Round Amount to Nearest Dollar Revenue Wi Form

What is the Round Amount To Nearest Dollar Revenue Wi

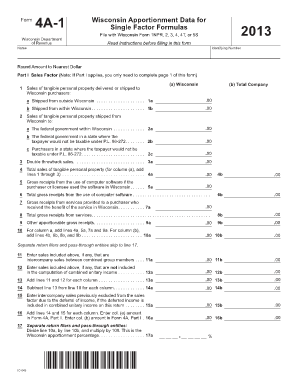

The Round Amount To Nearest Dollar Revenue Wi form is a financial document used primarily in the state of Wisconsin. This form is essential for businesses and individuals who need to report revenue figures accurately. By rounding amounts to the nearest dollar, it simplifies accounting and reporting processes. This practice helps to maintain consistency in financial records and ensures compliance with state regulations.

How to use the Round Amount To Nearest Dollar Revenue Wi

Using the Round Amount To Nearest Dollar Revenue Wi form involves several straightforward steps. First, gather all relevant financial data, including total revenue figures. Next, round each amount to the nearest dollar, ensuring accuracy in your calculations. Finally, input these rounded figures into the designated sections of the form. It's important to double-check your entries for any discrepancies before submission.

Steps to complete the Round Amount To Nearest Dollar Revenue Wi

Completing the Round Amount To Nearest Dollar Revenue Wi form can be done in a few easy steps:

- Collect all necessary financial documents that detail your revenue.

- Round each revenue figure to the nearest dollar. For example, if your revenue is $1,234.56, round it to $1,235.

- Fill in the form with the rounded amounts, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before finalizing it.

Legal use of the Round Amount To Nearest Dollar Revenue Wi

The legal use of the Round Amount To Nearest Dollar Revenue Wi form is governed by Wisconsin state laws. It is crucial for businesses to adhere to these regulations to avoid penalties. The form serves as an official record of reported revenue, which may be subject to audits. Therefore, ensuring that the form is filled out correctly and submitted on time is essential for compliance.

Examples of using the Round Amount To Nearest Dollar Revenue Wi

Examples of using the Round Amount To Nearest Dollar Revenue Wi form include various business scenarios. For instance, a small business owner may need to report their annual revenue for tax purposes. By rounding their total revenue from $45,678.90 to $45,679, they ensure that their reporting aligns with state guidelines. Similarly, freelancers can use this form to report income from multiple clients, simplifying their financial documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Round Amount To Nearest Dollar Revenue Wi form are typically aligned with state tax deadlines. Businesses and individuals should be aware of these dates to ensure timely submission. It is advisable to check the Wisconsin Department of Revenue website for specific deadlines, as they may vary depending on the type of entity and the fiscal year.

Quick guide on how to complete round amount to nearest dollar revenue wi

Complete Round Amount To Nearest Dollar Revenue Wi effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Round Amount To Nearest Dollar Revenue Wi on any platform using airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to modify and electronically sign Round Amount To Nearest Dollar Revenue Wi with ease

- Find Round Amount To Nearest Dollar Revenue Wi and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal standing as a traditional wet ink signature.

- Review all the information, then click the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Round Amount To Nearest Dollar Revenue Wi to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the round amount to nearest dollar revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to round amounts to the nearest dollar in revenue calculations?

Rounding amounts to the nearest dollar in revenue calculations helps to simplify financial statements and reporting. This practice can enhance clarity for stakeholders by providing a more straightforward view of revenue figures, particularly important in revenue-influenced decisions, including those involving airSlate SignNow.

-

How does airSlate SignNow assist in managing revenue data efficiently?

airSlate SignNow offers tools that allow businesses to streamline document management and tracking of revenue data. By ensuring that all financial documentation is signed and stored securely, companies can round amounts to the nearest dollar in revenue calculations more accurately and maintain compliance.

-

What features of airSlate SignNow can help with rounding amounts to the nearest dollar?

airSlate SignNow provides customizable templates and automated workflows that make it easy to manage financial documents. These features can help you focus on revenue calculations, including rounding amounts to the nearest dollar, ensuring your financial processes are efficient and precise.

-

Is airSlate SignNow cost-effective for small businesses looking to manage revenue?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. With scalable pricing plans, companies can effectively manage their documents and revenue calculations, such as rounding amounts to the nearest dollar, without overspending.

-

Can airSlate SignNow integrate with other financial tools for better revenue management?

Absolutely! airSlate SignNow seamlessly integrates with various financial and accounting software, allowing for efficient revenue management. These integrations enable businesses to streamline processes, including rounding amounts to the nearest dollar in their revenue calculations.

-

What are the benefits of using airSlate SignNow for revenue documentation?

Using airSlate SignNow for revenue documentation enhances accuracy, security, and efficiency. The platform ensures that all signed documents are easily accessible, facilitating the rounding of amounts to the nearest dollar in revenue calculations, leading to clearer financial insights.

-

How can I ensure compliance while rounding amounts to the nearest dollar in revenue reports?

With airSlate SignNow, compliance is integral to document management. The platform allows businesses to create audit trails and maintain records that help in rounding amounts to the nearest dollar for revenue reports, ensuring adherence to financial regulations.

Get more for Round Amount To Nearest Dollar Revenue Wi

- 1 power attorney form

- Indiana department of revenue power of attorney tax form

- Pub ks 1510 sales tax and compensating use tax booklet rev 12 20 this publication has been prepared by the kansas department of form

- Business axes for hotels and r kansas department of revenue form

- Pub ks 1216 business tax application rev 8 19 pdf4pro form

- Table of contents kansas department of revenue ksrevenue form

- Kansas division of vehicles medical form dv124m

- Medical forms to

Find out other Round Amount To Nearest Dollar Revenue Wi

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself