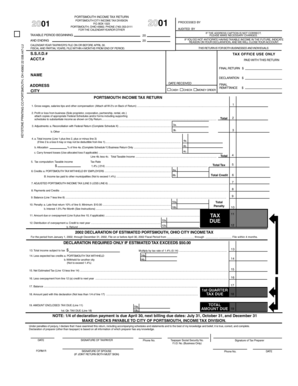

PORTSMOUTH INCOME TAX RETURN Form

Understanding the Portsmouth Income Tax Return

The Portsmouth Income Tax Return is a crucial document for residents of Portsmouth, designed to report income and calculate tax liabilities. This form is essential for ensuring compliance with local tax laws and regulations. It typically requires information regarding your total income, deductions, and credits applicable to your situation. Understanding the specifics of this form can help taxpayers accurately report their financial information and avoid potential penalties.

Steps to Complete the Portsmouth Income Tax Return

Completing the Portsmouth Income Tax Return involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions provided with the form to understand the requirements for your specific situation.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Double-check your calculations to avoid errors that could lead to penalties.

- Sign and date the form before submission to validate it.

How to Obtain the Portsmouth Income Tax Return

The Portsmouth Income Tax Return can be obtained through various channels. Residents can visit the official Portsmouth city website to download the form directly. Alternatively, physical copies may be available at local government offices or tax assistance centers. It is advisable to ensure you are using the most current version of the form to comply with the latest tax regulations.

Legal Use of the Portsmouth Income Tax Return

The Portsmouth Income Tax Return holds legal significance as it serves as an official declaration of income to the local tax authority. Proper completion and submission of this form are necessary to fulfill legal obligations and avoid penalties for non-compliance. Electronic submissions are legally recognized, provided they meet the requirements set forth by eSignature laws, ensuring the document's validity.

Filing Deadlines / Important Dates

Filing deadlines for the Portsmouth Income Tax Return are typically aligned with federal tax deadlines. It is essential to be aware of these dates to avoid late fees and penalties. Generally, the deadline falls on April 15, unless it falls on a weekend or holiday, in which case it may be extended. Taxpayers should also be aware of any local extensions that may apply.

Required Documents for Submission

To complete the Portsmouth Income Tax Return, taxpayers must gather several documents, including:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Any relevant tax credits documentation

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Form Submission Methods

The Portsmouth Income Tax Return can be submitted through various methods, including:

- Online submission through the official city tax portal

- Mailing a printed copy to the designated tax office

- In-person submission at local tax offices

Each method has its benefits, and taxpayers should choose the one that best fits their needs and preferences.

Quick guide on how to complete portsmouth income tax return

Complete PORTSMOUTH INCOME TAX RETURN effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage PORTSMOUTH INCOME TAX RETURN on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign PORTSMOUTH INCOME TAX RETURN effortlessly

- Find PORTSMOUTH INCOME TAX RETURN and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Leave behind worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign PORTSMOUTH INCOME TAX RETURN and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the portsmouth income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Portsmouth income tax return using airSlate SignNow?

Filing your Portsmouth income tax return with airSlate SignNow is straightforward. Start by uploading your tax documents and then utilize our eSigning feature to add your signature. Once completed, you can easily submit your return electronically, ensuring a quick and efficient process.

-

How much does it cost to file a Portsmouth income tax return with airSlate SignNow?

The pricing for filing a Portsmouth income tax return with airSlate SignNow is highly competitive and cost-effective. Our subscription plans are designed to fit various budgets, making it affordable for individuals and businesses alike to manage their tax filings seamlessly.

-

What features does airSlate SignNow offer for Portsmouth income tax return filings?

airSlate SignNow provides a suite of features tailored specifically for Portsmouth income tax return filings. These include secure eSigning, document templates, automated reminders, and real-time tracking, ensuring you can manage your tax documents efficiently and effortlessly.

-

Is airSlate SignNow compliant with Portsmouth tax regulations?

Yes, airSlate SignNow is fully compliant with Portsmouth tax regulations. Our platform is designed to meet local tax laws and guidelines, providing you with confidence that your Portsmouth income tax return will be processed accurately and in accordance with state requirements.

-

Can I integrate airSlate SignNow with other financial software for my Portsmouth income tax return?

Absolutely! airSlate SignNow offers seamless integrations with popular financial software to enhance your Portsmouth income tax return filing experience. This allows for streamlined workflows where you can easily sync your financial data and documents for efficient tax preparation.

-

What benefits does using airSlate SignNow provide for my Portsmouth income tax return?

Using airSlate SignNow for your Portsmouth income tax return provides numerous benefits, including time savings, enhanced accuracy, and increased security. With our electronic signing process, you can complete your returns more quickly and reduce the risk of errors associated with manual paperwork.

-

How secure is my information when filing a Portsmouth income tax return with airSlate SignNow?

Your information is highly secure when filing a Portsmouth income tax return with airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive data, ensuring confidentiality and compliance throughout the entire filing process.

Get more for PORTSMOUTH INCOME TAX RETURN

- Associates in dermatology pllc form

- Participant recordcontribution change form

- Appointment with chesapeake employers insurance company form

- Application clinical or adjunct faculty appointment form

- Dbs p form

- Through a third party form

- Agreement to furnish respite care form

- Request for verification of life insurance policy nd form

Find out other PORTSMOUTH INCOME TAX RETURN

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template