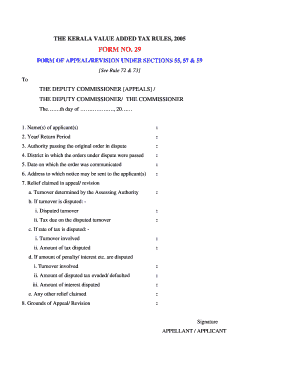

Keralataxes Form

What is the Keralataxes

The Keralataxes refer to a set of tax forms and regulations specific to the state of Kerala, India. However, in the context of U.S. taxpayers, it is essential to clarify that there is no direct equivalent. Instead, U.S. taxpayers must focus on federal and state tax forms relevant to their specific situations. Understanding the purpose of tax forms is crucial for compliance and accurate reporting of income and deductions.

How to use the Keralataxes

Using the Keralataxes involves understanding the specific requirements for your financial situation. U.S. taxpayers typically need to identify the correct forms based on their income sources, filing status, and any deductions or credits they may qualify for. It is advisable to consult with a tax professional or utilize reliable tax software to ensure that all necessary forms are completed accurately and submitted on time.

Steps to complete the Keralataxes

Completing the Keralataxes requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Identify the correct forms needed for your tax situation, such as the 1040 for individual income tax.

- Fill out the forms carefully, ensuring all information is accurate and complete.

- Review the completed forms for any errors or omissions.

- Submit the forms electronically or by mail, following the specific guidelines for your state and federal requirements.

Legal use of the Keralataxes

The legal use of tax forms, including the Keralataxes, is governed by federal and state tax laws. It is essential to ensure that all forms are filled out truthfully and submitted within the required deadlines. Misrepresentation or failure to comply with tax laws can result in penalties, fines, or legal action. Utilizing a trusted eSignature platform can help ensure that your forms are signed and submitted securely.

Filing Deadlines / Important Dates

Filing deadlines for tax forms are crucial for compliance. In the United States, the typical deadline for individual income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of deadlines for estimated tax payments and extensions. Keeping track of these dates helps avoid penalties and ensures timely submission of all necessary forms.

Required Documents

When preparing to complete the Keralataxes, it is important to gather all required documents. Commonly needed items include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Records of any tax credits

- Previous year’s tax return for reference

Penalties for Non-Compliance

Failing to comply with tax regulations can lead to significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal consequences. It is essential for taxpayers to understand their obligations and ensure timely and accurate submission of all forms. Utilizing tools for electronic filing can help mitigate the risk of errors and ensure compliance with deadlines.

Quick guide on how to complete keralataxes forms

Prepare keralataxes forms effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle keralataxes on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to modify and eSign keralataxes forms with ease

- Locate keralaxes and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive information with the features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign keralataxes and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to keralaxes

Create this form in 5 minutes!

How to create an eSignature for the keralataxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask keralaxes

-

What is airSlate SignNow and how does it relate to keralataxes?

airSlate SignNow is a powerful electronic signature solution that streamlines document signing and management. For businesses dealing with keralataxes, the platform provides a user-friendly interface to securely send, track, and sign tax-related documents, saving both time and resources.

-

How much does airSlate SignNow cost for handling keralataxes?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses dealing with keralataxes. Plans start at an affordable rate, ensuring that companies of all sizes can access essential features without breaking the bank.

-

What features does airSlate SignNow offer for managing keralataxes?

airSlate SignNow includes features such as customizable templates, audit trails, and mobile access, all ideal for handling keralataxes. These tools enhance efficiency, ensuring that businesses can easily manage tax documents while remaining compliant with regulations.

-

How does airSlate SignNow simplify the signing process for keralataxes?

With airSlate SignNow, the signing process for keralataxes is simplified through a step-by-step system that guides users. This means that both businesses and clients can eSign documents quickly, leading to faster transaction times and reduced paperwork.

-

Can airSlate SignNow integrate with other software for keralataxes?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, making it easier to manage keralataxes. Whether you use CRM systems, accounting software, or other cloud services, onboarding is straightforward and enhances workflow efficiency.

-

What security measures does airSlate SignNow implement for keralataxes?

Security is a top priority for airSlate SignNow, especially when handling sensitive keralataxes. The platform employs advanced encryption technologies and complies with industry standards to ensure that all documents remain secure throughout the signing process.

-

Is airSlate SignNow user-friendly for businesses involved in keralataxes?

Absolutely! airSlate SignNow is designed with user experience in mind, making it highly intuitive for businesses dealing with keralataxes. The straightforward setup process and easy navigation mean that even those unfamiliar with eSigning can quickly become proficient.

Get more for keralataxes

- This letter is to inform you that the cancellation of the subject deed of trust has been filed of

- County case no form

- Mortgage loan trust form

- City n a m e form

- Judgmentgarnishment form

- Company loan no form

- Of n a m e county no form

- Enclosed herewith please find a stamped quotfiledquot copy of the agreed order lifting the stay in form

Find out other keralataxes forms

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free