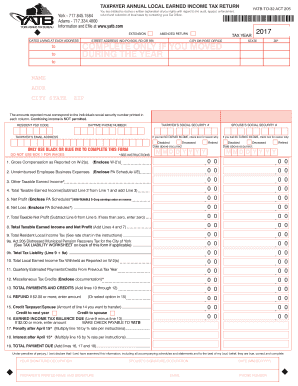

YATB to 32 ACT 205 Form

What is the YATB TO 32 ACT 205

The YATB TO 32 ACT 205 is a specific form utilized in various legal and administrative processes within the United States. It serves purposes that may include tax reporting, compliance verification, or other regulatory needs. Understanding the context and implications of this form is crucial for individuals and businesses to ensure they meet all necessary legal requirements.

How to use the YATB TO 32 ACT 205

Using the YATB TO 32 ACT 205 involves several steps to ensure proper completion and submission. First, gather all necessary information and documentation related to the form's requirements. Next, fill out the form accurately, ensuring that all fields are completed as per the guidelines. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on the specific instructions provided for the form.

Steps to complete the YATB TO 32 ACT 205

Completing the YATB TO 32 ACT 205 requires careful attention to detail. Here are the essential steps:

- Review the form's instructions thoroughly to understand the requirements.

- Collect all relevant documents and information needed to fill out the form.

- Complete the form, ensuring accuracy in all entries.

- Double-check for any errors or omissions before submission.

- Submit the form via the specified method, keeping a copy for your records.

Legal use of the YATB TO 32 ACT 205

The legal use of the YATB TO 32 ACT 205 is governed by specific regulations that ensure its validity. To be legally binding, the form must be completed in accordance with applicable laws and regulations. This includes proper signatures, dates, and any required supporting documentation. Compliance with these legal standards is essential to avoid potential disputes or penalties.

Key elements of the YATB TO 32 ACT 205

Several key elements define the YATB TO 32 ACT 205. These include:

- Identification of the parties involved in the transaction.

- Clear description of the purpose of the form.

- Accurate and complete information as required by the form.

- Signatures of all relevant parties, confirming agreement and understanding.

Who Issues the Form

The YATB TO 32 ACT 205 is issued by relevant governmental or regulatory bodies, depending on its specific use case. Typically, these forms are provided by state or federal agencies that oversee compliance and regulatory processes. Understanding the issuing authority can help individuals and businesses navigate the requirements associated with the form.

Quick guide on how to complete yatb to 32 act 205

Complete YATB TO 32 ACT 205 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any hold-ups. Handle YATB TO 32 ACT 205 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign YATB TO 32 ACT 205 without any hassle

- Locate YATB TO 32 ACT 205 and click on Get Form to initiate.

- Utilize the functionalities we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign YATB TO 32 ACT 205 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the yatb to 32 act 205

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is yatb met and how does it relate to airSlate SignNow?

Yatb met is a term associated with the seamless integration of eSigning solutions like airSlate SignNow. It represents the ease of use and efficiency gained when utilizing eSignature solutions to enhance business operations.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the chosen plan and the features selected. Yatb met ensures that you receive cost-effective solutions tailored to your business needs, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer?

airSlate SignNow boasts a range of features including document tracking, templates, and automated workflows. These features, aligned with the concept of yatb met, facilitate a streamlined signing process for users.

-

How can airSlate SignNow benefit my business?

By adopting airSlate SignNow, businesses can signNowly reduce the time spent on document management. The yatb met approach enhances productivity and ensures a smooth transition from traditional paper-based processes to digital signatures.

-

What types of documents can I sign using airSlate SignNow?

You can sign a wide variety of documents with airSlate SignNow, including contracts, agreements, and forms. The flexibility offered in handling different document types aligns with the yatb met philosophy of adaptability and ease.

-

Is airSlate SignNow compliant with eSignature laws?

Yes, airSlate SignNow complies with all major eSignature laws, including ESIGN and UETA in the United States. This compliance ensures that your signed documents are legally binding, consistent with the principles of yatb met.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integrations with various popular applications and platforms. This capability ensures that the yatb met solution you choose can fit seamlessly into your existing business workflow.

Get more for YATB TO 32 ACT 205

Find out other YATB TO 32 ACT 205

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe