Bankruptcy Worksheet Form

What is the Bankruptcy Worksheet

The bankruptcy worksheet is a crucial document used by individuals seeking to file for bankruptcy in the United States. It serves as a comprehensive questionnaire that collects essential financial information, including income, expenses, assets, and liabilities. This information helps to assess the individual's financial situation and determine eligibility for different types of bankruptcy relief, such as Chapter 7 or Chapter 13. Completing the worksheet accurately is vital, as it lays the groundwork for the bankruptcy filing process.

How to Use the Bankruptcy Worksheet

Using the bankruptcy worksheet involves several steps to ensure that all relevant financial information is captured. Begin by gathering necessary documents, such as pay stubs, bank statements, and tax returns. Next, fill out the worksheet with precise details regarding your financial situation. This includes listing all sources of income, monthly expenses, and any outstanding debts. Once completed, review the worksheet for accuracy, as this information will be submitted to the court as part of the bankruptcy filing.

Steps to Complete the Bankruptcy Worksheet

Completing the bankruptcy worksheet requires careful attention to detail. Follow these steps:

- Collect all financial documents, including income statements and bills.

- List all sources of income, including wages, benefits, and any additional earnings.

- Detail monthly expenses, categorizing them into necessary and discretionary spending.

- Document all debts, including credit cards, loans, and any other financial obligations.

- Review the completed worksheet for accuracy and completeness.

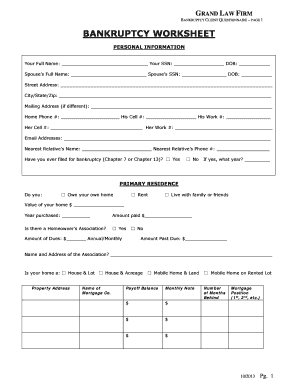

Key Elements of the Bankruptcy Worksheet

The bankruptcy worksheet consists of several key elements that must be accurately filled out. These include:

- Personal Information: Name, address, and contact details.

- Income Details: Monthly income from all sources.

- Expense Breakdown: Detailed listing of monthly expenses.

- Asset Inventory: List of all assets, including property and valuables.

- Liabilities: Comprehensive list of all debts and obligations.

Legal Use of the Bankruptcy Worksheet

The bankruptcy worksheet is legally recognized as part of the bankruptcy filing process. It must be completed accurately and submitted to the court to initiate the bankruptcy proceedings. Failure to provide truthful and complete information can lead to complications, including the dismissal of the bankruptcy case or potential legal repercussions. Therefore, it is essential to ensure that all information provided in the worksheet complies with legal standards and accurately reflects the individual's financial situation.

Form Submission Methods

Once the bankruptcy worksheet is completed, it can be submitted to the court through various methods. These include:

- Online Submission: Many courts allow electronic filing of bankruptcy documents.

- Mail: The completed worksheet can be mailed to the appropriate bankruptcy court.

- In-Person: Individuals may also choose to deliver the worksheet directly to the court clerk.

Quick guide on how to complete bankruptcy worksheet 444888703

Complete Bankruptcy Worksheet effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Bankruptcy Worksheet on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Bankruptcy Worksheet with ease

- Obtain Bankruptcy Worksheet and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Bankruptcy Worksheet and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bankruptcy worksheet 444888703

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bankruptcy worksheet and how can it help me?

A bankruptcy worksheet is a crucial tool that helps individuals organize their financial information conveniently. By detailing assets, debts, income, and expenditures, this worksheet simplifies the process of filing for bankruptcy and ensures all essential information is readily available.

-

Is airSlate SignNow suitable for creating a bankruptcy worksheet?

Yes, airSlate SignNow offers user-friendly templates that can help you create a comprehensive bankruptcy worksheet. Our platform allows you to easily customize the document and eSign it, ensuring that all necessary parties can complete the bankruptcy process efficiently.

-

What features does airSlate SignNow offer for managing bankruptcy worksheets?

airSlate SignNow provides features such as document templates, real-time collaboration, and secure electronic signatures specifically for bankruptcy worksheets. These features streamline document management and enhance productivity while ensuring compliance with legal requirements.

-

How much does it cost to use airSlate SignNow for creating and managing bankruptcy worksheets?

airSlate SignNow offers cost-effective pricing plans to suit various needs. You can choose from flexible pricing options that allow you to create and manage bankruptcy worksheets without overspending, making it accessible for individuals or businesses.

-

Can I integrate airSlate SignNow with other tools for my bankruptcy worksheet?

Absolutely! airSlate SignNow can seamlessly integrate with various applications, enabling you to access and manage your bankruptcy worksheets alongside other financial tools. This integration enhances your workflow by keeping all your information synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow to create a bankruptcy worksheet?

Using airSlate SignNow to create a bankruptcy worksheet provides several benefits, including ease of use, security, and fast document turnaround. With our platform, you can streamline your bankruptcy filing process by efficiently organizing your financial information.

-

Is it safe to store my bankruptcy worksheet on airSlate SignNow?

Yes, it is very safe to store your bankruptcy worksheet on airSlate SignNow. We prioritize your data security with advanced encryption protocols and secure cloud storage, ensuring that your sensitive financial information remains confidential and protected.

Get more for Bankruptcy Worksheet

Find out other Bankruptcy Worksheet

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA