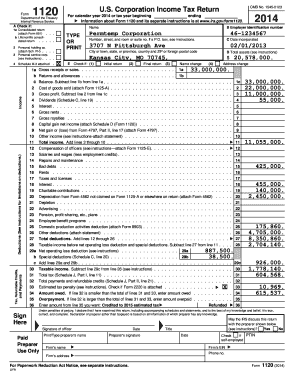

Form 1120 U S Corporation Income Tax Return

What is the Form 1120 U S Corporation Income Tax Return

The Form 1120 U S Corporation Income Tax Return is a federal tax form used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners. It provides the IRS with a comprehensive overview of a corporation's financial activities for the tax year, helping to determine the amount of tax owed. Completing this form accurately is crucial for compliance with federal tax regulations.

Steps to complete the Form 1120 U S Corporation Income Tax Return

Completing the Form 1120 involves several key steps:

- Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and records of expenses.

- Fill Out Basic Information: Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report Income: Detail all sources of income, including sales revenue, dividends, and interest.

- Calculate Deductions: List all allowable deductions, such as operating expenses, salaries, and benefits.

- Determine Tax Liability: Use the information provided to calculate the corporation's tax liability based on applicable tax rates.

- Sign and Date: Ensure that the form is signed by an authorized officer of the corporation and dated appropriately.

How to obtain the Form 1120 U S Corporation Income Tax Return

The Form 1120 can be obtained directly from the IRS website or by contacting the IRS for a physical copy. Many accounting software programs also include the form, allowing for easier completion and filing. It is advisable to use the most current version of the form to ensure compliance with the latest tax regulations.

Filing Deadlines / Important Dates

The deadline for filing the Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may apply for a six-month extension, but this does not extend the time to pay any taxes owed.

Legal use of the Form 1120 U S Corporation Income Tax Return

The Form 1120 is legally binding when completed and submitted according to IRS regulations. It serves as an official record of a corporation's financial performance and tax obligations. Accurate reporting is essential to avoid penalties and ensure compliance with federal tax laws. The form must be filed annually, and any discrepancies may lead to audits or legal consequences.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 can be submitted in several ways:

- Online Filing: Corporations can file electronically using IRS-approved e-file software, which often simplifies the process and reduces errors.

- Mail Submission: The completed form can be printed and mailed to the appropriate IRS address, based on the corporation's location and whether a payment is included.

- In-Person Filing: Corporations may also choose to file in person at designated IRS offices, although this is less common.

Quick guide on how to complete form 1120 u s corporation income tax return

Complete Form 1120 U S Corporation Income Tax Return seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Form 1120 U S Corporation Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Form 1120 U S Corporation Income Tax Return effortlessly

- Locate Form 1120 U S Corporation Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 1120 U S Corporation Income Tax Return while ensuring effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 u s corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1120 U S Corporation Income Tax Return used for?

The Form 1120 U S Corporation Income Tax Return is used by C corporations to report their income, gains, losses, deductions, and credits. It is essential for corporations to file this form with the IRS annually to determine their tax liability. Proper completion ensures compliance with federal tax laws and helps avoid penalties.

-

How can airSlate SignNow help with Form 1120 U S Corporation Income Tax Return?

airSlate SignNow simplifies the process of signing and submitting your Form 1120 U S Corporation Income Tax Return by providing an intuitive platform for electronic signatures. Our secure and user-friendly solution ensures that your tax filings are quickly prepared and sent, improving your workflow and avoiding delays in submission.

-

What are the pricing options for using airSlate SignNow for Form 1120 U S Corporation Income Tax Return?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses, making it both cost-effective and flexible. Pricing varies based on the features and number of users required, allowing you to select a plan that best fits your requirement for managing documents like the Form 1120 U S Corporation Income Tax Return.

-

Is airSlate SignNowcompliant with IRS regulations for Form 1120 U S Corporation Income Tax Return?

Yes, airSlate SignNow ensures full compliance with IRS regulations, making it a reliable solution for submitting your Form 1120 U S Corporation Income Tax Return. Our platform employs security measures that align with industry standards, safeguarding your sensitive tax information.

-

What features does airSlate SignNow offer to assist with Form 1120 U S Corporation Income Tax Return filings?

airSlate SignNow offers several features such as electronic signatures, document templates, and secure cloud storage to streamline your Form 1120 U S Corporation Income Tax Return process. These tools facilitate efficient collaboration and tracking of document status, enhancing the overall experience of tax preparation.

-

Can I integrate airSlate SignNow with other applications for managing Form 1120 U S Corporation Income Tax Return?

Absolutely! airSlate SignNow can seamlessly integrate with various applications including accounting software and productivity tools. This connectivity allows you to manage your Form 1120 U S Corporation Income Tax Return and related documents more efficiently across different platforms.

-

What are the benefits of using airSlate SignNow for Form 1120 U S Corporation Income Tax Return over traditional methods?

Using airSlate SignNow for your Form 1120 U S Corporation Income Tax Return offers numerous benefits compared to traditional methods, including faster processing times, reduced paper usage, and enhanced security. Our solution is designed to simplify the filing process, allowing easy access to documents anytime and from anywhere.

Get more for Form 1120 U S Corporation Income Tax Return

- Free virginia lease agreement with option to purchase form

- Printable sample roommate agreement form pinterest

- Hawaii agreement to subleasesublet templates free download form

- Free virginia roommate agreement room rental form pdf

- Free alabama lease to own option to purchase agreement form

- Free florida rental application form pdf eforms free

- Real estate transactions for corporate counsel association form

- Free kansas power of attorney formspdf templates

Find out other Form 1120 U S Corporation Income Tax Return

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online