Form 3885a

What is the Form 3885a

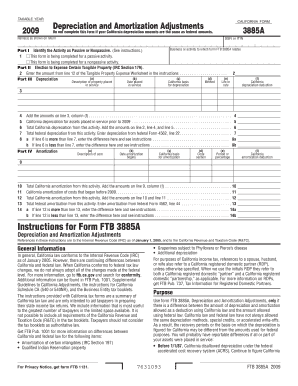

The Form 3885a, also known as the California Depreciation and Amortization Form, is a tax form used by individuals and businesses in California to report depreciation and amortization deductions. This form is crucial for taxpayers who wish to claim deductions on their tax returns related to the depreciation of assets. It helps to calculate the allowable depreciation for various types of property, ensuring that taxpayers can accurately reflect their financial situation on their tax returns.

How to use the Form 3885a

Using the Form 3885a involves several steps that ensure accurate reporting of depreciation and amortization. Taxpayers should first gather all relevant information regarding their assets, including purchase dates, costs, and useful lives. Once the necessary data is collected, the form can be filled out by entering the details of each asset, calculating the depreciation or amortization for the year, and then transferring these amounts to the appropriate sections of the California tax return. It is essential to follow the specific instructions provided for the form to avoid errors.

Steps to complete the Form 3885a

Completing the Form 3885a involves a systematic approach:

- Gather necessary documentation, including asset purchase receipts and prior depreciation schedules.

- Identify the assets to be depreciated and their respective categories, such as real estate or machinery.

- Calculate the depreciation or amortization for each asset using the appropriate method, such as straight-line or declining balance.

- Fill out the form by entering the calculated amounts in the designated fields.

- Review the completed form for accuracy before submitting it with your California tax return.

Legal use of the Form 3885a

The legal use of the Form 3885a is governed by California tax laws, which require accurate reporting of depreciation and amortization. To ensure compliance, taxpayers must adhere to the guidelines set forth by the California Franchise Tax Board. This includes using the correct forms for the tax year, maintaining proper documentation, and following the prescribed methods for calculating depreciation. Failure to comply with these regulations may result in penalties or disallowed deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3885a align with the general tax filing deadlines in California. Typically, individual taxpayers must submit their forms by April fifteenth of each year, while businesses may have different deadlines depending on their entity type. It is crucial to stay informed about any changes to these deadlines, as late submissions can result in penalties or interest on unpaid taxes.

Required Documents

To complete the Form 3885a accurately, several documents are required:

- Purchase invoices or receipts for the assets being depreciated.

- Prior year tax returns, if applicable, to reference past depreciation.

- Documentation of any improvements made to the assets, as these may affect depreciation calculations.

- Records of asset disposals, if any, to ensure accurate reporting.

Quick guide on how to complete form 3885a

Effortlessly Prepare Form 3885a on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form 3885a on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Form 3885a with Ease

- Locate Form 3885a and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Formulate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Alter and eSign Form 3885a and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3885a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3885a and why is it important?

The form 3885a is a crucial document used for reporting depreciation and amortization for tax purposes. Understanding how to properly fill out the form 3885a ensures compliance with IRS regulations and can lead to signNow tax savings for businesses.

-

How does airSlate SignNow simplify the process of completing form 3885a?

airSlate SignNow offers a user-friendly interface that allows you to easily fill out and eSign form 3885a. With simple templates and built-in guidance, users can quickly complete the form without confusion, saving valuable time during tax season.

-

What features does airSlate SignNow provide for the form 3885a?

airSlate SignNow includes features like document templates, eSignature functionality, and collaborative editing, which enhance the process of completing form 3885a. These features ensure that all stakeholders can review and sign the document seamlessly and securely.

-

Is airSlate SignNow a cost-effective solution for handling form 3885a?

Yes, airSlate SignNow is designed to be cost-effective, making it an ideal choice for businesses wanting to manage form 3885a efficiently. With flexible pricing plans, you can choose a solution that fits your budget while benefiting from robust document management features.

-

How can I integrate airSlate SignNow with my existing tools for managing form 3885a?

airSlate SignNow offers a range of integrations with popular business tools and software, allowing you to manage form 3885a alongside your current workflow. This capability minimizes disruption and enhances productivity, enabling smooth transitions between platforms.

-

Can multiple users collaborate on the form 3885a using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on form 3885a in real-time. This means team members can provide input, make revisions, and sign off on the document from any location, streamlining the approval process.

-

What security measures are in place for submitting form 3885a through airSlate SignNow?

Security is a top priority at airSlate SignNow. When you submit form 3885a, your documents are protected with end-to-end encryption, ensuring that sensitive information remains confidential and secure throughout the process.

Get more for Form 3885a

Find out other Form 3885a

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney