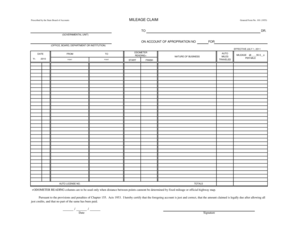

MILEAGE CLAIM General Form No 101 1955

What is the MILEAGE CLAIM General Form No

The MILEAGE CLAIM General Form No is a document used primarily for claiming reimbursement for business-related travel expenses. This form allows individuals, particularly employees and self-employed individuals, to report the miles driven for business purposes and request compensation from their employers or clients. It serves as an official record that can be used for tax deductions or reimbursement purposes, ensuring that all claimed mileage is documented accurately.

How to use the MILEAGE CLAIM General Form No

Using the MILEAGE CLAIM General Form No involves several straightforward steps. First, gather all necessary information regarding your travel, including dates, destinations, and the purpose of each trip. Next, accurately fill out the form, detailing the mileage for each trip and any associated expenses. After completing the form, review it for accuracy before submitting it to the appropriate party, whether that be an employer or a client. Utilizing digital tools can streamline this process, allowing for easy completion and submission.

Steps to complete the MILEAGE CLAIM General Form No

Completing the MILEAGE CLAIM General Form No requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all relevant travel details, including dates, locations, and reasons for travel.

- Calculate the total mileage driven for each trip.

- Fill in the form, ensuring all fields are completed accurately.

- Attach any necessary documentation, such as receipts or travel logs, to support your claim.

- Review the completed form for any errors or omissions.

- Submit the form to the designated recipient, either electronically or via mail.

Legal use of the MILEAGE CLAIM General Form No

The MILEAGE CLAIM General Form No is legally recognized as a valid document for claiming mileage reimbursement. To ensure its legal standing, it must be completed accurately and submitted in accordance with the relevant laws and regulations. This includes adhering to IRS guidelines for mileage deductions and maintaining proper records of all business-related travel. Using a reliable electronic signature solution can further enhance the legal validity of the submitted form.

Key elements of the MILEAGE CLAIM General Form No

Several key elements are essential to the MILEAGE CLAIM General Form No. These include:

- Personal Information: Name, address, and contact details of the claimant.

- Trip Details: Dates, destinations, and purposes of each trip.

- Mileage Calculation: Accurate recording of miles driven for business purposes.

- Expense Documentation: Any relevant receipts or logs that support the claim.

- Signature: A signature or electronic signature to validate the claim.

Form Submission Methods

The MILEAGE CLAIM General Form No can be submitted through various methods, ensuring flexibility for users. Common submission methods include:

- Online Submission: Many organizations allow for electronic submission through secure portals.

- Mail: The form can be printed and mailed to the appropriate department or individual.

- In-Person: Some users may prefer to submit the form directly to their employer or client.

Quick guide on how to complete mileage claim general form no 101 1955

Complete MILEAGE CLAIM General Form No 101 1955 effortlessly on any device

Online document management has become favored among enterprises and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage MILEAGE CLAIM General Form No 101 1955 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign MILEAGE CLAIM General Form No 101 1955 with ease

- Obtain MILEAGE CLAIM General Form No 101 1955 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive data with functionalities that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes necessitating the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Edit and electronically sign MILEAGE CLAIM General Form No 101 1955 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mileage claim general form no 101 1955

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MILEAGE CLAIM General Form No 101 1955?

The MILEAGE CLAIM General Form No 101 1955 is a standardized document used to claim mileage reimbursements for business-related travel. This form simplifies the reimbursement process, ensuring that all necessary details are captured accurately for efficient processing. Utilizing this form can help streamline your accounting processes.

-

How can airSlate SignNow facilitate the use of the MILEAGE CLAIM General Form No 101 1955?

airSlate SignNow allows users to easily create, send, and eSign the MILEAGE CLAIM General Form No 101 1955 through its intuitive platform. With features such as customizable templates and automatic reminders, it streamlines the entire process from submission to approval. This ensures timely reimbursements and improved efficiency within your organization.

-

Is there a cost associated with using airSlate SignNow for the MILEAGE CLAIM General Form No 101 1955?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when handling the MILEAGE CLAIM General Form No 101 1955. The cost varies based on features and the number of users. It’s recommended to evaluate which plan aligns best with your operational requirements.

-

Can I integrate airSlate SignNow with other applications for managing my MILEAGE CLAIM General Form No 101 1955?

Absolutely! airSlate SignNow provides integrations with several popular business applications, enabling you to manage the MILEAGE CLAIM General Form No 101 1955 seamlessly. This ensures smooth data flow and enhances overall productivity by connecting your document management tasks with your existing systems.

-

What are the benefits of using airSlate SignNow for the MILEAGE CLAIM General Form No 101 1955?

Using airSlate SignNow for the MILEAGE CLAIM General Form No 101 1955 offers signNow benefits, such as improved efficiency in document handling and faster approval times. The digital format reduces paperwork and enhances tracking, ensuring that submissions do not get lost. This ultimately leads to increased productivity and better financial management.

-

How secure is the data when using airSlate SignNow for my MILEAGE CLAIM General Form No 101 1955?

Data security is a top priority at airSlate SignNow. When using the platform for the MILEAGE CLAIM General Form No 101 1955, your documents are encrypted and stored securely. This ensures that sensitive information is protected from unauthorized access, giving you peace of mind with your document transactions.

-

Can I track the status of my MILEAGE CLAIM General Form No 101 1955 once sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your MILEAGE CLAIM General Form No 101 1955. You will receive notifications when the document is viewed, signed, and completed. This transparency helps in managing your claims efficiently without any uncertainties.

Get more for MILEAGE CLAIM General Form No 101 1955

Find out other MILEAGE CLAIM General Form No 101 1955

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile