Form 4952

What is the Form 4952

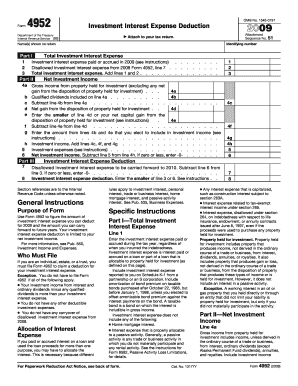

The Form 4952, officially known as the "Investment Interest Expense Deduction," is a tax form used by U.S. taxpayers to calculate the amount of investment interest expense that can be deducted from their taxable income. This form is particularly relevant for individuals who have incurred interest expenses related to investments, such as margin loans or other borrowing for investment purposes. Understanding the purpose and requirements of Form 4952 is essential for taxpayers seeking to maximize their deductions and ensure compliance with IRS regulations.

How to use the Form 4952

To effectively use Form 4952, taxpayers must first gather relevant financial information, including details about their investments and any associated interest expenses. The form requires inputting specific figures, such as the total investment interest expense and the amount of investment income. After completing the calculations on the form, taxpayers can transfer the deductible amount to their tax return, typically on Schedule A. Properly utilizing Form 4952 can significantly impact a taxpayer's overall tax liability.

Steps to complete the Form 4952

Completing Form 4952 involves several key steps:

- Gather all necessary documentation, including records of investment interest expenses and investment income.

- Fill out the top section of the form with personal information, including your name and Social Security number.

- Calculate the total investment interest expense incurred during the tax year.

- Determine the amount of investment income earned, as this will affect the deductible interest expense.

- Complete the calculations as outlined in the form, ensuring accuracy to avoid issues with the IRS.

- Transfer the deductible amount to the appropriate section of your tax return.

Legal use of the Form 4952

Form 4952 is legally valid when completed accurately and in accordance with IRS guidelines. Taxpayers must ensure that all reported figures are truthful and substantiated by proper documentation. The IRS requires that any investment interest expense claimed as a deduction must be directly related to taxable investment income. Failure to adhere to these regulations can lead to penalties, including disallowance of the deduction and potential audits.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 4952, including eligibility criteria for claiming investment interest expense deductions. Taxpayers should refer to IRS Publication 550 for detailed instructions on what constitutes investment interest and how to report it accurately. Staying informed about IRS updates and changes to tax laws is crucial for ensuring compliance and maximizing potential deductions.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form 4952 to avoid penalties. Generally, the deadline for submitting tax returns, including Form 4952, is April 15 of the following year. If taxpayers require additional time, they may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete Form 4952 accurately, taxpayers should have the following documents on hand:

- Records of all investment interest expenses, such as statements from brokers or lenders.

- Documentation of investment income, including dividends, interest, and capital gains.

- Previous tax returns, if applicable, to reference prior deductions and ensure consistency.

Quick guide on how to complete form 4952

Complete Form 4952 seamlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Form 4952 on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Form 4952 easily

- Obtain Form 4952 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Adjust and eSign Form 4952 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4952

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4952 and why is it important?

Form 4952 is used to calculate the investment interest expense deduction for taxpayers. Understanding this form is crucial for ensuring compliance with tax laws and maximizing deductions. Using airSlate SignNow can simplify the process of completing and submitting Form 4952, saving you time and reducing the risk of errors.

-

How can airSlate SignNow help with completing Form 4952?

airSlate SignNow offers easy-to-use tools for electronically signing and managing documents like Form 4952. Our platform allows you to fill out the form quickly, access it from anywhere, and store it securely. This streamlines the process of completing Form 4952, making it more efficient.

-

Is there a cost associated with using airSlate SignNow for Form 4952?

Yes, airSlate SignNow provides cost-effective pricing plans suitable for businesses of all sizes. Subscription plans vary, allowing you to choose the one that best fits your needs, whether you're a freelancer or a large organization needing to manage Form 4952 and other documents efficiently.

-

Can I integrate airSlate SignNow with my accounting software for Form 4952?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms. This integration allows you to manage Form 4952 alongside your financial documents, facilitating easier data transfer and enhanced organization. You can streamline your workflows and ensure accurate submissions using our integrations.

-

What are the benefits of using airSlate SignNow for eSigning Form 4952?

Using airSlate SignNow for eSigning Form 4952 offers convenience and security. You'll save time by electronically signing the form, and our robust security measures protect your sensitive information. Additionally, our solution ensures that your documents are compliant with the latest eSignature laws.

-

How do I get started with airSlate SignNow for Form 4952?

Getting started with airSlate SignNow for Form 4952 is easy! Simply sign up for an account on our website, choose a pricing plan that works for you, and start uploading your documents. Our user-friendly interface makes it easy to begin working with Form 4952 immediately.

-

What features does airSlate SignNow offer for Form 4952 management?

airSlate SignNow provides features such as document templates, cloud storage, and real-time collaboration to enhance your experience with Form 4952. These tools simplify the process of creating, sending, and managing forms, ensuring that you can efficiently track and finalize your documents.

Get more for Form 4952

- Statement of affirmation indiana department of natural form

- To farm vehicle compliance the texas department of public form

- Illinois parking program for persons with disabilities abuse complaint form

- S secretary of state this d m change form

- Please mail all required documentation to form

- Form vsd62 ampquotpersons with disabilities certification for

- Irs updates rules for vehicle mileage rate deductions form

- Application for replacement delaware dealer plate form

Find out other Form 4952

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free