Rrb 1099 Form

What is the Rrb 1099 Form

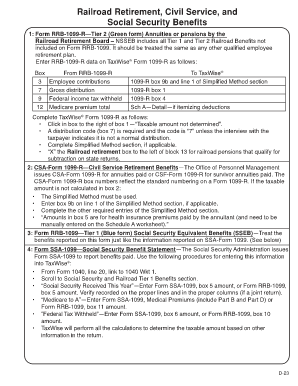

The Rrb 1099 Form is a tax document issued by the Railroad Retirement Board (RRB) in the United States. It reports various types of income received by individuals who are beneficiaries of the railroad retirement system. This form is essential for reporting income to the Internal Revenue Service (IRS) and is typically used by retirees, disabled individuals, and survivors of railroad workers. Understanding the Rrb 1099 Form is crucial for accurate tax filing and compliance with federal regulations.

How to use the Rrb 1099 Form

Using the Rrb 1099 Form involves several steps to ensure proper reporting of income. First, recipients should review the information provided on the form, including the types of payments received, such as retirement benefits or disability payments. Next, this information needs to be accurately reported on the individual's tax return. It is advisable to keep a copy of the Rrb 1099 Form for personal records as well. If there are discrepancies, contacting the RRB is essential for corrections.

Steps to complete the Rrb 1099 Form

Completing the Rrb 1099 Form requires attention to detail. Here are the key steps:

- Gather all necessary information, including personal identification and income details.

- Carefully fill out each section of the form, ensuring accuracy in reporting income amounts.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate it.

- Submit the form to the appropriate tax authorities as required.

Legal use of the Rrb 1099 Form

The Rrb 1099 Form is legally binding and must be completed in compliance with IRS regulations. It serves as an official record of income received and is used to calculate tax obligations. Failure to accurately report income from this form can result in penalties or audits by the IRS. Therefore, it is crucial to ensure that all information is correct and that the form is submitted by the appropriate deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Rrb 1099 Form are critical for compliance. Typically, the form must be issued to recipients by January 31 of the following tax year. Additionally, the IRS requires that the form be filed by the end of February if submitted on paper, or by March 31 if filed electronically. Keeping track of these dates helps avoid penalties and ensures timely processing of tax returns.

Who Issues the Form

The Rrb 1099 Form is issued by the Railroad Retirement Board, which is responsible for administering retirement, survivor, and disability benefits for railroad workers. The RRB generates this form based on the income reported by the beneficiaries and ensures that it is sent to both the recipients and the IRS. Understanding who issues the form helps recipients know where to direct any inquiries or issues related to their benefits.

Quick guide on how to complete rrb 1099 form

Complete [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign [SKS] without any hassle

- Obtain [SKS] and then select Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rrb 1099 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Rrb 1099 Form?

The Rrb 1099 Form is a tax document issued by the Railroad Retirement Board for the reporting of retirement benefits. It is primarily utilized by railroad employees and retirees to report various types of income. Understanding the Rrb 1099 Form is essential for accurate tax filing and financial planning.

-

How can airSlate SignNow help with Rrb 1099 Form management?

airSlate SignNow simplifies the process of managing Rrb 1099 Forms by allowing users to easily send, receive, and eSign documents. With a user-friendly interface, you can streamline the process of completing and submitting this essential form. This efficiency reduces the risk of errors and enhances compliance.

-

Is there a cost associated with using airSlate SignNow for Rrb 1099 Forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Regardless of the plan you choose, you will benefit from an affordable and effective solution for managing your Rrb 1099 Forms. Each plan comes with unique features designed to enhance your document workflow.

-

What features does airSlate SignNow offer for Rrb 1099 Form signing?

airSlate SignNow provides advanced features such as customizable templates, secure cloud storage, and automated workflows for Rrb 1099 Forms. Users can also track the status of their documents and receive notifications when actions are required. These features help eliminate delays and improve productivity.

-

Are there integrations available for Rrb 1099 Form handling?

Yes, airSlate SignNow seamlessly integrates with various applications and software to enhance your Rrb 1099 Form handling. Popular integrations include CRM systems, project management tools, and accounting software. This connectivity simplifies data flow and ensures that your documents are always up-to-date.

-

Can I access my Rrb 1099 Forms from any device using airSlate SignNow?

Absolutely! With airSlate SignNow, you can access your Rrb 1099 Forms from any device with internet connectivity. This flexibility allows you to manage your documents on the go, providing ease of access when you need it most. The platform is optimized for both desktop and mobile use.

-

What benefits does airSlate SignNow provide for businesses dealing with Rrb 1099 Forms?

Using airSlate SignNow for Rrb 1099 Forms means enhanced efficiency, improved document security, and reduced turnaround time. Businesses can focus on their core activities instead of spending time on paperwork. Additionally, the platform's compliance measures help ensure that your documents are handled properly.

Get more for Rrb 1099 Form

- The defendant through counsel moves for a new trial pursuant to form

- Motion for a new trial form

- Notice of intent office of the governor louisiana public form

- Return of notary and order to fix fees form

- Ors 205455 acceptance of filing of invalid claim of form

- 28 68 301 statutory form power of attorney justia law

- Articles of incorporation ofarchivesgvnewscom form

- When after reviewing the pleadings filed herein the testimony and evidence offered the form

Find out other Rrb 1099 Form

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online