Virginia Disclosure of Terms of Mortgage Application InterBank Form

What is the Virginia Disclosure Of Terms Of Mortgage Application InterBank

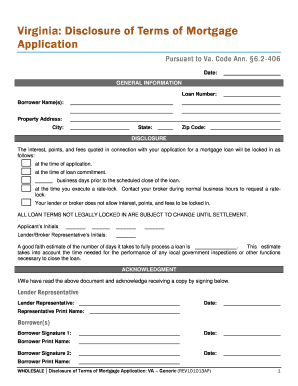

The Virginia Disclosure Of Terms Of Mortgage Application InterBank is a crucial document that outlines the terms and conditions associated with mortgage applications in Virginia. This form is designed to provide borrowers with clear and concise information regarding their mortgage options, including interest rates, fees, and repayment terms. Understanding this disclosure is essential for borrowers to make informed decisions about their mortgage agreements.

Key elements of the Virginia Disclosure Of Terms Of Mortgage Application InterBank

This disclosure includes several key elements that borrowers should pay attention to:

- Loan Amount: The total amount being borrowed, which affects monthly payments and overall interest.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Loan Term: The duration over which the loan will be repaid, typically ranging from fifteen to thirty years.

- Fees and Costs: Any additional costs associated with the mortgage, such as origination fees, closing costs, and private mortgage insurance.

- Repayment Terms: Details on how and when payments are to be made, including any penalties for late payments.

Steps to complete the Virginia Disclosure Of Terms Of Mortgage Application InterBank

Completing the Virginia Disclosure Of Terms Of Mortgage Application InterBank involves several important steps:

- Gather Necessary Information: Collect personal and financial information, including income, employment history, and credit details.

- Review Loan Options: Examine various mortgage options and their associated terms as outlined in the disclosure.

- Fill Out the Form: Accurately complete the disclosure form, ensuring all information is correct and up to date.

- Sign the Document: Provide your signature to confirm your understanding and acceptance of the terms.

- Submit the Form: Send the completed form to the lender, either electronically or via traditional mail.

Legal use of the Virginia Disclosure Of Terms Of Mortgage Application InterBank

The Virginia Disclosure Of Terms Of Mortgage Application InterBank is legally binding, provided it meets specific requirements. It must be signed by the borrower and comply with federal and state regulations governing mortgage disclosures. This legal framework ensures that borrowers are fully informed of their rights and obligations before entering into a mortgage agreement.

How to use the Virginia Disclosure Of Terms Of Mortgage Application InterBank

Using the Virginia Disclosure Of Terms Of Mortgage Application InterBank effectively involves understanding its contents and implications. Borrowers should carefully read each section to grasp the financial commitments they are making. It is advisable to consult with a financial advisor or mortgage professional if there are any uncertainties regarding the terms presented in the disclosure.

State-specific rules for the Virginia Disclosure Of Terms Of Mortgage Application InterBank

Virginia has specific regulations that govern the disclosure of mortgage terms. These rules require lenders to provide clear and comprehensive information to borrowers, ensuring transparency in the lending process. Compliance with these state-specific regulations is essential for both lenders and borrowers to maintain legal and ethical standards in mortgage transactions.

Quick guide on how to complete virginia disclosure of terms of mortgage application interbank

Effortlessly Prepare Virginia Disclosure Of Terms Of Mortgage Application InterBank on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Virginia Disclosure Of Terms Of Mortgage Application InterBank on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to Modify and Electronically Sign Virginia Disclosure Of Terms Of Mortgage Application InterBank with Ease

- Obtain Virginia Disclosure Of Terms Of Mortgage Application InterBank and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Virginia Disclosure Of Terms Of Mortgage Application InterBank to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia disclosure of terms of mortgage application interbank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia Disclosure Of Terms Of Mortgage Application InterBank?

The Virginia Disclosure Of Terms Of Mortgage Application InterBank outlines the key terms and conditions associated with mortgage applications in Virginia. This disclosure ensures that potential borrowers understand the essential elements of their mortgage agreements, including interest rates and repayment terms.

-

How does airSlate SignNow help with the Virginia Disclosure Of Terms Of Mortgage Application InterBank?

airSlate SignNow simplifies the process of obtaining signatures on the Virginia Disclosure Of Terms Of Mortgage Application InterBank. With our electronic signature platform, businesses can efficiently send documents for eSigning, reducing turnaround time and enhancing customer convenience.

-

What are the pricing options for using airSlate SignNow for the Virginia Disclosure Of Terms Of Mortgage Application InterBank?

airSlate SignNow offers competitive pricing plans tailored to various business needs, making it an affordable solution for managing the Virginia Disclosure Of Terms Of Mortgage Application InterBank. You can choose from monthly or annual subscriptions that provide unlimited access to our document signing features.

-

Can I integrate airSlate SignNow with other software for handling the Virginia Disclosure Of Terms Of Mortgage Application InterBank?

Yes, airSlate SignNow offers seamless integrations with a variety of popular software applications. This allows users to easily manage documents related to the Virginia Disclosure Of Terms Of Mortgage Application InterBank alongside their existing tools, streamlining workflows.

-

What are the benefits of using airSlate SignNow for the Virginia Disclosure Of Terms Of Mortgage Application InterBank?

By using airSlate SignNow for the Virginia Disclosure Of Terms Of Mortgage Application InterBank, businesses enjoy faster processing times and reduced paper usage. Our platform enhances efficiency, allowing clients to focus on closing loans rather than managing paperwork.

-

Is airSlate SignNow secure for documents related to the Virginia Disclosure Of Terms Of Mortgage Application InterBank?

Absolutely! airSlate SignNow prioritizes user security by employing advanced encryption and secure cloud storage for documents related to the Virginia Disclosure Of Terms Of Mortgage Application InterBank. We ensure that your sensitive information remains protected at all times.

-

How user-friendly is airSlate SignNow for managing the Virginia Disclosure Of Terms Of Mortgage Application InterBank?

airSlate SignNow is designed with a user-friendly interface that makes it easy for anyone to manage their Virginia Disclosure Of Terms Of Mortgage Application InterBank documents. Our intuitive platform allows users to navigate through the signing process effortlessly.

Get more for Virginia Disclosure Of Terms Of Mortgage Application InterBank

Find out other Virginia Disclosure Of Terms Of Mortgage Application InterBank

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document