MILEAGE CLAIM FORM Hawaii

What is the Mileage Claim Form Hawaii

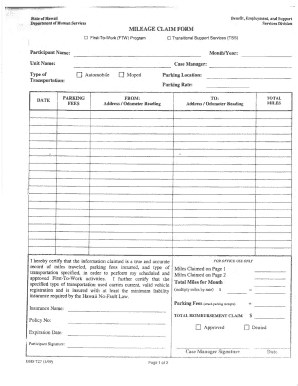

The Mileage Claim Form Hawaii is a document used by individuals and businesses to request reimbursement for miles driven for work-related purposes. This form is essential for employees who use their personal vehicles for business tasks, ensuring they are compensated for their travel expenses. It typically includes details such as the date of travel, purpose of the trip, starting and ending odometer readings, and the total miles driven. Understanding the purpose and structure of this form is crucial for accurate submission and reimbursement.

Steps to Complete the Mileage Claim Form Hawaii

Completing the Mileage Claim Form Hawaii involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary information, including your odometer readings and the purpose of each trip. Next, fill in your personal details, such as your name and contact information. Then, accurately record the dates of travel and the mileage for each trip. After completing the form, review it for any errors before submitting it to the appropriate department for reimbursement. Ensuring all details are correct helps prevent delays in processing your claim.

Legal Use of the Mileage Claim Form Hawaii

The Mileage Claim Form Hawaii is legally binding when filled out correctly and submitted according to state regulations. To ensure its validity, it must include accurate information regarding the mileage driven and the purpose of the trips. Compliance with federal and state eSignature laws is also essential, as electronic submissions must meet specific requirements to be considered legally enforceable. Utilizing a reliable digital platform for signing and submitting the form can enhance its legal standing.

Key Elements of the Mileage Claim Form Hawaii

Several key elements must be included in the Mileage Claim Form Hawaii to ensure it is complete and valid. These elements typically include:

- Personal Information: Name, address, and contact details of the claimant.

- Trip Details: Dates of travel, purpose of the trip, and starting and ending odometer readings.

- Total Mileage: Calculation of total miles driven for business purposes.

- Signature: The claimant's signature or eSignature to validate the claim.

Including all these elements helps facilitate a smooth reimbursement process.

Who Issues the Mileage Claim Form Hawaii

The Mileage Claim Form Hawaii is typically issued by employers or organizations that require employees to submit mileage for reimbursement. In some cases, state agencies may also provide this form for specific purposes related to government travel. It is essential to ensure that the correct version of the form is used, as different organizations may have their own templates or requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Mileage Claim Form Hawaii can vary depending on the employer or organization. Generally, it is advisable to submit the form as soon as possible after the travel has occurred to ensure timely reimbursement. Employers may set specific deadlines, such as monthly or quarterly submission dates, to streamline their accounting processes. Being aware of these deadlines helps avoid potential delays in receiving reimbursement.

Quick guide on how to complete mileage claim form hawaii

Effortlessly Prepare MILEAGE CLAIM FORM Hawaii on Any Device

The management of online documents has become increasingly popular among both enterprises and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage MILEAGE CLAIM FORM Hawaii on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to effortlessly modify and eSign MILEAGE CLAIM FORM Hawaii

- Obtain MILEAGE CLAIM FORM Hawaii and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors requiring fresh copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign MILEAGE CLAIM FORM Hawaii to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mileage claim form hawaii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a MILEAGE CLAIM FORM Hawaii?

A MILEAGE CLAIM FORM Hawaii is a document used by businesses and individuals in Hawaii to claim reimbursement for business-related travel expenses. This form allows users to accurately track and report their mileage, ensuring compliance with state regulations. Using airSlate SignNow, you can easily create and eSign this form for quick submission and processing.

-

How do I fill out the MILEAGE CLAIM FORM Hawaii using airSlate SignNow?

Filling out the MILEAGE CLAIM FORM Hawaii with airSlate SignNow is simple. Start by accessing the template, then input your travel details, including dates, destinations, and mileage. Once completed, you can eSign the form, making it easy to submit for reimbursement or record-keeping.

-

Is there a cost associated with the MILEAGE CLAIM FORM Hawaii?

While airSlate SignNow offers several pricing plans, the MILEAGE CLAIM FORM Hawaii itself does not have an additional cost. Depending on your subscription, you may have access to various features that can enhance your mileage tracking and reimbursement processes. Visit our pricing page for details on subscription options tailored to your needs.

-

What are the benefits of using the MILEAGE CLAIM FORM Hawaii?

Using the MILEAGE CLAIM FORM Hawaii streamlines reimbursement processes and simplifies record-keeping for travel expenses. airSlate SignNow allows for quick eSigning and submission, reducing paperwork and saving time. Additionally, it helps maintain accurate records for auditing purposes.

-

Can I integrate the MILEAGE CLAIM FORM Hawaii with other tools?

Yes, airSlate SignNow offers integrations with various business applications to enhance your workflow. You can integrate the MILEAGE CLAIM FORM Hawaii with tools such as Google Drive, Dropbox, and CRMs to streamline data management and improve efficiency. This flexibility makes it easier to manage your mileage claims alongside other documents.

-

Is the MILEAGE CLAIM FORM Hawaii compliant with state regulations?

Absolutely! The MILEAGE CLAIM FORM Hawaii is designed to comply with state regulations regarding mileage reimbursements. airSlate SignNow keeps your forms up-to-date, ensuring that you are using the latest version that meets all local compliance needs. This helps you avoid potential issues during audits.

-

Can I access the MILEAGE CLAIM FORM Hawaii on mobile devices?

Yes, airSlate SignNow is optimized for mobile use, allowing you to access, fill out, and eSign the MILEAGE CLAIM FORM Hawaii on your smartphone or tablet. This feature is particularly useful for users who need to submit mileage claims on-the-go. Stay productive and manage your mileage expenses from anywhere.

Get more for MILEAGE CLAIM FORM Hawaii

- Fs form 5178 revised may 2019

- Filing stateterritory form

- Fillable online company contact details cikm2018units form

- Notice to beneficiaryclaimant regarding the information

- Va form 26 4555c veteran servicemembers supplemental application for

- Va form 22 8864 training agreement for apprenticeship and other on the job training programs

- 2007 form va 21 8940 fill online printable fillable

- Housing assistance referral form 78446279

Find out other MILEAGE CLAIM FORM Hawaii

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement