Living Trust California Form

What is the Living Trust California

A living trust in California is a legal document that allows an individual to place assets into a trust during their lifetime. This trust can be managed by the individual, known as the grantor, and can be altered or revoked at any time while they are alive. Upon the grantor's death, the assets in the trust are distributed to the designated beneficiaries without going through the probate process. This can simplify the transfer of assets and provide privacy, as the trust does not become a matter of public record.

How to use the Living Trust California

Using a living trust in California involves several steps. First, the grantor must identify the assets to be included in the trust, such as real estate, bank accounts, and investments. Next, the trust document must be created, detailing how the assets will be managed and distributed. After the trust is established, the grantor must transfer ownership of the identified assets into the trust. This ensures that the trust controls these assets upon the grantor's death. Regular updates may be necessary to reflect changes in assets or beneficiaries.

Steps to complete the Living Trust California

Completing a living trust in California typically involves the following steps:

- Determine the assets to be placed in the trust.

- Draft the trust document, specifying terms and beneficiaries.

- Sign the trust document in front of a notary public.

- Transfer ownership of assets to the trust, which may involve changing titles on properties and accounts.

- Store the trust document in a safe place and inform relevant parties of its existence.

Key elements of the Living Trust California

Several key elements define a living trust in California:

- Grantor: The individual creating the trust.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or organizations designated to receive the trust assets upon the grantor's death.

- Trust document: The legal document outlining the terms of the trust, including management and distribution of assets.

Legal use of the Living Trust California

The legal use of a living trust in California is governed by state laws, which allow for the creation and management of such trusts. A properly executed living trust can help avoid probate, provide for the management of assets in the event of incapacity, and ensure a smooth transfer of assets to beneficiaries. It is essential to follow California's legal requirements when drafting and executing the trust to ensure its validity and effectiveness.

Required Documents

To create a living trust in California, certain documents are typically required:

- A completed trust agreement outlining the terms of the trust.

- Proof of ownership for assets being transferred into the trust, such as deeds and account statements.

- Identification documents for the grantor, trustee, and beneficiaries.

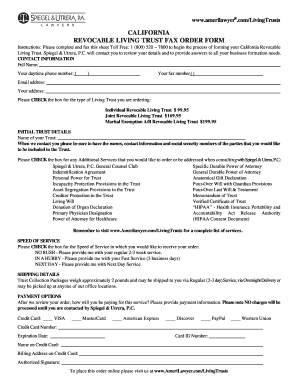

Quick guide on how to complete living trust california 26639116

Effortlessly Complete Living Trust California on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and efficiently. Manage Living Trust California on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and eSign Living Trust California with Ease

- Locate Living Trust California and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Living Trust California and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the living trust california 26639116

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a living trust in California?

A living trust in California is a legal document that allows you to place your assets into a trust during your lifetime. It helps manage your assets and provides a way to transfer them to beneficiaries without the need for probate. Creating a living trust can streamline the distribution of your estate and protect your privacy.

-

How much does it cost to create a living trust in California?

The cost of creating a living trust in California can vary widely based on the complexity of your estate and whether you choose to use legal services. Typically, you can expect to pay between $1,000 and $3,000 for a professionally drafted living trust. Utilizing airSlate SignNow can help you save money and time while ensuring your documents are legally binding.

-

What are the main benefits of having a living trust in California?

One of the main benefits of a living trust in California is that it allows for a smoother transfer of assets without going through probate, which can be time-consuming and costly. Additionally, a living trust ensures privacy, as the trust doesn't become a matter of public record. This arrangement also allows you to maintain control over your assets during your lifetime.

-

Can I change my living trust in California?

Yes, you can change your living trust in California at any time as long as you are alive and competent. This flexibility allows you to update beneficiaries and modify terms to reflect changes in your life circumstances. It's advisable to keep your trust updated to ensure your wishes are honored.

-

What assets can be included in a living trust in California?

A living trust in California can include various types of assets, such as real estate, bank accounts, stocks, and valuable personal belongings. However, certain assets like life insurance policies and retirement accounts typically need proper designation of beneficiaries outside the trust. Carefully planning which assets to place in your trust can maximize its benefits.

-

How does airSlate SignNow assist with living trust documents in California?

airSlate SignNow empowers you to create, edit, and eSign living trust documents with ease in California. Our user-friendly platform allows you to manage your legal documents efficiently, saving you time and reducing their complexity. By utilizing this service, you can ensure your living trust is legally compliant and easily accessible.

-

Is it necessary to have a lawyer for a living trust in California?

While it's not legally required to have a lawyer to create a living trust in California, consulting one can be beneficial, especially for complex estates. A qualified attorney can provide valuable guidance on legal requirements and tax implications. However, using solutions like airSlate SignNow can simplify the process and help you create a living trust without legal assistance.

Get more for Living Trust California

- Washington self proving affidavit form

- Form foc 115 motion regarding change of domicilelegal

- Instructions for minor children name change hearing dc 6 form

- Child and vulnerable adult abuse neglect and exploitation form

- Name change adult form

- Cover page template oct2017doc form

- Notice of appeal amp statement of facts las vegas justice court form

- Oklahoma self proving affidavit form

Find out other Living Trust California

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document