SBA 504 LOAN AppLicAtiON CheckLiSt Rmiinc Form

Understanding the SBA Loan Application Checklist

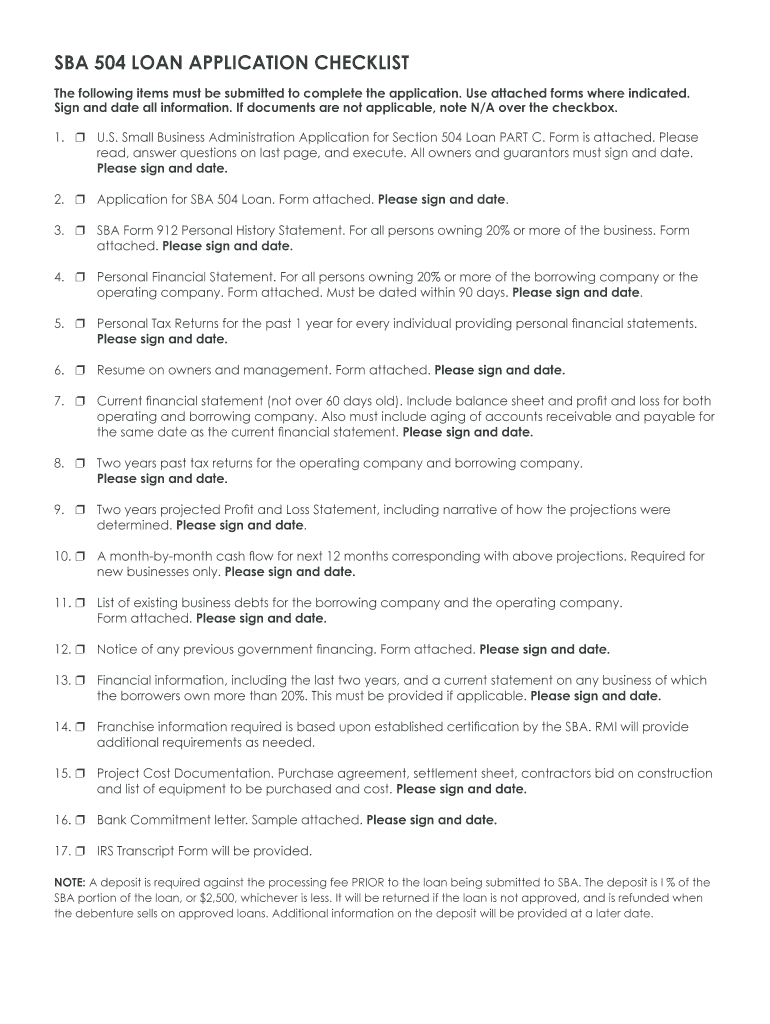

The SBA loan application checklist is a crucial tool for businesses seeking funding through the Small Business Administration. This checklist outlines the necessary documents and information required to complete the application process effectively. It typically includes financial statements, business plans, and personal information of the owners. By following this checklist, applicants can ensure they provide all required materials, which can significantly enhance their chances of approval.

Key Elements of the SBA Loan Application Checklist

Several key elements are essential to include in the SBA loan application checklist. These typically encompass:

- Business Plan: A comprehensive outline detailing the business model, market analysis, and financial projections.

- Financial Statements: Recent balance sheets, income statements, and cash flow statements that demonstrate the financial health of the business.

- Personal Financial Information: Personal tax returns and financial statements of the business owners.

- Legal Documents: Any necessary licenses, permits, or registrations required to operate the business legally.

Steps to Complete the SBA Loan Application Checklist

Completing the SBA loan application checklist involves several steps to ensure all necessary information is gathered and organized. Here are the recommended steps:

- Gather all required documents as outlined in the checklist.

- Ensure that all financial statements are current and accurately reflect the business's financial status.

- Draft a detailed business plan that aligns with the expectations of the SBA.

- Review the checklist thoroughly to confirm that no essential documents are missing.

- Submit the completed application along with the checklist to the appropriate SBA office or lender.

Legal Use of the SBA Loan Application Checklist

The legal use of the SBA loan application checklist is vital for ensuring compliance with federal regulations. The checklist serves as a guideline to help applicants meet the necessary legal requirements for obtaining an SBA loan. It is important to understand that the information provided must be accurate and truthful, as any discrepancies could lead to penalties or denial of the application.

Required Documents for the SBA Loan Application

When preparing the SBA loan application checklist, it is essential to include specific required documents. These documents typically consist of:

- Personal and business tax returns for the last three years.

- Profit and loss statements and balance sheets for the previous two years.

- Business licenses and registrations.

- Resumes of the business owners and key management personnel.

- Collateral documentation, if applicable.

Application Process and Approval Time

The application process for an SBA loan can vary depending on the lender and the complexity of the application. Generally, the process involves submitting the completed checklist and required documents, followed by a review period by the lender. Approval times can range from a few weeks to several months, depending on the thoroughness of the application and the lender's workload. It is advisable to remain in contact with the lender during this period for updates and any additional information that may be required.

Quick guide on how to complete loan application checklist

Complete loan application checklist effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without delays. Manage sba loan application checklist on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign sba loan checklist with ease

- Locate sba loan document checklist and click Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from your device of choice. Alter and eSign sba 504 loan checklist and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs loan application document checklist

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

-

Is there a way for you to outsource sensitive tasks securely? For instance, calling the bank, or filling out a loan application form that includes your social security number?

You might benefit from compartmentalizing your sensitive information. Realtors often use custom-purpose sticky notes to help people navigate paperwork, like a little yellow arrow that says “signNow” or a blue flag that says “review these options.” Perhaps your assistant could fill out the entire form for you, except where your SSN needs to be provided, and call those lines out to you with a little sticky arrow.When calling the bank, you may have to initiate the call and then allow your assistant to take over. That way, you’d provide the sensitive data to the bank and satisfy their identity verification, then you’d authorize your assistant to speak on your behalf about the account, and let them take it from there.If you have any tasks that require sensitive data to actually conduct the business - say, moving funds between several bank accounts, which would require constant access to account numbers and other info - then you’ll have to give that task to someone you trust with that info. If you’re the only one you trust, you’re the only one who can do the task.

Related searches to sba checklist

Create this form in 5 minutes!

How to create an eSignature for the sba 504 loan application

How to generate an electronic signature for the Sba 504 Loan Application Checklist Rmiinc online

How to make an electronic signature for the Sba 504 Loan Application Checklist Rmiinc in Google Chrome

How to make an eSignature for signing the Sba 504 Loan Application Checklist Rmiinc in Gmail

How to create an electronic signature for the Sba 504 Loan Application Checklist Rmiinc right from your mobile device

How to make an electronic signature for the Sba 504 Loan Application Checklist Rmiinc on iOS

How to create an electronic signature for the Sba 504 Loan Application Checklist Rmiinc on Android devices

People also ask rmiinc

-

What is an SBA loan application checklist?

An SBA loan application checklist is a comprehensive guide that outlines all necessary documentation and requirements needed to apply for an SBA loan. This checklist helps streamline the application process and ensures that you prepare all critical elements before submission.

-

How can airSlate SignNow help with my SBA loan application checklist?

airSlate SignNow simplifies the process of managing your SBA loan application checklist by providing an easy-to-use platform for eSigning and sending documents. You can upload all your checklist items, collaborate with your team, and securely store your documents, making your application process more efficient.

-

What are the key features of airSlate SignNow relevant to an SBA loan application checklist?

Key features of airSlate SignNow that benefit users with an SBA loan application checklist include customizable templates, secure eSignature options, and real-time document tracking. These features ensure that you can easily access your checklist items, obtain signatures quickly, and monitor the status of your documents.

-

Is there a cost associated with using airSlate SignNow for an SBA loan application checklist?

Yes, airSlate SignNow offers affordable pricing plans that cater to different business needs. This cost-effective solution allows you to manage your SBA loan application checklist without breaking the bank, ensuring you get great value for your investment.

-

How secure is my information when using airSlate SignNow for an SBA loan application checklist?

Security is a top priority with airSlate SignNow, and we employ advanced encryption protocols to protect your information while managing your SBA loan application checklist. Our platform is compliant with industry standards, ensuring that your documents and personal data remain confidential and secure.

-

Can I integrate airSlate SignNow with other software for my SBA loan application checklist?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications to enhance your workflow while managing your SBA loan application checklist. This flexibility allows you to connect with tools you already use, such as CRMs and cloud storage services.

-

What benefits does airSlate SignNow offer for managing an SBA loan application checklist?

Using airSlate SignNow for your SBA loan application checklist brings numerous benefits, including time savings through faster eSignatures, reduced paperwork, and better organization of your documents. By centralizing your checklist on our platform, you'll enhance collaboration and ensure all necessary steps are completed efficiently.

Get more for 504 loan application

- Printable human resource forms

- Testnav geometry answers form

- Az backflow certification form

- Sts20021 fillable form

- Wichita thunder donation request form

- Advanced dealer training institute form

- Northside hospital employee handbook form

- Day care home menu healthy infant meal pattern revised 1doc delawareopportunities form

Find out other sba loan application checklist

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online