even seasoned employees can be injured for various reasons. Work completion deadlines are a prime suspect. It causes shortcuts to be taken by an employee who feels pressured to “perform “ and both sides lose the needed safety attitude.I don't think there is a one size fits all answer. This is a question for the labour relations/employment standards branch.

-

What form do I fill out, a W9 or a W8-BEN? I am a US citizen living in Canada as a permanent resident. I am a freelancer (not an employee on a payroll) working for someone in the US, but I will be reporting my earnings to Canada Revenue, not the IRS.

You fill out a W-9. As a US citizen, you are taxed on your worldwide income. It doesn't matter if you don't even set foot in the US.You will however receive a foreign tax credit on your US return equal to the tax paid in Canada or the US tax on the same income, whichever is lower.You also must file an FBAR each year with the US Treasury if you have non-US financial accounts totalling $10K or more. This is measured by finding the highest balance at any time of year for each account and adding up those numbers. Failure to file carries signNow penalties.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

What if a cross-functional team working in a form of matrix structure is not working out for a project (services, PR, content creation, etc.) due to confusion from employees as they report to 2 managers? What kind of structure would you recommend?

You have two choices:Accept the disfunction and keep your head down below the RADAR. Hope the problem is corrected and resolved before the teams are disbanded and the project scrapped. In smaller companies, failure would probably result in loss of jobs; in larger companies, failure is usually a part of the process and people are simply reassigned with the “troublemakers” used as an object lesson for those remaining, that those who complain or ‘think they could have done it better’ get let go after some period of time with the explanation “that they didn’t fit in,” which, according to the culture, they didn’t.Begin greasing up your resume.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

-

Have you been able to form a relationship with any of your DNA relatives? If so, how did that work out for you?

We three surviving Stanleys learned in 2015 that we had a relative in Texas we had known nothing about until she and we discovered through DNA tests that we were cousins. She had been an illegitimate daughter of our black sheep uncle and had grown up in her adoptive family with no knowledge of her antecedents. For about a year we all wrote to each other, figured out who her birth mother had probably been, and learned about each other’s lives. Finally, we Stanleys got together from our scattered homes at my sister’s place in San Jose, and Cousin Karen flew up from Texas to meet us.She turn out to be a delightful person, as we had expected from her letters. She told us how she was practicing on the plane not saying “you all” or “I’m fixing to.” We enjoyed each other’s company for a couple of days before she had to fly home again.And then we returned to our widely divergent lives. We’re still occasionally in touch, but discovering each other was a passing incident for us, though one that left affectionate memories. We’re all glad the meetup occurred, but our most meaningful relationships remain those we formed in our long, separate lives.

Create this form in 5 minutes!

How to create an eSignature for the employees report of work related injury des umd

How to create an electronic signature for your Employees Report Of Work Related Injury Des Umd online

How to make an eSignature for your Employees Report Of Work Related Injury Des Umd in Chrome

How to create an eSignature for signing the Employees Report Of Work Related Injury Des Umd in Gmail

How to make an eSignature for the Employees Report Of Work Related Injury Des Umd from your mobile device

How to make an electronic signature for the Employees Report Of Work Related Injury Des Umd on iOS

How to generate an eSignature for the Employees Report Of Work Related Injury Des Umd on Android

People also ask

-

What is airSlate SignNow and how does it relate to des umd?

airSlate SignNow is a user-friendly platform that enables businesses to send and eSign documents efficiently. It features des umd capabilities that simplify the signing process and improve workflow, making it an ideal solution for organizations of all sizes.

-

What are the pricing options for airSlate SignNow's des umd services?

airSlate SignNow offers several pricing plans to cater to various business needs, including options specifically designed for organizations that require detailed des umd functionalities. Users can choose from monthly or annual subscriptions, with the ability to scale as their business grows.

-

What are the key features of airSlate SignNow's des umd service?

The key features of airSlate SignNow's service include customizable templates, secure document storage, and advanced eSignature options. These features ensure that businesses can effectively manage their signing processes while leveraging des umd capabilities.

-

How can airSlate SignNow help improve my business processes related to des umd?

By utilizing airSlate SignNow, businesses can streamline their document workflows and reduce turnaround times signNowly related to des umd. This efficiency allows for more timely decision-making and better overall productivity.

-

Does airSlate SignNow integrate with other applications for des umd workflows?

Yes, airSlate SignNow offers a wide range of integrations with popular business applications to enhance des umd workflows. This includes CRM systems, project management tools, and cloud storage services, making it easier for users to manage their documents.

-

Is my data secure when using airSlate SignNow's des umd features?

Absolutely. airSlate SignNow prioritizes data security and compliance, ensuring that all documents processed through its des umd features are encrypted and stored securely. This makes it a reliable choice for businesses concerned about data protection.

-

Can I try airSlate SignNow before committing to des umd solutions?

Yes, airSlate SignNow offers a free trial for new users interested in exploring its des umd services. This allows prospective customers to evaluate the platform’s features and determine how it can benefit their document management processes.

Get more for Employee's Report Of Work Related Injury Des Umd

- Medpoint dispute form

- Fall risk questionnaire form

- Form 44 016

- Irs publication 950 for form

- International prostate symptom score 76856166 form

- Vmfh org content damvirginia mason franciscan health financial vmfh org form

- Hyaluronic acid drugs ccrd prior authorization form prior authorization form for hyaluronic acid drugs

- 8333575153 form

Find out other Employee's Report Of Work Related Injury Des Umd

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract