560 7 7 03 Corporations Rules and Regulations by Georgia Rules Sos State Ga Form

What is the 560 7 7 03 Corporations Rules and Regulations by Georgia Rules SOS State GA

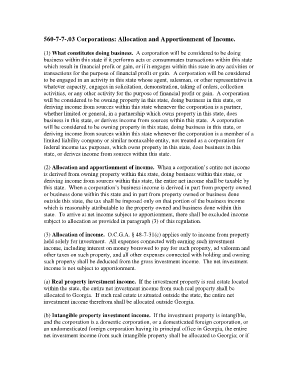

The 560 7 7 03 Corporations Rules and Regulations by Georgia Rules SOS State GA form is a crucial document for businesses operating within Georgia. This form outlines the specific regulations that corporations must adhere to in order to maintain compliance with state laws. It serves as a guideline for corporate governance, detailing the responsibilities and rights of corporate officers, shareholders, and directors. Understanding this form is essential for ensuring that a corporation operates within the legal framework established by the state of Georgia.

How to use the 560 7 7 03 Corporations Rules and Regulations by Georgia Rules SOS State GA

Utilizing the 560 7 7 03 Corporations Rules and Regulations form involves several steps. First, businesses must familiarize themselves with the specific rules outlined in the document. This includes understanding the requirements for corporate structure, reporting obligations, and compliance measures. Once the necessary information is gathered, the form can be filled out electronically, ensuring that all details are accurate and up to date. After completion, the form should be submitted to the appropriate state office for processing.

Steps to complete the 560 7 7 03 Corporations Rules and Regulations by Georgia Rules SOS State GA

Completing the 560 7 7 03 Corporations Rules and Regulations form requires careful attention to detail. Here are the steps to follow:

- Review the form thoroughly to understand the requirements.

- Gather all necessary documentation related to your corporation.

- Fill out the form accurately, ensuring that all information is correct.

- Provide any required signatures from authorized corporate representatives.

- Submit the completed form electronically or via mail, as per state guidelines.

Legal use of the 560 7 7 03 Corporations Rules and Regulations by Georgia Rules SOS State GA

The legal use of the 560 7 7 03 Corporations Rules and Regulations form is essential for ensuring compliance with Georgia state laws. This form must be completed and submitted according to the regulations set forth by the Georgia Secretary of State. Failure to adhere to these guidelines can result in penalties, including fines or suspension of corporate status. It is important for corporations to understand the legal implications of this form to avoid potential legal issues.

Key elements of the 560 7 7 03 Corporations Rules and Regulations by Georgia Rules SOS State GA

Several key elements are integral to the 560 7 7 03 Corporations Rules and Regulations form. These include:

- Corporate structure requirements, including the number of directors and officers.

- Reporting obligations for financial statements and corporate actions.

- Compliance measures that corporations must implement to adhere to state laws.

- Procedures for amending corporate bylaws and articles of incorporation.

State-specific rules for the 560 7 7 03 Corporations Rules and Regulations by Georgia Rules SOS State GA

Georgia has specific rules that govern the use of the 560 7 7 03 Corporations Rules and Regulations form. These rules may differ from those in other states, emphasizing the importance of understanding local regulations. Corporations must be aware of the unique requirements for filing, including deadlines and documentation needed for compliance. Staying informed about these state-specific rules is essential for maintaining good standing with the Georgia Secretary of State.

Quick guide on how to complete 560 7 7 03 corporations rules and regulations by georgia rules sos state ga

Accomplish 560 7 7 03 Corporations Rules And Regulations By Georgia Rules Sos State Ga effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle 560 7 7 03 Corporations Rules And Regulations By Georgia Rules Sos State Ga on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign 560 7 7 03 Corporations Rules And Regulations By Georgia Rules Sos State Ga seamlessly

- Locate 560 7 7 03 Corporations Rules And Regulations By Georgia Rules Sos State Ga and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign 560 7 7 03 Corporations Rules And Regulations By Georgia Rules Sos State Ga and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 560 7 7 03 corporations rules and regulations by georgia rules sos state ga

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 560 7 7 03 Corporations Rules and Regulations by Georgia?

The 560 7 7 03 Corporations Rules and Regulations by Georgia outline the legal framework for corporations operating within the state. Understanding these regulations is crucial for compliance and efficient business operations. airSlate SignNow can help streamline documentation processes that align with these regulations, making it easier to manage your corporate legal needs.

-

How can airSlate SignNow help me comply with Georgia's Corporations Rules?

airSlate SignNow provides a comprehensive solution to ensure that your signing and document processes comply with the 560 7 7 03 Corporations Rules and Regulations by Georgia. With features like legally binding eSignatures and document tracking, your business can stay compliant while enhancing efficiency.

-

What features does airSlate SignNow offer for managing corporate documents?

airSlate SignNow offers a variety of features tailored for businesses, including eSigning, document templates, and team collaboration tools. These features help you manage documents in accordance with the 560 7 7 03 Corporations Rules and Regulations by Georgia, ensuring that all paperwork is completed accurately.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By leveraging the platform, you can reduce costs associated with traditional document management and eSigning processes while ensuring compliance with the 560 7 7 03 Corporations Rules and Regulations by Georgia.

-

Can airSlate SignNow integrate with other business tools?

Absolutely! airSlate SignNow seamlessly integrates with various popular business tools, enhancing your workflow and ensuring that all your document processes align with the 560 7 7 03 Corporations Rules and Regulations by Georgia. Integration options include CRM systems, cloud storage, and productivity applications.

-

What are the benefits of using airSlate SignNow for corporate documentation?

Using airSlate SignNow for corporate documentation streamlines the signing process and enhances compliance with the 560 7 7 03 Corporations Rules and Regulations by Georgia. Benefits include increased efficiency, reduced turnaround times, and the ability to manage documents from anywhere.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security with encryption, secure access controls, and audit trails. These features are crucial for maintaining compliance with the 560 7 7 03 Corporations Rules and Regulations by Georgia, ensuring that your sensitive corporate documents remain protected.

Get more for 560 7 7 03 Corporations Rules And Regulations By Georgia Rules Sos State Ga

- Pro se form

- Wpf drpscu 010330 joinder jn washington form

- Wpf dr 010500 order of child support rs washington form

- Wpf dr 030100 motion and declaration for default mtdfl washington form

- Ordfl form

- Washington notice dissolution form

- Wa wpf form

- Wpf dr 040120 declaration in support of parenting plan dclr washington form

Find out other 560 7 7 03 Corporations Rules And Regulations By Georgia Rules Sos State Ga

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer