Borrower's Certification & Authorization American Bank Form

Understanding the Borrower's Certification & Authorization

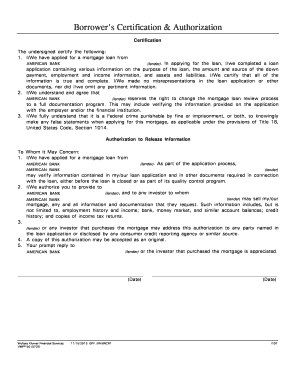

The Borrower's Certification & Authorization is a crucial document in the mortgage process. It serves as a formal declaration from the borrower, affirming their intent to proceed with the mortgage application. This document typically includes personal information, financial details, and a statement granting the lender permission to verify the borrower's financial history. By signing this form, borrowers acknowledge their understanding of the terms and conditions associated with the mortgage, ensuring transparency and compliance with lending regulations.

Steps to Complete the Borrower's Certification & Authorization

Completing the Borrower's Certification & Authorization involves several key steps to ensure accuracy and compliance. Begin by gathering necessary personal and financial information, including your Social Security number, income details, and employment history. Next, fill out the form carefully, providing all requested information. It is essential to review the document for any errors or omissions before signing. Once completed, submit the form to your lender, either electronically or by mail, depending on their submission guidelines.

Key Elements of the Borrower's Certification & Authorization

Several key elements must be included in the Borrower's Certification & Authorization to ensure its validity. These elements typically consist of:

- Borrower Information: Full name, address, and contact details.

- Financial Disclosure: Details about income, debts, and assets.

- Authorization Statement: A declaration allowing the lender to verify financial information.

- Signature: The borrower's signature, indicating agreement and understanding.

Including these components helps establish the document's legal standing and facilitates the mortgage approval process.

Legal Use of the Borrower's Certification & Authorization

The Borrower's Certification & Authorization is legally binding, provided it meets specific legal requirements. In the United States, eSignature laws, such as the ESIGN Act and UETA, validate electronic signatures, ensuring that documents signed digitally hold the same weight as traditional paper forms. This legal recognition is vital for both borrowers and lenders, as it streamlines the mortgage application process while maintaining compliance with federal and state regulations.

Examples of Using the Borrower's Certification & Authorization

There are various scenarios where the Borrower's Certification & Authorization is utilized in the mortgage process. For instance, a first-time homebuyer may complete this form as part of their mortgage application to secure financing for their new home. Similarly, a homeowner refinancing their mortgage will also need to submit this document to authorize the lender to access their financial information. Each use case underscores the importance of this form in facilitating smooth and transparent transactions in the mortgage industry.

State-Specific Rules for the Borrower's Certification & Authorization

While the Borrower's Certification & Authorization is a standard document, specific rules and requirements may vary by state. Some states may have additional disclosures or stipulations that borrowers must adhere to when completing the form. It is essential for borrowers to familiarize themselves with their state's regulations to ensure compliance and avoid potential issues during the mortgage approval process. Consulting with a local mortgage professional can provide clarity on any state-specific requirements.

Quick guide on how to complete borroweramp39s certification amp authorization american bank

Effortlessly prepare Borrower's Certification & Authorization American Bank on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools essential for swiftly creating, modifying, and electronically signing your documents without delays. Handle Borrower's Certification & Authorization American Bank on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Borrower's Certification & Authorization American Bank effortlessly

- Locate Borrower's Certification & Authorization American Bank and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Borrower's Certification & Authorization American Bank to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borroweramp39s certification amp authorization american bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to authorize mortgage documents electronically?

To authorize mortgage documents electronically means using a digital signature platform like airSlate SignNow to sign and approve mortgage agreements online. This process enhances efficiency and reduces paperwork while ensuring legally binding compliance. It helps streamline the transaction process, making it quicker and easier for all parties involved.

-

How does airSlate SignNow help in the mortgage authorization process?

airSlate SignNow simplifies the mortgage authorization process by providing an intuitive platform for securely signing and sharing documents. Users can easily create, send, and track mortgage documents, ensuring all necessary parties can provide their electronic signatures without delays. This expedites the approval timeline, allowing for faster closings.

-

What are the pricing options for using airSlate SignNow to authorize mortgage documents?

airSlate SignNow offers several pricing plans designed to meet the needs of businesses looking to authorize mortgage documents efficiently. The plans are competitively priced, providing essential features such as unlimited document signing and custom templates. Organizations can choose a plan that best fits their volume and integration requirements.

-

Are there any integration options for airSlate SignNow when authorizing mortgages?

Yes, airSlate SignNow integrates seamlessly with various platforms commonly used in the mortgage industry, including CRM systems and document management tools. This integration allows users to streamline workflows and effectively authorize mortgage documents without leaving their preferred applications. These integrations enhance productivity and minimize errors during the signing process.

-

What benefits does airSlate SignNow offer for mortgage professionals?

For mortgage professionals, airSlate SignNow offers signNow benefits such as faster document turnaround and enhanced client experience. By enabling users to authorize mortgage documents electronically, it eliminates the hassle of printing and mailing, saving time and resources. Additionally, the secure environment ensures that sensitive information is always protected.

-

Can I track the status of my mortgage documents with airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive tracking features that allow you to monitor the status of mortgage documents that you send for authorization. You'll receive notifications once your documents have been viewed and signed, ensuring that you stay updated throughout the entire process. This transparency helps in managing expectations and timelines effectively.

-

Is airSlate SignNow compliant with legal standards for mortgage authorizations?

Yes, airSlate SignNow is compliant with industry standards and regulations such as ESIGN and UETA, which govern electronic signatures. This compliance ensures that when you authorize mortgage documents with airSlate SignNow, they hold the same legal weight as traditional handwritten signatures. Users can proceed with confidence knowing their electronic transactions are secure and legitimate.

Get more for Borrower's Certification & Authorization American Bank

Find out other Borrower's Certification & Authorization American Bank

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe